DEFR14A: Definitive revised proxy soliciting materials

Published on May 2, 2023

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☑ Filed by a Party other than the Registrant

Check the appropriate box:

Preliminary Proxy Statement

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

Definitive Proxy Statement

Definitive Additional Materials

Soliciting Material Pursuant to §240.14a-12

TERRASCEND CORP.

(Name of Registrant as Specified In Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

No fee required.

Fee paid previously with preliminary materials.

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

EXPLANATORY NOTE

On April 20, 2023, due to a clerical error, an EDGAR filing by TerrAscend Corp. (the “Corporation”) that was intended to be a preliminary proxy statement filed as a “PRE 14A” submission was inadvertently filed as a “DEF 14A” submission. The Corporation corrected this error by refiling the initial submission on April 21, 2023 as a “PRE 14A” submission. This EDGAR filing constitutes the Corporation’s filing of a definitive proxy statement. The Corporation will distribute and make available to its shareholders this definitive proxy statement. Due to the initial inadvertent filing of this proxy statement as a “DEF 14A” submission, the Corporation is technically unable to file this definitive proxy statement as a “DEF 14A” submission. Accordingly, the Corporation is filing this definitive proxy statement as a “DEFR14A” submission. However, this submission is not an amendment or revision of any prior definitive proxy statement or of the versions of this proxy statement filed on April 20 and April 21, 2023, which are substantively identical to this definitive proxy statement.

NOTICE OF MEETING,

MANAGEMENT INFORMATION CIRCULAR

AND PROXY STATEMENT

FOR THE ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS OF

TERRASCEND CORP.

TO BE HELD ON

June 22, 2023

These materials are important and require your immediate attention. If you have questions as to how to deal with these documents or the matters to which they refer, please contact your financial, legal or other professional advisor.

If you have any questions or require further information with regard to voting your shares or completing your documentation, please contact Odyssey Trust Company, our transfer agent, toll free within North America at 1-888-290-1175 or 1-587-885-0960, or via www.odysseycontact.com.

May 2, 2023

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS OF TERRASCEND CORP.

TO BE HELD ON JUNE 22, 2023

TO: The holders of common shares of TerrAscend Corp.

NOTICE IS HEREBY GIVEN that the annual and special meeting of the holders (the “Shareholders”) of common shares (the “Common Shares”) of TerrAscend Corp. (the “Corporation”) will be held virtually at https://web.lumiagm.com/239473997 (password: “terrascend2023” (case-sensitive)) on June 22, 2023, at 1:00 p.m. (Eastern Time) (the “Meeting”), for the following purposes:

The specific details of the foregoing matters to be put before the Meeting are set forth in the Circular accompanying this Notice of Meeting.

The record date for determining the Shareholders entitled to receive notice of and vote at the Meeting is the close of business on April 27, 2023 (the “Record Date”). Only Shareholders whose names have been entered in the applicable register of Shareholders as of 5:00 p.m. (Eastern Time) on the Record Date are entitled to receive notice of and vote at the Meeting. Those Shareholders of record will be included in the list of Shareholders prepared as of the Record Date and will be entitled to vote the Common Shares recorded therein at the Meeting.

Each Common Share entitled to be voted at the Meeting will entitle the holder thereof to one vote at the Meeting.

A Shareholder may attend the Meeting or may be represented by proxy through the Lumi platform. Registered Shareholders who are unable to attend the Meeting are requested to complete, sign and date the enclosed form of proxy and send it to Odyssey Trust Company (“Odyssey”), the Corporation’s transfer agent, at its offices located at Trader’s Bank Building, 702, 67 Yonge Street, Toronto, Ontario, M5E 1J8, or to vote over the Internet as specified in the form of proxy. To be effective, such proxy must be received by Odyssey by 1:00 p.m. (Eastern Time) on June 20, 2023, or not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time fixed for the Meeting or any adjournment(s) or postponement(s) thereof.

Non-registered Shareholders who receive these materials through their broker or other intermediary should complete

1

and return the voting instruction form provided by their broker or other intermediary in accordance with the instructions provided.

Virtual Meeting Logistics

As noted above, the Corporation is holding the Meeting as a completely virtual meeting, which will be conducted via live webcast. Shareholders will not be able to attend the Meeting in person. In order to attend, participate or vote at the Meeting, Shareholders must have a valid username.

Registered Shareholders and duly appointed proxyholders will be able to attend, participate and vote at the Meeting online at https://web.lumiagm.com/239473997. Such persons may then enter the Meeting by clicking “I have a login” and entering a username and password before the start of the Meeting.

Registered Shareholders: The control number located on the form of proxy (or in the email notification you received if you have previously consented to receiving Shareholder materials via email) is the username. The password to the Meeting is “terrascend2023” (case sensitive). If as a registered Shareholder you are using your control number to login to the Meeting and you have previously voted, you do not need to vote again when the polls open during the Meeting. By voting at the Meeting, you will revoke your previous voting instructions received prior to the proxy voting cut-off.

Duly appointed proxyholders: A Shareholder who wishes to appoint a person other than the management nominee(s) identified in the form of proxy to attend, participate or vote at the Meeting (including a non-registered Shareholder who wishes to appoint themselves) must register the appointed proxyholder by sending an email to appointee@odysseytrust.com by 1:00 p.m. (Eastern Time) on June 20, 2023, providing Odyssey with the required proxyholder contact as set out in the enclosed instructions, so that Odyssey may provide the proxyholder with a username via email. Without a username, proxyholders will not be able to attend, participate in or vote at the Meeting. Odyssey will provide the proxyholder with a username by e-mail after the voting deadline has passed. The password to the Meeting is “terrascend2023” (case sensitive).

Only registered Shareholders and duly appointed proxyholders will be entitled to attend, participate and vote at the Meeting.

DATED at Toronto, Ontario, this 2nd day of May, 2023.

2

Important Notice Regarding the Availability of Proxy Materials for the Shareholders’ Meeting to Be Held on June 22, 2023 at 1:00p.m. Eastern Time.

The proxy statement and annual report to shareholders are available at https://ir.terrascend.com. As permitted by the rules of the US Securities and Exchange Commission (“SEC”) and the Canadian securities regulators, the Corporation is providing meeting-related materials to Shareholders over the internet (rather than in paper form) in accordance with the rules of the SEC and the “notice-and-access” provisions provided for under National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer. This means that, rather than receiving paper copies of the proxy materials in connection with the Meeting in the mail, Shareholders will have access to them online.

Shareholders may request to receive paper copies of the proxy materials related to the above referenced meeting by mail at no cost. Shareholders may request to receive a paper copy of the Materials for up to one year from the date the Materials were filed on www.sedar.com.

For more information regarding notice-and-access or to obtain a paper copy of the Materials you may contact our transfer agent, Odyssey Trust Company, via www.odysseycontact.com or by phone at 1-888-290-1175 (toll-free within North America) or 1-587-885-0960 (direct from outside North America).

BY ORDER OF THE BOARD OF DIRECTORS

/s/ Lynn Gefen

Lynn Gefen

Chief Legal Officer and Corporate Secretary

Toronto, Ontario

May 2, 2023

We have filed our Management Discussion & Analysis and Annual Report on Form 10-K for the fiscal year ended December 31, 2022 under the Corporation’s profile on the System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com and with the United States Securities and Exchange Commission (the “SEC”) through EDGAR at www.sec.gov/edgar, respectively. Such documents can be accessed free of charge. Shareholders can also access this proxy statement and our Annual Report on Form 10-K at https://ir.terrascend.com. A copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 is also available without charge upon written request to us via email at IR@terrascend.com.

3

MANAGEMENT INFORMATION CIRCULAR and proxy statement

FOR 2023 ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON June 22, 2023

at 1:00 P.M. (EASTERN TIME)

This management information circular and proxy statement (the “Circular”) is being furnished to holders (“Shareholders”) of common shares (the “Common Shares”) in the capital of TerrAscend Corp. (“TerrAscend” or the “Corporation”) in connection with the solicitation of proxies by management of the Corporation for use at the annual general and special meeting of Shareholders to be held virtually at https://web.lumiagm.com/239473997 (password: “terrascend2023” (case-sensitive)) on June 22, 2023, at 1:00 p.m. (Eastern Time) (the “Meeting”), or any adjournment(s) or postponement(s) thereof, for the purposes set forth in the accompanying notice of meeting (the “Notice of Meeting”).

