EX-99.1

Published on August 10, 2023

TerrAscend Reports Second Quarter 2023 Record Net Revenue of $72.1 Million, an Increase of 12.7% Year-Over-Year and 3.9% Sequentially, Representing its 7th Consecutive Quarter of Sequential Revenue Growth

Gross profit margin increased to 50.2%, an improvement of 140 basis points sequentially

Reaffirms Net Revenue guidance for the full year of 2023 of at least $305 million and Adjusted EBITDA from continuing operations1 of at least $58 million

TORONTO, August 10, 2023 - TerrAscend Corp. (“TerrAscend” or the “Company”) (TSX: TSND) (OTCQX: TSNDF), a leading North American cannabis operator, today reported its financial results for the second quarter ended June 30, 2023. All amounts are expressed in U.S. dollars and are prepared under U.S. Generally Accepted Accounting Principles (GAAP), unless indicated otherwise.

The following financial measures are reported as results from continuing operations due to the shutdown of the licensed producer business in Canada, which is reported as discontinued operations for all of 2022. All historical periods have been restated accordingly.

Second Quarter 2023 Financial Highlights

Second Quarter 2023 Business and Operational Highlights

Subsequent Events

“We are pleased to deliver results in the second quarter that exceeded our internal forecasts. We have made substantial progress over the last several months across virtually all facets of our business. We have significantly improved our margins, transformed our balance sheet, materially lowered our interest expense, delivered positive operating cashflow, acquired four dispensaries in Maryland and successfully listed on the TSX, all while driving sector leading revenue growth of 26% in the first half of 2023,” stated Jason Wild, Executive Chairman of TerrAscend. “These achievements give us confidence in the remainder of the year, as evidenced by our full year revenue and Adjusted EBITDA guidance. We expect to deliver significant growth in revenue and profitability as we realize the benefits of our now vertically integrated operations in Maryland as well as continued strong execution in our other geographies.”

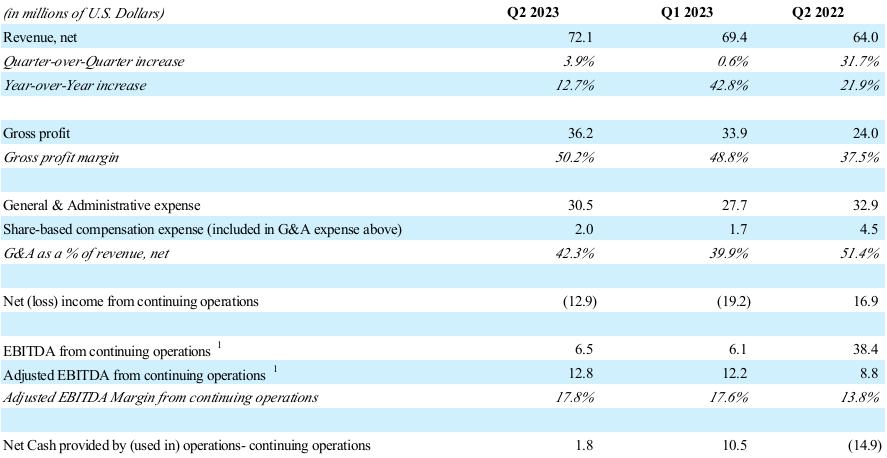

Financial Summary Q2 2023 and Comparative Periods

All figures are restated for the Canadian business recorded as discontinued operations.

Second Quarter 2023 Financial Results

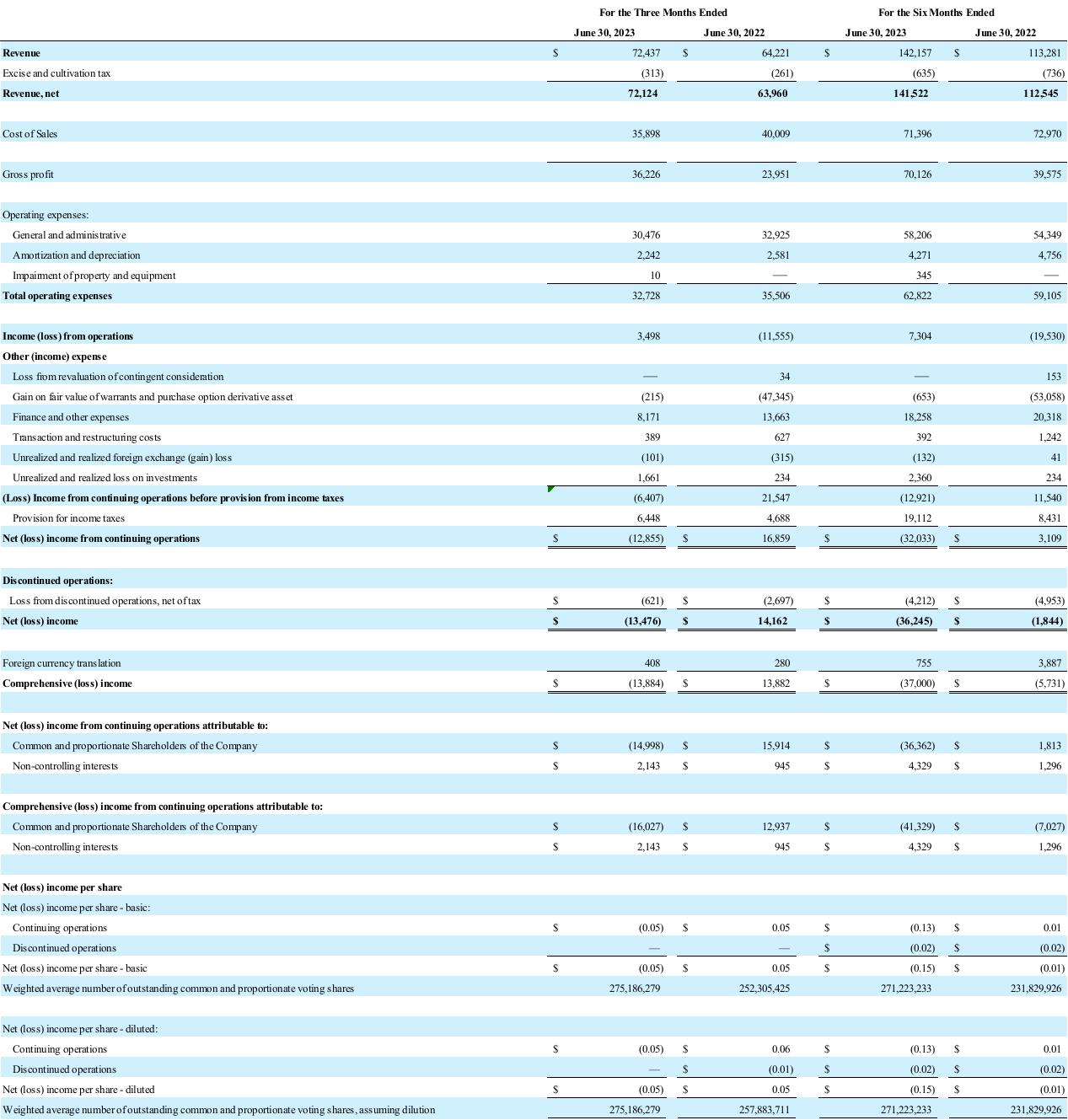

Net revenue for the second quarter of 2023 was $72.1 million as compared to $69.4 million in the first quarter of 2023 and $64.0 million in the second quarter of 2022, representing 3.9% growth sequentially and 12.7% growth year-over-year. The sequential growth was driven primarily by a full quarter of the Allegany dispensary acquisition in Maryland and same store sales growth in Michigan.

Gross margin for the second quarter of 2023 was 50.2% as compared to 48.8% in the first quarter of 2023 and 35.5% in the second quarter of 2022. The 140-basis point improvement in gross margin from the first quarter to the second quarter of 2023 follows a 420-basis point sequential improvement in the first quarter of 2023. These improvements

were driven by increased yields, optimization of mix and better utilization of capacity in New Jersey, Michigan and Maryland.