INFORMATION CONTAINED IN THIS CIRCULAR

Information contained in this Circular is given as of May 1, 2023, unless otherwise specifically stated. Unless otherwise indicated herein as Canadian dollars (C), all dollar amounts are in United States (US) dollars.

The Corporation is a reporting issuer or equivalent in the provinces of British Columbia, Alberta and Ontario and files its continuous disclosure documents with the provincial securities regulatory authorities of those provinces. The continuous disclosure documents of the Corporation are filed under the Corporation’s profile on the System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com and with the United States Securities and Exchange Commission (the “SEC”) through EDGAR at www.sec.gov/edgar.

CAUTION REGARDING CANNABIS OPERATIONS IN THE UNITED STATES

Investors should note that there are significant legal restrictions and regulations that govern the cannabis industry in the US. Cannabis remains a Schedule I drug under the US Controlled Substances Act, making it illegal under federal law in the US to, among other things, cultivate, distribute or possess cannabis in the US. Financial transactions involving proceeds generated by, or intended to promote, cannabis-related business activities in the US may form the basis for prosecution under applicable US federal money laundering legislation.

While the approach to enforcement of such laws by the federal government in the US has trended toward non-enforcement against individuals and businesses that comply with medical- or adult-use cannabis programs in states where such programs are legal, strict compliance with state laws with respect to cannabis will neither absolve the Corporation of liability under US federal law, nor will it provide a defense to any federal proceeding which may be brought against the Corporation. The enforcement of federal laws in the US is a significant risk to the business of the Corporation and any proceedings brought against the Corporation thereunder may adversely affect the Corporation’s operations and financial performance.

[Remainder of this page intentionally left blank]

4

INFORMATION CONCERNING THE CORPORATION

General Information

The Corporation was incorporated under the Business Corporations Act (Ontario) (“OBCA”) as “TerrAscend Corp.” on March 7, 2017. The Corporation’s registered and head office is located at 3610 Mavis Road, Mississauga, Ontario L5C 1W2. The Board has determined to move the Corporation's registered office to 77 City Centre Drive, East Tower - Suite 501, Mississauga, ON L5B 1M5. In accordance with the OBCA, the Board intends to change the registered office to 77 City Centre Drive, East Tower - Suite 501, Mississauga, ON L5B 1M5 to be effective May 10, 2023.The Common Shares are listed and posted for trading on the Canadian Securities Exchange (the “CSE”) under the symbol “TER” and on the OTCQX® Best Market under the symbol “TRSSF”.

Voting Securities and Principal Holders of Voting Securities

The Corporation is authorized to issue an unlimited number of Common Shares, an unlimited number of proportionate voting shares (“Proportionate Voting Shares”), an unlimited number of non-participating, non-voting, unlisted exchangeable shares (“Exchangeable Shares”), and an unlimited number of preferred shares, issuable in series (“Preferred Shares”). As of the close of business on April 27, 2023 (the “Record Date”), there were a total of 274,625,998 Common Shares, no Proportionate Voting Shares, 63,492,037 Exchangeable Shares and 12,950 Preferred Shares issued and outstanding. Each Common Share entitles the holder thereof to one vote on all matters to be acted upon at the Meeting, and each Proportionate Voting Share would entitle the holder thereof to 1,000 votes on all matters to be acted upon at the Meeting. The Exchangeable Shares and the Preferred Shares are not entitled to vote at the Meeting. Therefore, there are a total of 274,625,998 votes eligible to be cast at the Meeting.

To the knowledge of the directors and executive officers of the Corporation, as of the Record Date, no person or company beneficially owns, or controls or directs, directly or indirectly, Common Shares carrying 10% or more of the voting rights attached to the Common Shares except for the following:

Name of Shareholder |

Number of Votes Held |

Percentage of Total Eligible Votes (1) |

Jason Wild |

88,621,984 (2) |

32.27% |

_______________

[Remainder of this page intentionally left blank]

5

6

GENERAL PROXY MATTERS

Solicitation of Proxies

Management of the Corporation is using this Circular to solicit proxies from Shareholders for use at the Meeting. TerrAscend will bear all costs associated with the preparation and mailing of this Circular, the Notice of Meeting and the accompanying form of proxy, as well as the cost of the solicitation of proxies. Solicitations of proxies will be primarily made by mail, but may also be made by telephone, by email, by other means of electronic transmission or in person by directors, officers and employees of TerrAscend. TerrAscend will pay for the delivery of its proxy-related materials indirectly to all Non-Registered Shareholders (as defined below). Banks, brokerage houses and other custodians and nominees or fiduciaries will be requested to forward proxy solicitation material to their principals and to obtain authorizations for the execution of proxies.

As permitted by the rules of the SEC and the Canadian securities regulators, the Corporation is providing meeting related materials to Shareholders over the internet (rather than in paper form) in accordance with the rules of the SEC and the “notice-and-access” provisions provided for under National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer. This means that, rather than receiving paper copies of the proxy materials in connection with the Meeting in the mail, Shareholders will have access to them online.

Record Date

The Board fixed the close of business on April 27, 2023 as the Record Date for determining which Shareholders shall be entitled to receive notice of, and to vote at, the Meeting. Only Shareholders of record as of the Record Date are entitled to receive notice of, and to vote at, the Meeting or any adjournment(s) or postponement(s) thereof. Persons who acquire Common Shares after the Record Date will not be entitled to vote such shares at the Meeting.

Appointment and Revocation of Proxies

The persons named in the enclosed form of proxy are directors and/or officers of the Corporation. A Shareholder has the right to appoint a person, persons or entity (who need not be a Shareholder) other than the persons designated in the form of proxy provided by the Corporation to attend and act on behalf of the Shareholder at the Meeting. A Shareholder wishing to exercise this right may do so by inserting the name(s) of the desired person, persons or entity in the blank space provided in the form of proxy or by completing another proper form of proxy. This is an additional step to be completed once you have submitted your form of proxy or voting instruction form (see section below entitled “Virtual Meeting Protocols: Registering a Proxyholder to Attend the Meeting”). In order to be effective, a proxy must be received by the Corporation’s transfer agent, Odyssey Trust Company (“Odyssey”), at Trader’s Bank Building, 702, 67 Yonge Street, Toronto, Ontario, M5E 1J8, or over the Internet as specified in the form of proxy, by 1:00 p.m. (Eastern Time) on June 20, 2023, or not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time fixed for the Meeting or any adjournment(s) or postponement(s) thereof. The Chair of the Meeting may waive or extend the proxy cut-off without notice and in his sole discretion. The proxy must be in writing and executed by the Shareholder, or such Shareholder’s attorney authorized in writing, or if such Shareholder is a corporation, under its corporate seal or by a duly authorized officer or attorney thereof.

A registered Shareholder who has given a proxy may revoke it by an instrument in writing executed by such registered Shareholder, by such registered Shareholder’s attorney authorized in writing or, if the registered Shareholder is a corporation, under its corporate seal or by a duly authorized officer or attorney thereof, and delivered either to the Corporation or to Odyssey at the address specified above at any time up to and including the last business day preceding the day of the Meeting, or any adjournment(s) or postponement(s) thereof, or with the Chair of the Meeting on the day of the Meeting before the commencement of the Meeting or the reconvening of any adjournment or postponement of the Meeting. A revocation of a proxy will not affect a matter on which a vote is taken before the revocation.

7

If you are a Non-Registered Shareholder who has voted by proxy through your Intermediary (as defined below) and would like to change or revoke your vote, contact your Intermediary to discuss whether this is possible and what procedures you need to follow. The change or revocation of voting instructions by a Non-Registered Shareholder can take several days or longer to complete and, accordingly, any such action should be completed well in advance of the deadline given in the proxy or Voting Instruction Form (as defined below) by the Intermediary or its service company to ensure it is effective.

Proxy Voting

The persons named in the form of proxy will vote (or withhold from voting) the Common Shares in respect of which they are appointed in accordance with the instructions of the Shareholder appointing them, and if the Shareholder specifies a choice with respect to any matter to be acted upon at the Meeting, the persons appointed as proxyholders shall vote accordingly. In the absence of such direction, such Common Shares will be voted FOR the passing of all matters and resolutions described herein. The form of proxy confers discretionary authority upon the persons named therein with respect to amendments or variations to the matters identified in the Notice of Meeting and with respect to other matters which may properly come before the Meeting or any adjournment(s) or postponement(s) thereof. The persons named in the enclosed proxy will have discretionary authority with respect to any amendments or variations of the matters of business to be acted on at the Meeting or any other matters properly brought before the Meeting or any adjournment(s) or postponement(s) thereof, in each instance, to the extent permitted by law, whether or not the amendment, variation or other matter that comes before the Meeting is routine and whether or not the amendment, variation or other matter that comes before the Meeting is contested. As of the date of this Circular, management of the Corporation knows of no such amendments, variations or other matters to come before the Meeting. However, if any other matters should properly come before the Meeting, or any adjournment(s) or postponements(s) thereof, the form of proxy will be voted on such matters in accordance with the best judgment of the persons named in the form of proxy.

Non-Registered Shareholders

Only registered Shareholders or the person(s) they appoint as their proxies are permitted to vote at the Meeting. However, in many cases, Common Shares beneficially owned by a holder whose Common Shares are held by an Intermediary (“Non-Registered Shareholder”) are registered either: (i) in the name of a broker or other intermediary (“Intermediary”) with whom the Non-Registered Shareholder deals in respect of the Common Shares; or (ii) in the name of a clearing agency (such as CDS & Co.) of which the Intermediary is a participant.

In accordance with the requirements of National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer, the Corporation has elected to send the Notice of Meeting, this Circular and the voting instruction form (“Voting Instruction Form”, and together with the Notice of Meeting and this Circular, “Meeting Materials”) directly to Non-Registered Shareholders through the services of their Intermediary. Typically, Intermediaries will use a service company (such as Broadridge Investor Communications Corporation (“Broadridge”)) to forward Meeting Materials to Non-Registered Shareholders. The Corporation will pay for Intermediaries to deliver the Meeting Materials to Non-Registered Shareholders who have objected to their Intermediary disclosing ownership information about themselves to the Corporation.

These Meeting Materials are being sent to both registered Shareholders and Non-Registered Shareholders. If you are a Non-Registered Shareholder, and the Corporation or its agent has sent the Meeting Materials directly to you, your name, address and information about your holdings of Common Shares have been obtained in accordance with applicable securities regulatory requirements from the Intermediary holding the Common Shares on your behalf. By choosing to send the Meeting Materials to you directly, the Corporation (and not the Intermediary holding the Common Shares on your behalf) has assumed responsibility for (i) delivering the Meeting Materials to you, and (ii) executing your proper voting instructions. Please return your voting instructions as specified in the Voting Instruction Form.

Non-Registered Shareholders will be given, in substitution for the form of proxy otherwise contained in the proxy-related materials, a Voting Instruction Form which, when properly completed and, if applicable, signed by the Non-Registered Shareholder and returned to the Intermediary, as applicable, will constitute voting instructions which the Intermediary, as applicable, must follow. The purpose of this procedure is to permit Non-Registered Shareholders to

8

direct the voting of the Common Shares they beneficially own. Should a Non-Registered Shareholder who receives the Voting Instruction Form wish to vote at the Meeting in person (or have another person attend the vote on behalf of the Non-Registered Shareholder), the Non-Registered Shareholder should so indicate in the place provided for that purpose in the Voting Instruction Form and a form of legal proxy will be sent to the Non-Registered Shareholder. Every Intermediary has its own mailing procedures and provides its own return instructions, which should be carefully followed by Non-Registered Shareholders in order to ensure that their Common Shares are voted at the Meeting. If you have any questions with respect to the voting of Common Shares held through a broker or other Intermediary, please contact the broker or other Intermediary for assistance.

The Corporation may utilize Broadridge’s QuickVoteTM system to assist Shareholders with voting their Common Shares. Certain Non-Registered Shareholders who have not objected to the Corporation knowing who they are (non-objecting beneficial owners) may be contacted by the Corporation, to conveniently obtain a vote directly over the phone.

Voting Thresholds Required for Approval

In order to approve a motion proposed at the Meeting, the affirmative vote of a simple majority of the votes cast by TerrAscend shareholders present virtually or represented by proxy and entitled to vote at the Meeting will be required (an “Ordinary Resolution”) unless the motion requires a special resolution (a “Special Resolution”), in which case the affirmative vote of not less than two-thirds (66⅔%) of the votes cast by TerrAscend shareholders present virtually or represented by proxy and entitled to vote at the Meeting will be required. The following table summarizes the type of resolution needed to approve each proposal outlined below:

Proposal |

Type of Resolution |

Proposal No. 1: Re-election of the Corporation’s Board until the close of the next annual meeting of Shareholders. |

Ordinary Resolution |

Proposal No. 2: Ratification of the appointment of MNP LLP, Chartered Professional Accountants, as auditor of the Corporation at remuneration to be fixed by the Board. |

Ordinary Resolution |

Proposal No. 3: Approval of the amendments to the Corporation’s Stock Option Plan (including all unallocated stock options issuable thereunder). |

Ordinary Resolution |

Proposal No. 4: Approval of the amendments to the Corporation’s Restricted Share Unit Plan (including all unallocated awards issuable thereunder). |

Ordinary Resolution |

Proposal No. 5: Approval of the issuance and sale on a private placement basis of TerrAscend Growth Common Shares for aggregate gross proceeds of US$1,000,000, which shall be deemed, for the purposes of section 184(3) of the Business Corporations Act (Ontario), to be a sale of all or substantially all of the assets of the Corporation. |

Special Resolution |

Virtual Meeting Protocols: Attending and Participating in the Meeting

The Corporation is holding the Meeting as a completely virtual meeting, which will be conducted via live webcast.

9

Shareholders will not be able to attend the Meeting in person. In order to attend, participate in or vote at the Meeting, Shareholders must have a valid username.

Registered Shareholders and duly appointed proxyholders will be able to attend, participate in and vote at the Meeting online at https://web.lumiagm.com/239473997 (password: “terrascend2023” (case-sensitive)). Such persons may then enter the Meeting by clicking “I have a login” and entering a username and password before the start of the Meeting:

Registered Shareholders: The control number located on the form of proxy (or in the email notification you received if you have previously consented to receiving shareholder materials via email) is the username. The password to the Meeting is “terrascend2023” (case sensitive). If, as a registered Shareholder you are using your control number to login to the Meeting and you have previously voted, you do not need to vote again when the polls open during the Meeting. By voting at the Meeting, you will revoke your previous voting instructions received prior to voting cut-off.

Duly appointed proxyholders: Odyssey will provide the proxyholder with a username by e-mail after the voting deadline has passed (see section below entitled “Virtual Meeting Protocols: Registering a Proxyholder to Attend the Meeting”). The password to the Meeting is “terrascend2023” (case sensitive). Only registered Shareholders and duly appointed proxyholders will be entitled to attend, participate in and vote at the Meeting. Non-Registered Shareholders who have not duly appointed themselves as proxyholder will be able to attend the Meeting as a guest but will not be able to participate in or vote at the Meeting. Shareholders who wish to appoint a third party proxyholder to represent them at the Meeting (including Non-Registered Shareholders who wish to appoint themselves as proxyholder to attend, participate in or vote at the Meeting) MUST submit their duly completed proxy or Voting Instruction Form AND register the proxyholder.

Virtual Meeting Protocols: Registering a Proxyholder to Attend the Meeting

The following applies to Shareholders who wish to appoint a person (a “Third Party Proxyholder”) other than the management nominees set forth in the form of proxy or Voting Instruction Form as proxyholder, including Non-Registered Shareholders who wish to appoint themselves as proxyholder to attend, participate in or vote at the Meeting.

Shareholders who wish to appoint a Third Party Proxyholder to attend, participate in or vote at the Meeting as their proxy and vote their Common Shares MUST submit their proxy or Voting Instruction Form (as applicable) appointing such Third Party Proxyholder AND register the Third Party Proxyholder, as described below. Registering your proxyholder is an additional step to be completed AFTER you have submitted your proxy or Voting Instruction Form. Failure to register the proxyholder will result in the proxyholder not receiving a username to attend, participate in or vote at the Meeting.