General & Administrative (G&A) expenses for the second quarter of 2023 were $30.5 million as compared to $27.7 million in the first quarter of 2023 and $32.9 million in the second quarter of 2022. G&A expenses for the second quarter of 2023 included $2.5 million of one-time items including M&A costs related to the acquisitions in Maryland, capital raising transaction costs, legal settlement fees, and TSX listing related costs.

Net loss from continuing operations in the second quarter of 2023 was $12.9 million compared to $19.2 million in the first quarter of 2023 and a net income of $16.9 million in the second quarter of 2022.

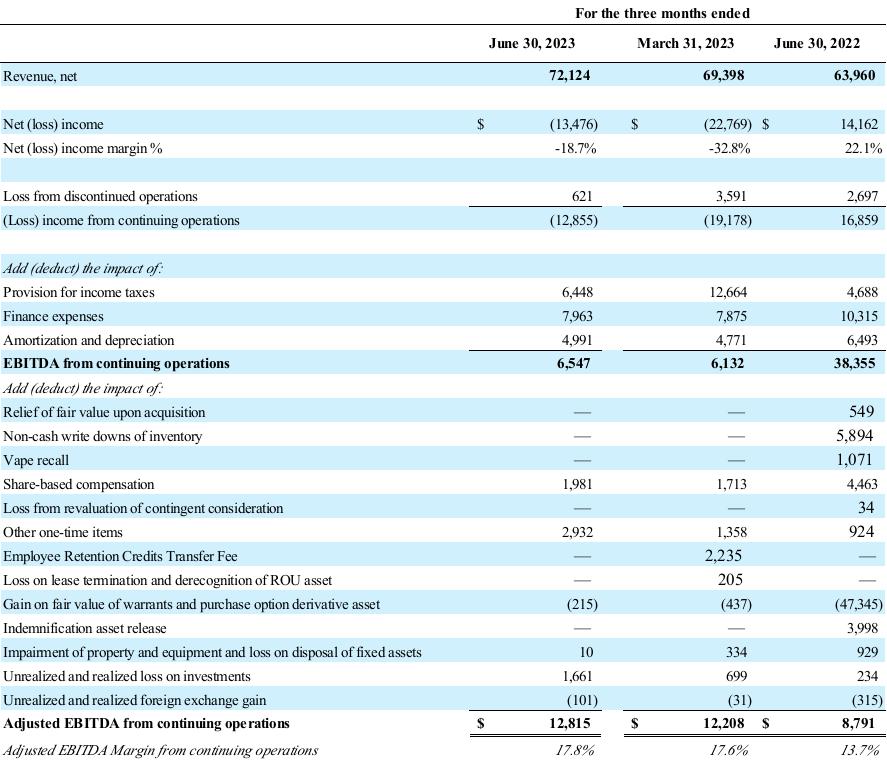

Adjusted EBITDA from continuing operations for the second quarter of 2023, a non-GAAP measure, was $12.8 million, representing a 17.8% margin, compared to $12.2 million and a 17.6% margin in the first quarter of 2023 and $8.8 million and a 13.8% margin in the second quarter of 2022.