Step 1: Submit your proxy or Voting Instruction Form: To appoint a Third Party Proxyholder, insert such person’s name in the blank space provided in the form of proxy or Voting Instruction Form (if permitted) and follow the instructions for submitting such form of proxy or Voting Instruction Form. This must be completed prior to registering such proxyholder, which is an additional step to be completed once you have submitted your form of proxy or Voting Instruction Form. If you are a Non-Registered Shareholder located in the US, you must also provide Odyssey with a duly completed legal proxy if you wish to attend, participate in or vote at the Meeting or, if permitted, appoint a third party as your proxyholder.

Step 2: Register your proxyholder: To register a proxyholder, Shareholders must send an email to appointee@odysseytrust.com by 1:00 p.m. (Eastern Time) on June 20, 2023 and provide Odyssey with their proxyholder’s contact information, amount of Common Shares appointed, name in which the Common Shares are registered if they are a registered Shareholder, or name of broker where the Common Shares are held if a Non-Registered Shareholder, so that Odyssey may provide the proxyholder with a username via email. Without a username, proxyholders will not be able to attend, participate in or vote at the Meeting.

If you are a Non-Registered Shareholder and wish to attend, participate in or vote at the Meeting, you have to insert your own name in the space provided on the Voting Instruction Form sent to you by your Intermediary, follow all of the applicable instructions provided by your Intermediary AND register yourself as your proxyholder, as described

10

above. By doing so, you are instructing your Intermediary to appoint you as proxyholder. It is important that you comply with the signature and return instructions provided by your Intermediary.

Virtual Meeting Protocols: Legal Proxy – US Non-Registered Shareholders

If you are a Non-Registered Shareholder located in the United States and wish to attend, participate in or vote at the Meeting or, if permitted, appoint a Third Party Proxyholder, in addition to the steps described above, you must obtain a valid legal proxy from your Intermediary. Follow the instructions from your Intermediary included with the legal proxy form and the Voting Information Form sent to you, or contact your Intermediary to request a legal proxy form or a legal proxy if you have not received one. After obtaining a valid legal proxy from your Intermediary, you must then submit such legal proxy to Odyssey. Requests for registration from Non-Registered Shareholders located in the United States that wish to attend, participate in or vote at the Meeting or, if permitted, appoint a third party as their proxyholder must be sent by email to appointee@odysseytrust.com and received by 1:00 p.m. (Eastern time) on June 20, 2023.

Virtual Meeting Protocols: Voting at the Meeting

Any Shareholder who has already submitted a duly completed form of proxy or Voting Instruction Form does not need to vote again when the polls open during the Meeting. By voting at the Meeting, you will revoke your previous voting instructions received prior to voting cut-off.

Registered Shareholders and proxyholders who have registered prior to the Meeting by following the steps above may vote at the Meeting by completing the poll online during the Meeting.

Questions at the Meeting

The Corporation believes that the ability to participate in the Meeting in a meaningful way, including asking questions, remains important despite the decision to hold this year’s Meeting virtually. It is anticipated that registered Shareholders and proxyholders (including Non-Registered Shareholders who have appointed themselves as proxyholder) will have substantially the same opportunity to ask questions related to the matters of business to be considered at the Meeting as in past years when the annual meeting of Shareholders was held in person. Only registered Shareholders and duly appointed proxyholders will be able to submit questions. Guests will not be able to submit questions. To ask a question, please follow the steps outlined on the virtual meeting platform.

Questions related to the matters to be considered at the Meeting will be addressed at the relevant time during the Meeting. As at an in-person meeting, to ensure fairness for all attendees, the Chair of the Meeting will decide on the amount of time allocated to each question and will have the right to limit or consolidate questions and to reject questions that do not relate to the business of the Meeting or which are determined to be inappropriate, do not directly relate to the matters to be considered at the Meeting, or are otherwise out of order.

Difficulties Accessing the Meeting

If you are accessing the Meeting you must remain connected to the Internet at all times during the Meeting in order to vote when balloting commences. It is your responsibility to ensure Internet connectivity for the duration of the Meeting. Note that if you lose connectivity once the Meeting has commenced, there may be insufficient time to resolve your issue before ballot voting is completed. Therefore, even if you currently plan to access the Meeting and vote during the live webcast, you should consider voting your shares in advance or by proxy so that your vote will be counted in the event you experience any technical difficulties or are otherwise unable to access the Meeting.

Quorum

A quorum of Shareholders is required to transact business at the Meeting. Pursuant to the by-laws of the Corporation, the quorum requirement for the Meeting will be satisfied, and the Meeting will be properly constituted, where the holders of shares representing, in the aggregate, 5% of the shares entitled to vote at a Meeting, whether present or by proxy.

11

Shareholder Proposals and Director Nominations

Shareholder Proposals for 2023

The final date and time by which the Corporation must receive a proposal for any matter that a Shareholder proposes to raise at the annual meeting of Shareholders to be held on June 22, 2023 must be received by April 23, 2023.

Shareholder Proposals for 2024

To be considered for inclusion in next year’s proxy materials, a shareholder proposal must be submitted in writing on or before (i) January 3, 2024 for proposals submitted pursuant to Rule 14a-8 promulgated under the Exchange Act or (ii) April 23, 2024 for proposals submitted pursuant to the OBCA, and provided such shareholder proposal satisfies all other requirements for shareholder proposals under Rule 14a-8 or the OBCA, as applicable. Any such proposals should be submitted to: TerrAscend Corp. ATT: Corporate Secretary, 77 City Centre Drive, East Tower - Suite 501, Mississauga, ON L5B 1M5. If you wish to bring a matter before the shareholders at next year’s annual meeting by a shareholder proposal and you do not submit a valid shareholder proposal to the Corporation before April 23, 2024, then (i) the Corporation will not be required to include such proposal in the proxy materials for the 2024 Annual Meeting and (ii) for all proxies we receive, the proxyholders will have discretionary authority to vote on the matter, including discretionary authority to vote in opposition to the matter.

Advance Notice Provision

The Corporation’s by-laws include an advance notice provision (the “Advance Notice Provision”). The Advance Notice Provision requires advance notice to the Corporation if nominations of persons for election to the Board are to be made by Shareholders of the Corporation other than pursuant to (i) a requisition of a meeting made pursuant to the provisions of the Corporation’s enacting statute or (ii) a Shareholder proposal made pursuant to the provisions of the Corporation’s enacting statute.

The purpose of the Advance Notice Provision is to ensure that all Shareholders – including those participating in a given meeting by proxy rather than in person – receive adequate notice of the nominations to be considered at the given meeting and can thereby exercise their voting rights in an informed manner. Among other things, the Advance Notice Provision fixes a deadline by which holders of Common Shares must submit director nominations to the Corporation prior to any annual or special meeting of Shareholders and sets forth the minimum information that a Shareholder must include in the notice to the Corporation for the notice to be in proper written form.

To be timely, a Shareholder’s notice must be received by the Corporation:

i. in the case of an annual (or annual and special) meeting to be held on a date that is 50 days or more after the date on which the first public announcement of the date of that meeting is made, not later than 5:00 p.m. (EST time) on the date that is 30 days before the date of that meeting;

ii. in the case of an annual (or annual and special meeting) to be held on a date that is less than 50 days after the date on which the first public announcement of the date of that meeting is made, not later than 5:00 p.m. (EST time) on the 10th day following the date on which the first public announcement of the date of that meeting is made;

iii. in the case of a special meeting (which is not also an annual meeting) called for the purpose of electing directors (whether or not called for other purposes), not later than 5:00 p.m. (EST time) on the 15th day following the date on which the first public announcement of the date of that meeting is made.

The foregoing is merely a summary of the Advance Notice Provision, is not comprehensive and is qualified by the full text of such provision contained in the Corporation’s by-laws which are available under the Corporation’s profile on SEDAR at www.sedar.com and with the SEC through EDGAR at www.sec.gov/edgar.

The Corporation has not received notice of any nominations in respect of the Meeting in compliance with the Advance Notice Provision at the date of this Circular.

12

In addition, to comply with the universal proxy rules, shareholders who intend to solicit proxies in support of director nominees other than the Corporation’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than April 23, 2024.

Dissenters’ Rights

Under the OBCA, dissenters rights are not available to our Shareholders with respect to matters to be voted on at the Meeting, other than with respect to the Transaction Proposal. A description of a registered shareholder’s Dissent Rights is included under the heading “Dissent Rights”.

[Remainder of this page intentionally left blank]

13

GLOSSARY OF TERMS

14

The following terms used in this Circular have the following meanings:

15

“Advance Notice Provision” |

has the meaning ascribed thereto under the heading “General Proxy Matters – Advance Notice Provision”. |

“Advanced Put Notice” |

has the meaning ascribed thereto under the heading “Proposal No.5: Transaction Proposal – Background”. |

“Aggregate Repurchase Price” |

means the sum of: (a) the Repurchase/Put Price; plus (b) the amount equal to 40% of the Subscription Amount less the aggregate Dividend Amounts paid to the Investor as of the date of the Exercise Notice. |

“AIP” |

has the meaning ascribed thereunder under the heading “Compensation of Named Executive Officers”. |

“Arbor” |

means Arbor Pharmaceuticals. |

“Arrangement Agreement” |

has the meaning ascribed thereto under the heading “Transactions With Related Persons”. |

“Arthouse” |

means Arthouse Entertainment. |

“Audit Committee” |

means the Audit Committee of the Corporation. |

“Break Fee” |

means the amount determined by calculating the interest payable on the Subscription Amount from the date of the Subscription Agreement equal to 20% per annum calculated on the basis of a 365-day year whereby the rate used in such calculation is equivalent to the rate so used multiplied by the actual number of days in the calendar year in which the same is to be ascertained and divided by 365. |

“Board” |

means the board of directors of the Corporation. |

“Broadridge” |

has the meaning ascribed thereto under the heading “General Proxy Matters – Non-Registered Shareholders”. |

“Canopy USA Entities” |

has the meaning ascribed thereto under the heading “Audit Committee – Audit Committee Report”. |

“Circular” |

has the meaning ascribed thereto under the heading “Management Information Circular And Proxy Statement For 2023 Annual General And Special Meeting Of Shareholders”. |

“Closing Document” |

means any document delivered at or subsequent to the Time of Closing as provided in or pursuant the Subscription Agreement. |

“Common Shares” |

means the common shares of the Corporation. |

“Cookies” |

means Cookies Retail Canada Corp. |

“Corporation” |

means TerrAscend Corp. |

“Court” |

means the Ontario Superior Court of Justice (Commercial List). |

“Credit Agreements” |

means, collectively, the Michigan Agreement, the TerrAscend NJ LLC Agreement and the WBD Holding PA Agreement. |

“CSA” |

means the Controlled Substances Act. |

“CSE” |

means the Canadian Securities Exchange. |

16

“Director Nominees” |

has the meaning ascribed thereto under the heading “Matters To Be Acted Upon At The Meeting – Proposal No. 1: Election of Directors”. |

“Dissent Notice” |

has the meaning ascribed thereto under the heading “Dissent Rights”. |

“Dissent Rights” |

means the right of a registered shareholder to dissent to the Transaction Resolution and to be paid the fair value of its shares in respect of which the holder dissents, all in accordance with Section 185 of the OBCA. |

“Dissenting Shareholders” |

means a registered shareholder who has duly and validly exercised the Dissent Rights and has not withdrawn or been deemed to have withdrawn such exercise of Dissent Rights, but only in respect of shares in respect of which Dissent Rights are validly exercised by such registered shareholder, and “Dissenting Shareholder” means any one of them. |

“Dividend Amount” |

has the meaning ascribed thereto under the heading “Proposal No. 5: Transaction Proposal – The Transaction Proposal”. |

“Eligible Persons” |

has the meaning ascribed thereto under the heading “Matters To Be Acted Upon At The Meeting – Proposal No. 3: Approval of the Stock Option Plan Resolution”. |

“Exchange Rate” |

has the meaning ascribed thereto under the heading “Matters To Be Acted Upon At The Meeting – Proposal No. 2: Ratification of Selection of MNP as Auditor”. |

“Exchangeable Shares” |

has the meaning ascribed thereto under the heading “Information Concerning The Corporation - Voting Securities and Principal Holders of Voting Securities”. |

“Exercise Notice” |

has the meaning ascribed thereto under the heading “Proposal No. 5: Transaction Proposal – Background”. |

“Gage” |

means Gage Growth Corp. |

“Grant Date” |

has the meaning ascribed thereto under the heading “Matters To Be Acted Upon At The Meeting –2023 Stock Option Plan Amendments”. |

“Intermediary” |

has the meaning ascribed thereto under the heading “General Proxy Matters – Non-Registered Shareholders”. |

“Investment” |

has the meaning ascribed thereto under the heading “Proposal No. 5: Transaction Proposal – Background”. |

17

“Investor” |

means TERINVEST LLC. |

“Investor Nominee” |

has the meaning ascribed thereto under the heading “Proposal No. 5: Transaction Proposal – Structure of TerrAscend Growth”. |

“ISOs” |

has the meaning ascribed thereto under the heading “Matters To Be Acted Upon At The Meeting –2021 Stock Option Plan Amendments”. |

“Lender Consents” |

means, collectively, the consent, waiver or other agreement of the Lenders, as applicable, pursuant to the Credit Agreements as is necessary to permit the Investment as determined by TerrAscend Growth, acting reasonably. |

“Lenders” |

means, collectively, the Michigan Lenders, the TerrAscend NJ Lenders and the WBD Lenders. |

“Meeting” |

has the meaning ascribed thereto under the heading “Notice Of Annual General And Special Meeting Of Shareholders Of Terrascend Corp. To Be Held On June 22, 2023”. |

“Meeting Materials” |

has the meaning ascribed thereto under the heading “General Proxy Matters – Non-Registered Shareholders”. |

“MI 61-101” |

has the meaning ascribed thereto under the heading “Transactions With Related Persons”. |

“Michigan Agreement” |

means the credit agreement made by and among, inter alios, TerrAscend Growth, as parent and co-borrower, the credit parties and lenders party thereto and Chicago Atlantic Admin, LLC dated as of November 22, 2021, as amended by that certain Joinder, First Amendment to Credit Agreement and Security Agreements and Consent dated as of August 10, 2022 and Joinder and Second Amendment to Credit Agreement and Security Agreements dated as of November 29, 2022. |

“Michigan Lenders” |

means the lenders party to the Michigan Agreement. |

“MNP” |

has the meaning ascribed thereto under the heading “Matters To Be Acted Upon At The Meeting – Proposal No. 2: Ratification of Selection of MNP as Auditor”. |

“Named Executive Officers” |

has the meaning ascribed thereto under the heading “Executive Compensation”. |

“NEOs” |

has the meaning ascribed thereto under the heading “Executive Compensation”. |

18

“NI 52-110” |

has the meaning ascribed thereto under the heading “Corporate Governance – Board of Directors”. |

“Non-Registered Shareholder” |

has the meaning ascribed thereto under the heading “General Proxy Matters – Non-Registered Shareholders”. |

“Non-Voting Shares” |

has the meaning ascribed thereto under the heading “Proposal No. 5: Transaction Proposal – Background”. |

“Notice of Meeting” |

means the 2023 Notice of Annual General and Special Meeting of Shareholders of the Corporation |

“NP 58-201” |

has the meaning ascribed thereto under the heading “Corporate Governance”. |

“NQSOs” |

has the meaning ascribed thereto under the heading “Matters To Be Acted Upon At The Meeting –2021 Stock Option Plan Amendments”. |

“OBCA” |

has the meaning ascribed thereto under the heading “Information Concerning the Corporation – General Information”. |

“Odyssey” |

has the meaning ascribed thereto under the heading “Notice Of Annual General And Special Meeting Of Shareholders Of Terrascend Corp. To Be Held On June 22, 2023”. |

“Offer to Pay” |

has the meaning ascribed thereto under the heading “Dissent Rights”. |

“Options” |

has the meaning ascribed thereto under the heading “Matters To Be Acted Upon At The Meeting – Proposal No. 3: Approval of the Stock Option Plan Resolution”. |

“Ordinary Resolution” |

has the meaning ascribed thereto under the heading “General Proxy Matters – Voting Thresholds Required for Approval”. |