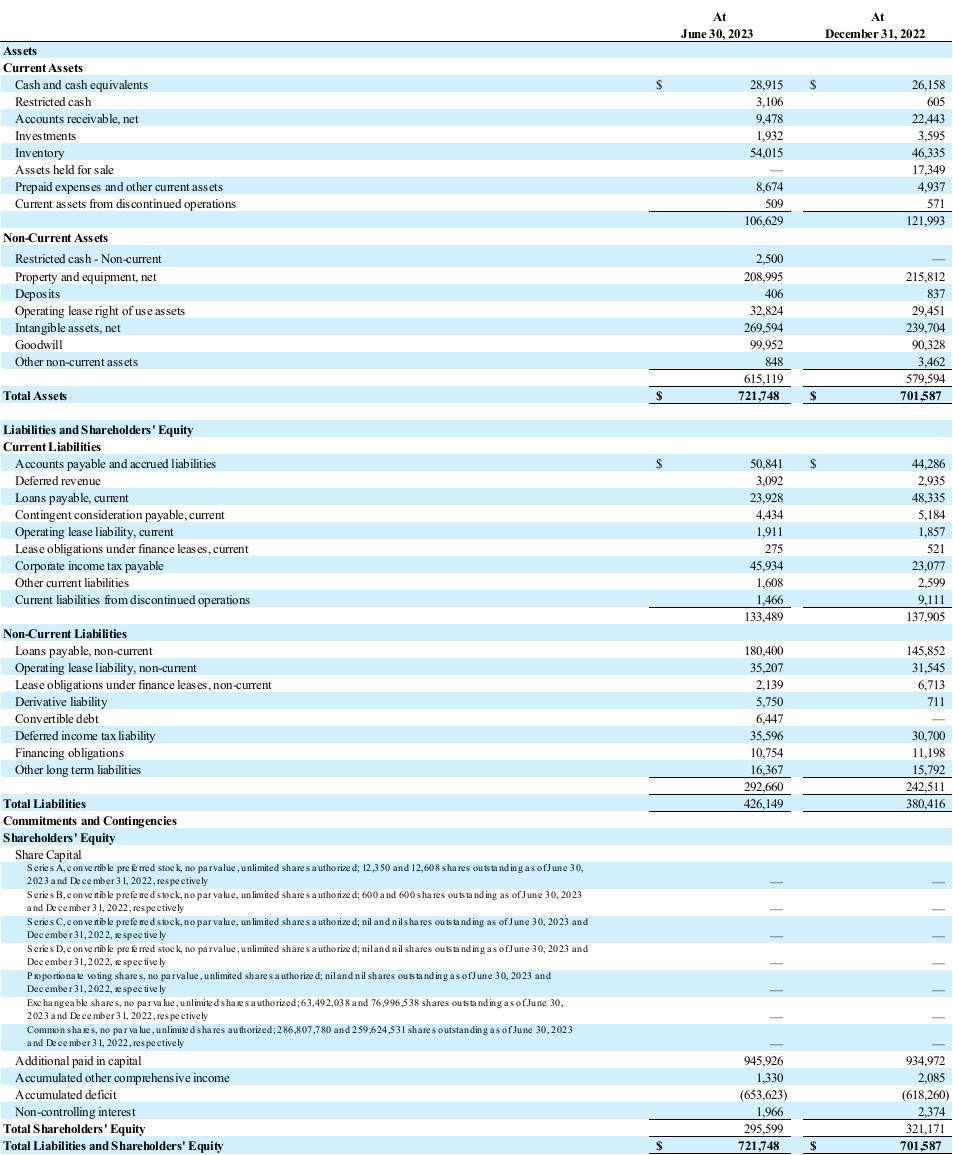

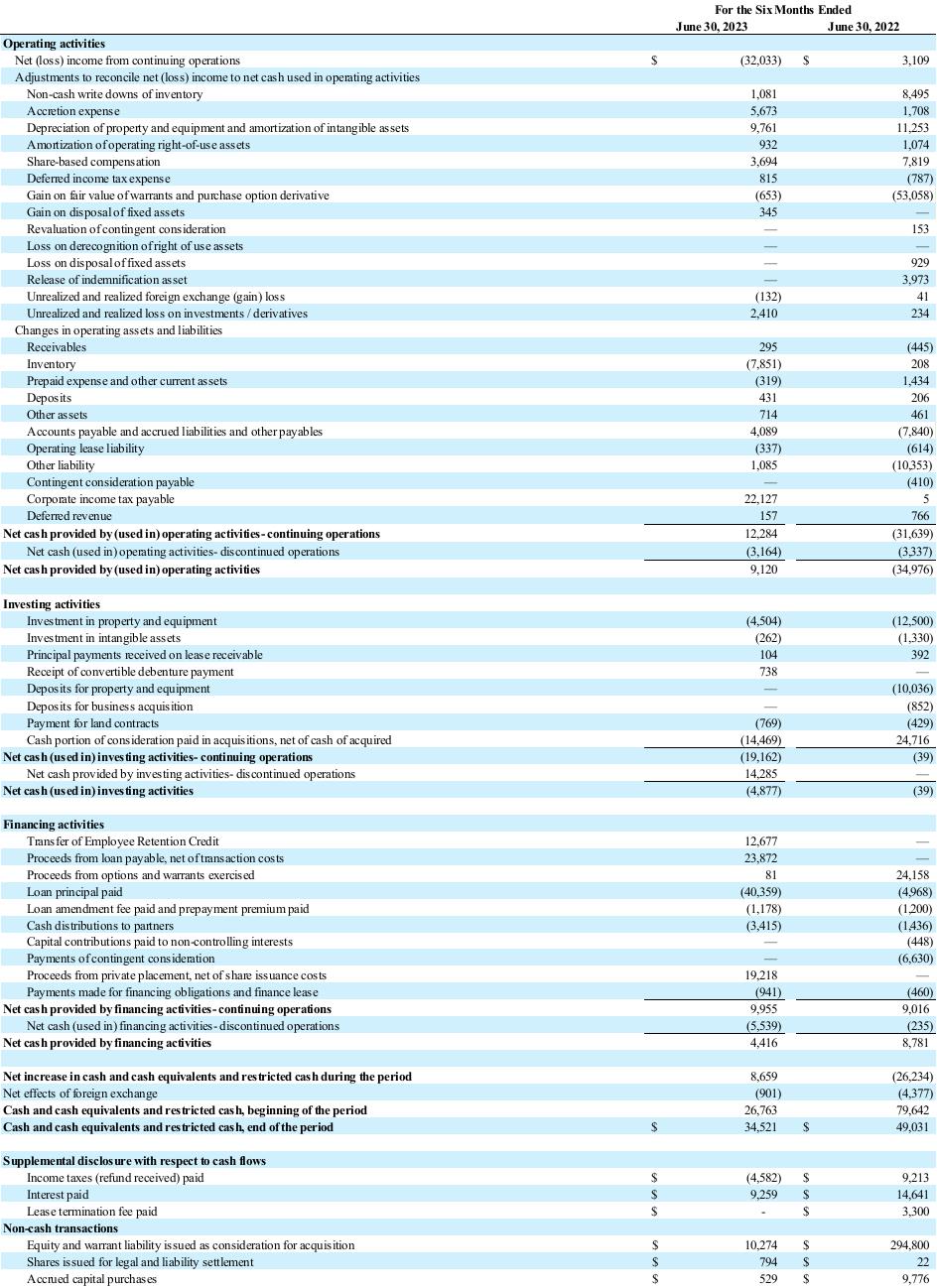

Balance Sheet and Cash Flow

Cash and cash equivalents, including restricted cash, were $34.5 million as of June 30, 2023, compared to $33.5 million as of March 31, 2023. Net cash provided by continuing operations was $1.8 million for the second quarter of 2023, representing the fourth consecutive quarter of positive cashflow from operations. No cash income tax payments were made during the quarter. Capital expenditure spending was $2.2 million in the second quarter of 2023, primarily relating to store openings in Michigan. Free cashflow, a non-GAAP financial measure, was ($0.4) million for the quarter.

During the quarter, the Company completed the sale of its facility in Canada for $14.3 million, completed private placements for gross proceeds of $21.5 million, closed on a $25 million loan with Stearns bank at a rate of prime plus 2.25%, paid down $43 million of higher interest debt on its Ilera term loan, and made cash consideration payments totaling $4.9 million for two Maryland acquisitions which closed in the quarter.

As of August 10, 2023, there were 363 million basic shares outstanding, including 287 million common shares, 13 million preferred shares as converted, and 63 million exchangeable non-voting shares. Additionally, there are 51 million warrants and options outstanding at a weighted average price of $4.44.

Outlook for 2023

The Company is reiterating its outlook for Net Revenue and Adjusted EBITDA from continuing operations1 for 2023 to be at least $305 million and at least $58 million, respectively, representing year-over-year growth of 23% in Net Revenue and 49% in Adjusted EBITDA from continuing operations1.