“Outside Date” |

means August 31, 2023 or such later date as may be agreed to in writing by TerrAscend Growth and the Investor. |

“Payment Demand” |

has the meaning ascribed thereto under the heading “Dissent Rights”. |

“PCAOB” |

means Public Company Accounting Oversight Board. |

“Pinnacle” |

means KISA Enterprises MI Inc. |

19

“Preferred Shares” |

has the meaning ascribed thereto under the heading “Information Concerning The Corporation - Voting Securities and Principal Holders of Voting Securities”. |

“Proportionate Voting Shares” |

has the meaning ascribed thereto under the heading “Information Concerning The Corporation - Voting Securities and Principal Holders of Voting Securities”. |

“Protection Agreement” |

means the protection agreement between the Corporation and TerrAscend Growth dated April 18, 2023. |

“Put Option” |

has the meaning ascribed thereto under the heading “Proposal No. 5: Transaction Proposal – Background”. |

“Record Date” |

has the meaning ascribed thereto under the heading “Notice Of Annual General And Special Meeting Of Shareholders Of Terrascend Corp. To Be Held On June 22, 2023”. |

“Repurchase Option” |

has the meaning ascribed thereto under the heading “Proposal No. 5: Transaction Proposal – Background”. |

“Repurchase/Put Price” |

means, on a per TerrAscend Growth Common Share basis, the greater of: (i) the Subscription Price; and (ii) the fair market value of a TerrAscend Growth Common Share, which shall be equal to the product obtained by multiplying 322,580.65 by the volume-weighted average price of the Common Shares on the principal Canadian national or regional securities exchange on which the Common Shares are then listed, or, if the Common Shares are not then listed on a Canadian national or regional securities exchange, the principal other market on which the Common Shares are then traded during the 20 consecutive trading days ending on the day immediately preceding the Exercise Notice or Advanced Put Notice, as the case may be. |

“RSU Plan” |

means the RSU Plan of the Corporation. |

“RSU Plan Resolution” |

has the meaning ascribed thereto under the heading “Matters To Be Acted Upon At The Meeting - 2023 RSU Plan Amendments”. |

“SEC” |

means the United States Securities and Exchange Commission. |

20

“Securities Laws” |

means, as applicable, the securities laws, regulations, rules, rulings and orders in each of the provinces and territories of Canada and the United States, the applicable policy statements, notices, blanket rulings, orders and all other regulatory instruments of the securities regulators in each of the provinces/states and territories of Canada and the United States. |

“SEDAR” |

means System for Electronic Document Analysis and Retrieval. |

“Shareholders” |

has the meaning ascribed thereto under the heading “Notice Of Annual General And Special Meeting Of Shareholders Of Terrascend Corp. To Be Held On June 22, 2023”. |

“Side Letter” |

means the side letter agreement dated April 19, 2023 among TerrAscend, TerrAscend Growth and the Investor. |

“Special Resolution” |

has the meaning ascribed thereto under the heading “General Proxy Matters – Voting Thresholds Required for Approval”. |

“Stock Option Plan” |

means the Stock Option Plan of the Corporation. |

“Stock Option Plan Amendments” |

has the meaning ascribed thereto under the heading “Matters To Be Acted Upon At The Meeting –2023 Stock Option Plan Amendments”. |

“Stock Option Plan Resolution” |

has the meaning ascribed thereto under the heading “Matters To Be Acted Upon At The Meeting –2023 Stock Option Plan Amendments”. |

“Subscription Agreement” |

means the subscription agreement dated April 19, 2023 between TerrAscend Growth and the Investor. |

“Subscription Amount” |

has the meaning ascribed thereto under the heading “Proposal No.5: Transaction Proposal – Background”. |

“TerrAscend” |

means TerrAscend Corp. |

“TerrAscend Canada” |

means TerrAscend Canada Inc. |

“TerrAscend Canada Transfer” |

has the meaning ascribed thereto under the heading “Proposal No. 5: Transaction Proposal”. |

“TerrAscend Growth” |

means TerrAscend Growth Corp. (formerly Gage Growth Corp.). |

“TerrAscend Growth Articles” |

has the meaning ascribed thereto under the heading “Proposal No. 5: Transaction Proposal – Background”. |

21

“TerrAscend Growth Board” |

means the board of directors of TerrAscend Growth. |

“TerrAscend Growth Class B Shares” |

has the meaning ascribed thereto under the heading “Proposal No. 5: Transaction Proposal – Background”. |

“TerrAscend Growth Common Shares” |

has the meaning ascribed thereto under the heading “Proposal No. 5: Transaction Proposal – Background”. |

“TerrAscend NJ LLC Agreement” |

means the loan agreement made by and among, inter alios, TerrAscend NJ LLC, HMS Processing LLC, HMS Hagerstown, LLC and HMS Health, LLC, collectively as borrower, the guarantors party thereto and Pelorus. |

“TerrAscend NJ Lenders” |

means the lenders party to the TerrAscend NJ LLC Agreement. |

“TerrAscend Nominee” |

has the meaning ascribed thereto under the heading “Proposal No. 5: Transaction Proposal – Structure of TerrAscend Growth”. |

“Third Party Proxyholder” |

Has the meaning ascribed thereto under the heading “General Proxy Matters – Virtual Meeting Protocols: Registering a Proxyholder to Attend the Meeting”. |

“Time of Closing” |

means 8:00 a.m. (Eastern Time) on the date on which the closing of the Investment occurs, or such other time as may be agreed to by TerrAscend Growth and the Investor. |

“Transaction Documents” |

means the Subscription Agreement, the Protection Agreement, the Side Letter and the Closing Documents. |

“Transaction Proposal” |

has the meaning ascribed thereto under the heading “Proposal No. 5: Transaction Proposal”. |

“Transaction Resolution” |

has the meaning ascribed thereto under the heading “Proposal No. 5: Transaction Proposal”. |

“TSX” |

means the Toronto Stock Exchange. |

“TSX Listing” |

means the Corporation’s proposed listing of its Common Shares on the TSX. |

“TSX Requirements” |

has the meaning ascribed thereto under the heading “Proposal No. 5: Transaction Proposal – Background”. |

22

“TSX Staff Notice” |

has the meaning ascribed thereto under the heading “Proposal No. 5: Transaction Proposal – Background”. |

“US GAAP” |

has the meaning ascribed thereto under the heading “Matters To Be Acted Upon At The Meeting – Proposal No. 2: Ratification of Selection of MNP as Auditor”. |

“Veloxis” |

means Veloxis Pharmaceuticals, Inc. |

“Voting Instruction Form” |

Has the meaning ascribed thereto under the heading “General Proxy Matters – Non-Registered Shareholders”. |

“WBD Holding PA Agreement” |

means the credit agreement by and among, inter alios, WDB Holding PA, Inc., as borrower, the loan parties party thereto and Acquiom Agency Services LLC, dated as of December 18, 2020, as amended by Amendment No. 1 thereto, dated as of April 28, 2022 and Amendment No. 2, dated as of November 11, 2022. |

“WBD Lenders” |

means the lenders party to the WBD Holding PA Agreement. |

MATTERS TO BE ACTED UPON AT THE MEETING

Presentation of Financial Statements

The audited consolidated financial statements of the Corporation for the year ended December 31, 2022 and the report of the auditor thereon will be presented at the Meeting. The financial statements of the Corporation and the report of the auditor thereon are publicly available under the Corporation’s profile on SEDAR at www.sedar.com and on the SEC’s website through EDGAR at www.sec.gov/edgar. No vote by the Shareholders with respect to the audited consolidated financial statements is required.

Proposal No. 1: Election of Directors

The Board of the Corporation currently consists of six directors, five of whom have been recommended for re-election to the Board by the Nominating and Corporate Governance Committee: Craig Collard, Kara DioGuardi, Ira Duarte, Ed Schutter, and Jason Wild (the “Director Nominees”). Mr. Collard, Ms. DioGuardi, Mr. Schutter, and Mr. Wild are each a current director of the Corporation who was previously elected by the Shareholders. Ms. Duarte, a member of the Board of the Corporation since December 2, 2022, was recommended by Craig Collard, a non-management director, to be a member of the Board of the Corporation. Each elected director will hold office until the close of the next annual meeting of Shareholders following his or her election, or any postponement(s) or adjournment(s) thereof, unless his or her office is vacated earlier or until his or her successor is elected or appointed. Effective immediately prior to the Meeting, upon Ms. Swartzman ceasing to be a director of the Corporation, the Board shall consist of five directors.

Management does not contemplate that any of the Director Nominees will be unable to serve as a director, but if that should occur for any reason prior to the Meeting, it is intended that discretionary authority shall be exercised by the persons named in the accompanying form of proxy to vote the proxy for the election of any other person or persons in place of any Director Nominee(s) unable to serve.

23

Unless otherwise indicated, the persons designated as proxyholders in the accompanying form of proxy will vote the Common Shares represented by such form of proxy, properly executed, FOR the election of each of the Director Nominees.

The following table sets forth information about each Director Nominee, including (i) his or her name, age, and province or state and country of residence, (ii) the period during which each has served as a director, (iii) memberships on committees of the Board, (iv) present principal occupation, business or employment, and (v) the number of Common Shares of the Corporation or any of its subsidiaries beneficially owned, or controlled or directed, directly or indirectly.

Information regarding the number of Common Shares beneficially owned, or controlled or directed, directly or indirectly, by the Director Nominees, not being within the knowledge of the Corporation, is based upon information furnished by the applicable Director Nominee and is as at the date hereof.

Name, Age, Province or State and Country of Residence |

Principal Occupation |

Current Position(s) with the Corporation |

Director Since |

Number of Common Shares Beneficially Owned, or Controlled or Directed, Directly or Indirectly |

Craig Collard, 57 |

CEO and Director, Heron Therapeutics |

Lead Independent Director Chair of the Nominating and Corporate Governance Committee Member of the Audit Committee and Compensation Committee |

December 6, 2018 |

408,579 Common Shares(1) |

|

Kara DioGuardi, 52 Maine, United States |

Co-Founder, Arthouse Entertainment |

Director Member of Compensation Committee Member of Nominating and Corporate Governance Committee |

March 3, 2022 |

60,827 Common Shares (2) |

24

Name, Age, Province or State and Country of Residence |

Principal Occupation |

Current Position(s) with the Corporation |

Director Since |

Number of Common Shares Beneficially Owned, or Controlled or Directed, Directly or Indirectly |

|

Ira Duarte, 54 North Carolina, United States

|

Chief Financial Officer, Veloxis Pharmaceuticals |

Director Chair of the Audit Committee Member of Nominating and Corporate Governance Committee |

December 2, 2022 |

Nil |

Ed Schutter, 71 |

Director |

Director Chair of the Compensation Committee |

November 2, 2020 |

1,123,645 Common Shares (3) |

Jason Wild, 50 |

President and Chief Investment Officer, JW Asset Management, LLC |

Director, Chairman of the Board, Executive Chairman |

December 8, 2017 |

88,621,984 Common Shares (4) |

________________

Director Biographies

The following are brief profiles of our Director Nominees, including a description of each individual’s principal occupation within the past five years.

Craig Collard

Craig A. Collard has served as a member of our Board since December 2018. Mr. Collard is currently the Chief Executive Officer and a member of the board of Heron Therapeutics, Inc., a commercial-stage biotechnology company, positions he has held since April 2023 and February 2023, respectively. He served as the Chief Executive

25

Officer of Veloxis Pharmaceuticals, Inc. (“Veloxis”) from December 2015 until December 2021. Mr. Collard is a member of the board of directors of Sierra Oncology, Inc. Mr. Collard holds a Bachelor of Science in Engineering from the Southern College of Technology (now Southern Polytechnic State University) in Marietta, Georgia. The Corporation believes that Mr. Collard is qualified to serve on the Board of Directors because of his extensive experience as an executive, his experience as a director and his industry experience in pharmaceuticals.

Kara DioGuardi

Kara DioGuardi has served as a member of our Board since March 2022. Ms. DioGuardi co-founded Arthouse Entertainment (“Arthouse”), a music publishing company, in 2000 and is currently the Chief Executive Officer of Arthouse. Ms. DioGuardi graduated from Duke University in 1992 with a Bachelor of Political Science and Government. The Corporation believes that Ms. DioGuardi is qualified to serve on the Board because of her extensive industry experience in the music and publishing industry that brings a strong understanding of people, marketing and culture.

Ira Duarte

Ira Duarte has served as a member of our Board since December 2022. Ms. Duarte currently serves as Chief Financial Officer of Veloxis, a position she has held since October 2018, and has held other finance roles at Veloxis from 2009 to 2018. A Certified Public Accountant, Ms. Duarte holds a B.S. in Accounting from Florida Atlantic University. The Corporation believes that Ms. Duarte is qualified to serve on the Board because of her extensive experience as an executive, her financial expertise as a CFO and her industry experience in pharmaceuticals.

Ed Schutter

Ed Schutter has served as a member of our Board since November 2020. Mr. Schutter was Chief Executive Officer of Arbor Pharmaceuticals (“Arbor”) from 2010 to 2021. Mr. Schutter is a registered pharmacist with a B.S. degree in Pharmaceutical Sciences from Mercer University and an M.B.A. from Kennesaw State University. He has also completed graduate studies in International Business at Njienrode University, Amsterdam, Netherlands. Mr. Schutter is currently a board member of Vitruvias Therapeutics, Intrance Medical Systems and Establishment Labs. The Corporation believes that Mr. Schutter is qualified to serve on the Board because of his extensive experience as an executive, his experience as a director and his industry experience in pharmaceuticals.

Jason Wild

Jason Wild has served as Chairman of our Board since December 2017. Mr. Wild is the President and Chief Investment Officer of JW Asset Management, LLC, an investment fund that he founded in 2003. Mr. Wild has also worked as a professional portfolio manager at JW Asset Management, LLC since 2003. Mr. Wild received a Bachelor’s Degree in Pharmacy from the Arnold and Marie Schwartz College of Pharmacy. The Corporation believes that Mr. Wild is qualified to serve on the Board because of his extensive experience in capital markets, the cannabis industry and his experience in pharmaceuticals.

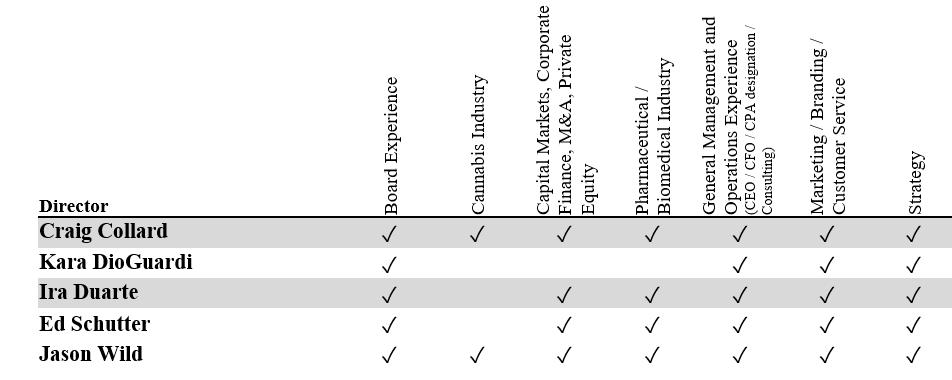

Director Skills Matrix

In addition to the information provided in our directors’ biographies and elsewhere in this Circular, the following matrix summarizes certain skills and experience of our current directors, taking into account a number of qualifications we believe are important for service on our Board. This matrix is based on self-reported data collected from our directors. The matrix is intended to provide a summary of our directors’ self-reported qualifications and should not be considered to be a complete list of each director’s strengths and contributions to our Board.

26

Family Relationships

There are no family relationships between any of our executive officers, directors or Director Nominees.

Cease Trade Orders

To the knowledge of the Corporation, no proposed director of the Corporation is, or within the ten years before the date of this Circular, has been, a director or officer of any company that:

Bankruptcies

To the knowledge of the Corporation, no proposed director of the Corporation is, or within ten years before the date of this Circular, has been, a director or an executive officer of any company that, while the person was acting in that capacity, or within a year of that person ceasing to act in the capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or was subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold its assets or made a proposal under any legislation relating to bankruptcies or insolvency.