Conference Call

TerrAscend will host a conference call today, August 10, 2023, to discuss these results. Jason Wild, Executive Chairman, Ziad Ghanem, Chief Executive Officer, and Keith Stauffer, Chief Financial Officer, will host the call starting at 5:00 p.m. Eastern time. A question-and-answer session will follow management's presentation.

|

CONFERENCE CALL DETAILS

|

|

|

|

Date: |

Thursday, August 10, 2023 |

Time: |

5:00 p.m. Eastern Time |

RapidConnect URL: |

https://emportal.ink/44mrcy0 |

Webcast: |

Click Here |

Dial-in Number: |

1-888-664-6392 |

Conference ID: |

98441769 |

|

Replay:

|

416-764-8677 or 1-888-390-0541

Available until 12:00 midnight Eastern Time Thursday, August 24, 2023 Replay Entry Code: 441769# |

|

|

Financial results and analyses are available on the Company’s website (www.terrascend.com) and SEDAR (www.sedar.com).

About TerrAscend

TerrAscend is a leading TSX-listed cannabis company with interests across the North American cannabis sector, including vertically integrated operations in Pennsylvania, New Jersey, Maryland, Michigan and California through TerrAscend Growth Corp. and retail operations in Canada through TerrAscend Canada Inc. (“TerrAscend”). TerrAscend operates The Apothecarium, Gage and other dispensary retail locations as well as scaled cultivation, processing, and manufacturing facilities in its core markets. TerrAscend’s cultivation and manufacturing practices yield consistent, high-quality cannabis, providing industry-leading product selection to both the medical and legal adult-use markets. The Company owns or licenses several synergistic businesses and brands including Gage Cannabis, The Apothecarium, Cookies, Lemonnade, Ilera Healthcare, Kind Tree, Legend, State Flower, Wana, and Valhalla Confections. For more information visit www.terrascend.com.

Caution Regarding Cannabis Operations in the United States

Investors should note that there are significant legal restrictions and regulations that govern the cannabis industry in the United States. Cannabis remains a Schedule I drug under the U.S. Controlled Substances Act, making it illegal under federal law in the United States to, among other things, cultivate, distribute or possess cannabis in the United States. Financial transactions involving proceeds generated by, or intended to promote, cannabis-related business activities in the United States may form the basis for prosecution under applicable US federal money laundering legislation.

While the approach to enforcement of such laws by the federal government in the United States has trended toward non-enforcement against individuals and businesses that comply with medical or adult-use cannabis programs in states where such programs are legal, strict compliance with state laws with respect to cannabis will neither absolve TerrAscend of liability under U.S. federal law, nor will it provide a defense to any federal proceeding which may be brought against TerrAscend. The enforcement of federal laws in the United States is a significant risk to the business of TerrAscend and any proceedings brought against TerrAscend thereunder may adversely affect TerrAscend’s operations and financial performance.

Notice Regarding Forward-Looking Information

This press release contains “forward-looking information” within the meaning of applicable securities laws. Forward-looking information contained in this press release may be identified by the use of words such as, “may”, “would”, “could”, “will”, “likely”, “expect”, “anticipate”, “believe”, “intend”, “plan”, “forecast”, “project”, “estimate”, “outlook” and other similar expressions. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors relevant in the circumstances, including assumptions in respect of current and future market conditions, the current and future regulatory environment, and the availability of licenses, approvals and permits. Examples of forward-looking information contained in this press release include statements regarding the impacts of the listing on the TSX Listing; and expectations for other economic, business, and/or competitive factors.

Although the Company believes that the expectations and assumptions on which such forward-looking information is based are reasonable, undue reliance should not be placed on the forward-looking information because the Company can give no assurance that they will prove to be correct. Actual results and developments may differ materially from those contemplated by these statements. Forward-looking information is subject to a variety of risks and uncertainties that could cause actual events or results to differ materially from those projected in the forward-looking information. Such risks and uncertainties include, but are not limited to, current and future market conditions; risks related to federal, state, provincial, territorial, local and foreign government laws, rules and regulations, including federal and state laws in the United States relating to cannabis operations in the United States; and the risk factors set out in the Company’s most recently filed MD&A, filed with the Canadian securities regulators and available under the Company’s profile on SEDAR at www.sedar.com and in the section titled “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 filed with the Securities and Exchange Commission (the

“SEC”) on March 16, 2023, the Company’s Annual Report on Form 10-K/A for the year ended December 31, 2022 filed with the SEC on May 4, 2023 and its subsequently filed quarterly reports on Form 10-Q.

The statements in this press release are made as of the date of this press release. TerrAscend disclaims any intent or obligation to update any forward-looking information, whether as a result of new information, future events or results or otherwise, other than as required by applicable securities laws.

No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Definition and Reconciliation of Non-GAAP Measures

In addition to reporting the financial results in accordance with GAAP, the Company reports certain financial results that differ from what is reported under GAAP. Non-GAAP measures used by management do not have any standardized meaning prescribed by GAAP and may not be comparable to similar measures presented by other companies. The Company believes that certain investors and analysts use these measures to measure a company’s ability to meet other payment obligations or as a common measurement to value companies in the cannabis industry, and the Company calculates Adjusted Gross Profit and Adjusted Gross Profit Margin as Gross Profit and gross profit margin adjusted for certain material non-cash items including the one-time relief of fair value of inventory on acquisition, non-cash write downs of inventory, sales returns and write downs of inventory as a result of a vape recall in Pennsylvania, and other one-time adjustments to gross profit that management does not believe are reflective of ongoing operations. We calculate Adjusted EBITDA from continuing operations and Adjusted EBITDA Margin from continuing operations as EBITDA from continuing operations adjusted for certain material non-cash items such as inventory write downs outside of the normal course of operations, share based compensation expense, impairment charges taken on goodwill, intangible assets and property and equipment, the gain or loss recognized on the revaluation of our contingent consideration liabilities, one-time write off of accounts receivable related to one customer that was deemed uncollectible, loan modification fees related to the modification of debt, the gain recognized on the extinguishment of debt, the gain or loss recognized on the remeasurement of the fair value of the U.S denominated preferred share warrants, one time fees incurred in connection with our acquisitions and certain other adjustments management believes are not reflective of the ongoing operations and performance. Such information is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP. The Company believes this definition is a useful measure to assess the performance of the Company as it provides more meaningful operating results by excluding the effects of expenses that are not reflective of the Company’s underlying business performance and other one-time or non-recurring expenses.

For more information regarding TerrAscend:

Keith Stauffer

Chief Financial Officer

ir@terrascend.com

855-837-7295

Briana Chester

MATTIO Communications

424-465-4419

terrascend@mattio.com

TerrAscend Corp.

Unaudited Interim Condensed Consolidated Balance Sheets

(Amounts expressed in thousands of United States dollars, except for share and per share amounts)

TerrAscend Corp.

Unaudited Interim Condensed Consolidated Statements of Operations and Comprehensive Loss

(Amounts expressed in thousands of United States dollars, except for share and per share amounts)

TerrAscend Corp.

Unaudited Interim Condensed Consolidated Statements of Cash Flows

(Aounts expressed in thousands of United States dollars, except for share and per share amounts)

TerrAscend Corp.

Reconciliation of GAAP to Non-GAAP Financial Measures

(Amounts expressed in thousands of United States dollars, except for share, per share amounts and percentages)(unaudited)

GAAP to Adjusted EBITDA

GAAP to Adjusted Gross Profit

|

|

For the three months ended |

|

|||||||||

|

|

|

June 30, 2023 |

|

|

March 31, 2023 |

|

June 30, 2022 |

|

|||

Revenue, net |

|

|

|

72,124 |

|

|

|

69,398 |

|

|

63,960 |

|

|

|

|

|

|

|

|

|

|

|

|||

Gross profit |

|

|

|

36,226 |

|

|

|

33,900 |

|

|

23,951 |

|

Add the impact of: |

|

|

|

|

|

|

|

|

|

|||

Relief of fair value of inventory upon acquisition |

|

|

|

— |

|

|

|

— |

|

|

549 |

|

Non-cash write downs of inventory |

|

|

|

— |

|

|

|

— |

|

|

5,894 |

|

Vape recall |

|

|

|

— |

|

|

|

— |

|

|

1,071 |

|

Other one time adjustments to gross profit |

|

|

|

— |

|

|

|

94 |

|

|

— |

|

Adjusted Gross Profit |

|

|

|

36,226 |

|

|

|

33,994 |

|

|

31,465 |

|

Adjusted Gross Profit Margin % |

|

|

|

50.2 |

% |

|

|

49.0 |

% |

|

49.2 |

% |