To the knowledge of the Corporation, no proposed director of the Corporation has, within the ten years before the date of this Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director.

Penalties and Sanctions

To the knowledge of the Corporation, no proposed director of the Corporation has been subject to: (a) any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered

27

into a settlement agreement with a securities regulatory authority; or (b) any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable securityholder in deciding whether to vote for a proposed director.

Proposal No. 2: Ratification of Appointment of MNP as Auditor

Management proposes the ratification of the appointment by the audit committee of MNP LLP (“MNP”), Chartered Professional Accountants, of Toronto, Ontario, as auditor of the Corporation at remuneration to be fixed by the Board. MNP was first appointed as auditor of the Corporation on March 7, 2017. To the Corporation’s knowledge, a representative of MNP will not be present at the Meeting, although the firm will be permitted to make a statement if it so desires.

The following table sets out the fees for services provided to the Corporation by our independent registered public accounting firm for the years ended December 31, 2022 and December 31, 2021.

Nature of Services |

|

|

December 31, 2022(1) |

December 31, 2021 (1) |

||

Audit Fees(2) |

$ |

|

2,286,914 |

|

$ |

1,414,961 |

Audit-Related Fees(3) |

$ |

|

5,758 |

|

$ |

114,197 |

Tax Fees(4) |

$ |

|

193,216 |

|

$ |

48,616 |

All Other Fees |

$ |

|

-- |

|

$ |

-- |

Total |

$ |

|

2,485,888 |

|

$ |

1,577,774 |

________________

(1) Such fees were paid in Canadian dollars and translated into U.S. dollars using the daily average exchange rate as reported by the H.10 statistical release of the Board of Governors of the Federal Reserve System on December 31, 2022 of C$1.3014 = US$1.00 and on December 31, 2021 of C$1.2753 = US$1.00 for the respective periods (the “Exchange Rate”, as applicable).

(2) Consists of fees for audit services. This includes, among other things, quarterly reviews and audit of the annual financial statements, including audit of historical financial statements converted from International Financial Reporting Standards to U.S. generally accepted accounting principles (“US GAAP”), and services that are normally provided in connection with statutory and regulatory filings or engagements. Included in audit fees are audit services of $636,335 relating to the Company’s Form 8-K for the acquisition of Gage Growth Corp. The 8-K filing included the December 31, 2021 audited standalone financial statements of Gage Growth Corp.

(3) Consists of fees that traditionally are performed by the independent accountant. This includes, among other things, review of the Registration Statement on Form 10 and the Registration Statements on Form S-8 and S-3 filings.

(4) Consists of fees billed for tax planning, tax advice and various taxation matters.

The Corporation’s audit committee (the “Audit Committee”) pre-approved all services provided by MNP in 2022. The Audit Committee has pre-approved all services anticipated to be provided by MNP during 2023.

On March 15, 2023, the Corporation adopted an Audit Committee Pre-approval Policy for the approval of services of the independent registered accounting firm. The Policy sets forth the particular services that may be pre-approved on a collective basis as well as the procedures for such pre-approval. The policy generally pre-approves specified services in the defined categories of audit-services, audit-related services and tax services up to specified amounts. Pre-approval may also be given as part of the Audit Committee’s approval of the scope of the engagement of the independent auditor or on an individual, explicit, case-by-case basis before the independent auditor is engaged to provide each service. The pre-approval of services may be delegated to one or more of the Audit Committee’s members, but the decision must be reported to the full Audit Committee at its next scheduled meeting.

Unless otherwise indicated, the persons designated as proxyholders in the accompanying form of proxy will vote the Common Shares represented by such form of proxy, properly executed, FOR the re-appointment of MNP as auditor of the Corporation to hold office until the close of the next annual meeting of Shareholders and the authorization of the Board to fix their remuneration.

Proposal No. 3: Approval of the Stock Option Plan Resolution and Unallocated Options

At the Meeting, management is seeking Shareholder approval of certain amendments to the Corporation’s stock option plan (the “Stock Option Plan”) and the approval of all unallocated stock options issuable thereunder in anticipation of the Corporation’s proposed TSX Listing pursuant to the Transaction Proposal as described further in this Circular. Management is also seeking an increase to the aggregate plan limit for the Stock Option Plan and the RSU Plan

28

(together with any other share compensation arrangement of the Corporation) from a rolling 10% to 15% of the outstanding Common Shares on each date on which the award is granted (on a non-diluted basis).

The Stock Option Plan was originally adopted and approved by the Board effective March 8, 2017, was further amended and restated on November 2, 2021 and on April 19, 2023 as further described below. The Stock Option Plan governs the grant, administration and exercise of options to purchase Common Shares (“Options”) which may be granted to employees, directors or consultants (“Eligible Persons”) of the Corporation. A copy of the Stock Option Plan, including the recent amendments, is attached as Schedule “B” of the Circular and available under the Corporation’s profile on SEDAR at www.sedar.com and on the SEC’s website at www.sec.gov. For a description of the key features of the Stock Option Plan see the section below entitled “Stock Option Plan and RSU Plan – Stock Option Plan”.

2021 Stock Option Plan Amendments

In November 2021, the Corporation undertook certain normal course revisions to the Stock Option Plan to: (i) extend the standard vesting provisions of options granted under the Stock Option Plan from 33.3% on each of the first three anniversary dates from the date of grant to 25% on each of the first four anniversary dates from the date of grant; (ii) clarify that in the case of a voluntary resignation of employment from the Corporation or a subsidiary, any vested portion of options held by a participant will expire on the earlier of the expiry date of the option and the date which is 90 days after the termination date; and (iii) make other conforming changes to the plan for the participation of U.S. participants, including to permit the award of Options to U.S. taxpayers that can be either non-qualified stock options that do not meet the requirements of Section 422 of the United States Internal Revenue Code (“NQSOs”) or incentive stock options (referred to herein as “ISOs”) that are qualified under Section 422 of the United States Internal Revenue Code.

ISOs allow more favorable U.S. federal income tax treatment, in some circumstances, for participants in the Stock Option Plan who are subject to United States federal income tax. However, the Corporation may not be entitled to a compensation expense deduction when ISOs are exercised for purposes of the Corporation’s United States corporate income taxes. The Stock Option Plan does not require that Options awarded to United States participants in the Plan be ISOs; the Corporation has discretion to award either ISOs or NQSOs under the Stock Option Plan, as amended.

The Corporation has not granted any ISOs under the Stock Option Plan, and will not do so unless and until shareholder approval for the amendments is obtained at the Meeting. Other than the revisions to permit the award of ISOs to U.S. taxpayers, the other amendments to the Stock Option Plan in 2021 were within the authority of the Board to make without Shareholder approval under the terms of the Stock Option Plan.

2023 Stock Option Plan Amendments

In anticipation of the Corporation’s proposed TSX Listing pursuant to the Transaction Proposal as described further in this Circular, on April 19, 2023 the Board approved certain revisions to the Stock Option Plan to bring it into conformity with the provisions of the TSX Company Manual.

The Stock Option Plan also includes a number of “housekeeping” amendments, including conforming certain definitions with the Corporation’s RSU Plan for consistency (definitions of: “Corporation”, “Shares” and “Plan”) and updating certain other definitions to conform with TSX requirements (definitions of: “Exchange”, “Insider”, “Investor Relations Activities”, “NI 45-106” and “Share Compensation Arrangement”), all which were within the authority of the Board to make without Shareholder approval under the terms of the Stock Option Plan.

No changes are made to the individual limits on grants to consultants, investor relations persons, to any one participant, or to insiders individually or within any one year. However, the Stock Option Plan has been revised to clarify that the calculation of such limits as a percentage of the Corporation’s then-outstanding Shares will be calculated on a non-diluted basis. Therefore, in order to ensure that the Corporation can continue to make awards under its equity based compensation plans, management is also seeking an increase to the aggregate plan limits for the Stock Option Plan and the RSU Plan (together with any other share compensation arrangement of the Corporation) from a rolling 10%

29

to 15% of the outstanding Common Shares on each date on which the award is granted (on a non-diluted basis).

The key substantive amendments to the Stock Option Plan for which Shareholder approval at the Meeting is being sought are summarized below: