EXHIBIT 3.2

Published on December 22, 2021

Exhibit 3.2

Exhibit “A”

PLAN OF ARRANGEMENT

PLAN OF ARRANGEMENT

UNDER SECTION 182

OF THE BUSINESS CORPORATIONS ACT (ONTARIO)

ARTICLE

1

INTERPRETATION

| 1.1 | Definitions |

Unless indicated otherwise, where used in this Plan of Arrangement, capitalized terms used but not defined shall have the meanings specified in the Arrangement Agreement and the following terms shall have the following meanings (and grammatical variations of such terms shall have corresponding meanings):

“Arrangement” means the arrangement under Section 182 of the OBCA on the terms and subject to the conditions set out in this Plan of Arrangement.

“Arrangement Agreement” means the arrangement agreement made as of October 8, 2018 among the JW Entities, Canopy Growth, Canopy Rivers and the Company (including the Schedules thereto) as it may be amended, modified or supplemented from time to time in accordance with its terms.

“Arrangement Resolution” means the special resolution approving this Plan of Arrangement to be considered at the Company Meeting by the Company Shareholders entitled to vote thereon pursuant to the Interim Order.

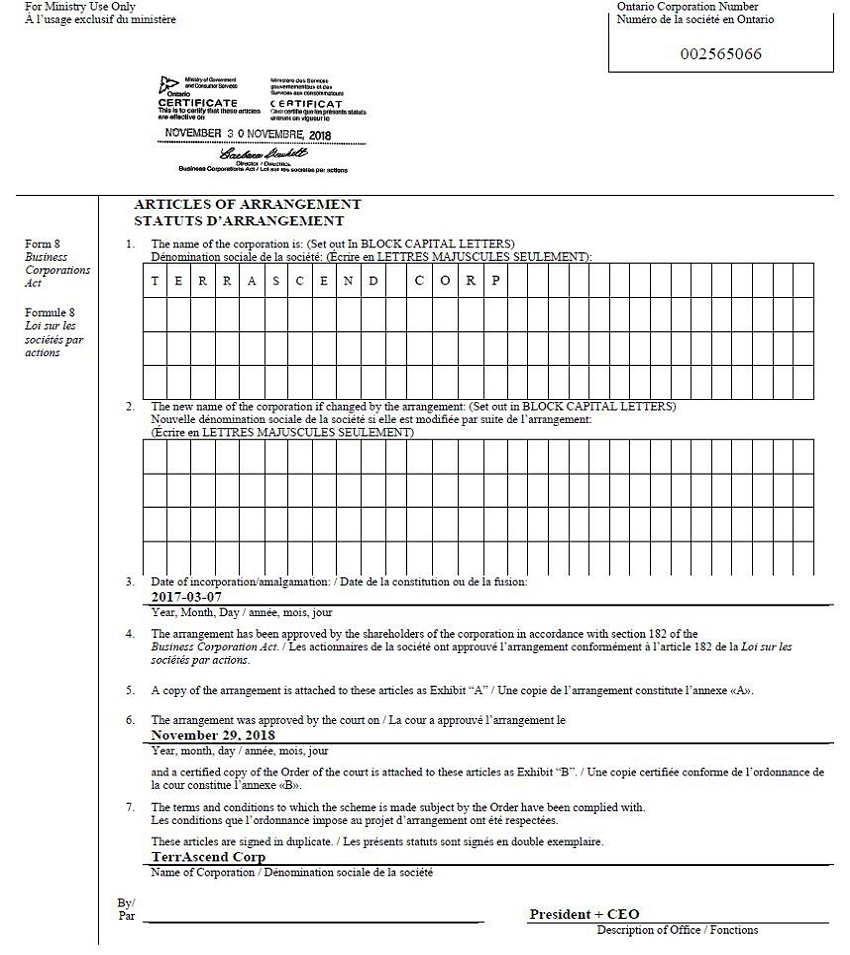

“Articles of Arrangement” means the articles of arrangement of the Company in respect of the Arrangement, required by the OBCA to be sent to the Director after the Final Order is made, which shall include this Plan of Arrangement and otherwise be in a form satisfactory to the JW Entities, Canopy Growth, Canopy Rivers and the Company, each acting reasonably.

“Business Day” means any day of the year, other than a Saturday, Sunday or any day on which major banks are closed for business in Toronto, Ontario.

“Certificate of Arrangement” means the certificate of arrangement issued by the Director pursuant to subsection 183(2) of the OBCA in respect of the Articles of Arrangement.

“Canopy Growth” means Canopy Growth Corporation, a corporation incorporated under the federal laws of Canada.

“Canopy Rivers” means Canopy Rivers Corporation, a corporation incorporated under the federal laws of Canada.

“Canopy Warrants” means (i) the outstanding Warrants issued by the Company to Canopy Growth on December 8, 2017, being 9,545,456 Warrants as of the date of the Arrangement Agreement represented by Warrant certificate 2017-05; and (ii) the outstanding Warrants issued by the Company to Canopy Rivers on December 8, 2017, being 9,545,456 Warrants as of the date of the Arrangement Agreement represented by Warrant certificate 2017-04.

- 2 -

“Common Share VWAP” means $7.5778, being the volume weighted average trading price of the Common Shares on the CSE for the five trading days immediately prior to the date of the Arrangement Agreement.

“Common Shares” means the common shares in the capital of the Company.

“Company” means TerrAscend Corp., a corporation incorporated under the laws of the Province of Ontario.

“Company Meeting” means the special meeting of Company Shareholders, including any adjournment or postponement of such special meeting in accordance with the terms of the Arrangement Agreement, to be called and held in accordance with the Interim Order to consider the Arrangement Resolution and for any other purpose as may be set out in the Company Circular and agreed to in writing by the Parties.

“Company Shareholders” means the registered or beneficial holders of Common Shares, as the context requires.

“Court” means the Ontario Superior Court of Justice (Commercial List), or other court as applicable.

“Director” means the Director appointed pursuant to Section 278 of the OBCA.

“Effective Date” means the date shown on the Certificate of Arrangement giving effect to the Arrangement.

“Effective Time” means 12:01 a.m. (Toronto time) on the Effective Date, or such other time as the Parties agree to in writing before the Effective Date.

“Exchangeable Shares” has the meaning specified in Section 2.3(a).

“Final Order” means the final order of the Court made pursuant to Section 182(5)(f) of the OBCA in a form acceptable to the JW Entities, Canopy Growth, Canopy Rivers and the Company, each acting reasonably, approving the Arrangement, as such order may be amended by the Court (with the consent of the JW Entities, Canopy Growth, Canopy Rivers and the Company, each acting reasonably) at any time prior to the Effective Date or, if appealed, then, unless such appeal is withdrawn or denied, as affirmed or as amended (provided that any such amendment is acceptable to the JW Entities, Canopy Growth, Canopy Rivers and the Company, each acting reasonably) on appeal.

“Governmental Entity” means (i) any international, multinational, national, federal, provincial, territorial, state, regional, municipal, local or other government, governmental or public department, central bank, court, tribunal, arbitral body, commission, board, bureau, ministry, agency or instrumentality, domestic or foreign, (ii) any subdivision or authority of any of the above, (iii) any quasi-governmental or private body exercising any regulatory, anti-trust, foreign investment, expropriation or taxing authority under or for the account of any of the foregoing or (iv) any stock exchange.

- 3 -

“Interim Order” means the interim order of the Court made pursuant to section 182(5) of the OBCA, in a form acceptable to the JW Entities, Canopy Growth, Canopy Rivers and the Company, each acting reasonably, providing for, among other things, the calling and holding of the Company Meeting, as such order may be amended by the Court with the consent of the JW Entities, Canopy Growth, Canopy Rivers and the Company, each acting reasonably.

“JW Entities” means, collectively, (i) JW Opportunities Master Fund, Ltd., a corporation incorporated under the laws of the Cayman Islands (ii) JW Partners, LP, a limited partnership formed under the laws of Delaware, USA and (iii) Pharmaceutical Opportunities Fund, LP, a limited partnership formed under the laws of Delaware, USA.

“JW Warrants” means the outstanding Warrants issued by the Company to the JW Entities on December 8, 2017, being an aggregate of 28,636,361 Warrants as of the date of the Arrangement Agreement represented by Warrant certificates 2017-01, 2017-02 and 2017-03.

“Law” means, with respect to any Person, any and all applicable law (statutory, common or otherwise), constitution, treaty, convention, ordinance, code, rule, regulation, order, injunction, notice, judgment, decree, ruling or other similar requirement, whether domestic or foreign, enacted, adopted, promulgated or applied by a Governmental Entity that is binding upon or applicable to such Person or its business, undertaking, property or securities, and to the extent that they have the force of law, policies, guidelines, notices and protocols of any Governmental Entity, as amended unless expressly specified otherwise.

“Lien” means any mortgage, charge, pledge, hypothec, security interest, lien (statutory or otherwise), or adverse right or claim, or other third party interest or encumbrance of any kind.

“OBCA” means the Business Corporations Act (Ontario).

“Options” means the options to purchase Common Shares issued pursuant to the Company’s Stock Option Plan dated March 8, 2017, as amended on August 6, 2018.

“Parties” means the JW Entities, Canopy Growth, Canopy Rivers and the Company, and “Party” means any one of them.

“Person” includes any individual, partnership, association, body corporate, trust, organization, estate, trustee, executor, administrator, legal representative, government (including Governmental Entity), syndicate or other entity, whether or not having legal status.

“Plan of Arrangement” means this plan of arrangement proposed under Section 182 of the OBCA, and any amendments or variations made in accordance with the Arrangement Agreement or Section 4.1 hereof or made at the direction of the Court in the Interim Order or Final Order with the prior written consent of the JW Entities, Canopy Growth, Canopy Rivers and the Company, each acting reasonably.

“Proportionate Voting Shares” has the meaning specified in Section 2.3(a).

- 4 -

“Subscription Agreements” means the subscription agreements entered into between the Company and each of the JW Entities, Canopy Growth and Canopy Rivers dated November 15, 2017.

“Tax Act” means the Income Tax Act (Canada).

“Transfer Agent” means, prior to the Effective Time, the Person appointed as the transfer agent and registrar of the Common Shares, and following the Effective Time, the Person appointed as the transfer agent and registrar of the Common Shares, Proportionate Voting Shares and the Exchangeable Shares.

“Warrants” means all outstanding warrants to purchase Common Shares, including the Canopy Warrants and the JW Warrants.

| 1.2 | Certain Rules of Interpretation |

In this Plan of Arrangement, unless otherwise specified:

| (a) | Headings, etc. The division of this Plan of Arrangement into Articles and Sections and the insertion of headings are for convenient reference only and do not affect the construction or interpretation of this Plan of Arrangement. |

| (b) | Currency. All references to dollars or to $ are references to Canadian dollars, unless specified otherwise. |

| (c) | Gender and Number. Any reference to gender includes all genders. Words importing the singular number only include the plural and vice versa. |

| (d) | Certain Phrases, etc. The words (i) “including”, “includes” and “include” mean “including (or includes or include) without limitation,” (ii) “the aggregate of’, “the total of”, “the sum of”, or a phrase of similar meaning means “the aggregate (or total or sum), without duplication, of,” and (iii) unless stated otherwise, “Article”, “Section”, and “Schedule” followed by a number or letter mean and refer to the specified Article or Section of or Schedule to this Plan of Arrangement. |

| (e) | Statutes. Any reference to a statute refers to such statute and all rules, resolutions and regulations made under it, as it or they may have been or may from time to time be amended or re-enacted, unless stated otherwise. |

| (f) | Computation of Time. A period of time is to be computed as beginning on the day following the event that began the period and ending at 5:00 p.m. on the last day of the period, if the last day of the period is a Business Day, or at 5:00 p.m. on the next Business Day if the last day of the period is not a Business Day. If the date on which any action is required or permitted to be taken under this Plan of Arrangement by a Person is not a Business Day, such action shall be required or permitted to be taken on the next succeeding day which is a Business Day. |

| (g) | Time References. References to time herein are to local time, Toronto, Ontario. |

- 5 -

ARTICLE 2

THE ARRANGEMENT

| 2.1 | Arrangement Agreement |

This Plan of Arrangement is made pursuant to the Arrangement Agreement.

| 2.2 | Binding Effect |

This Plan of Arrangement and the Arrangement, upon the filing of the Articles of Arrangement and the issuance of the Certificate of Arrangement, will become effective and be binding on the JW Entities, Canopy Growth, Canopy Rivers, the Company, all holders and beneficial owners of Common Shares, Options and Warrants, the Transfer Agent and all other Persons, at and after the Effective Time without any further act or formality required on the part of any Person.

| 2.3 | Arrangement |

At the Effective Time each of the following events shall occur and shall be deemed to occur sequentially as set out below without any further authorization, act or formality, in each case, unless stated otherwise, effective as at five minute intervals starting at the Effective Time:

| (a) | the articles of the Company will be amended to: (i) authorize the issuance of an unlimited number of a new class of proportionate voting shares (the “Proportionate Voting Shares”); (ii) authorize the issuance of an unlimited number of a new class of exchangeable shares (the “Exchangeable Shares”); (iii) authorize the issuance of an unlimited number of a new class of preferred shares, issuable in series (the “Preferred Shares”); and (iv) add the rights, privileges, restrictions and conditions attaching to the Proportionate Voting Shares, Common Shares, Exchangeable Shares and Preferred Shares set out in Exhibit A; |

| (b) | each Common Share held by any of the JW Entities shall, without any further action by or on behalf of the JW Entities, be deemed to be assigned and transferred by the holder thereof to the Company (free and clear of all Liens) in exchange for 0.001 of a Proportionate Voting Share, and: |

| (i) | the JW Entities shall cease to be the holders thereof and to have any rights as holders of such Common Shares other than the right to receive Proportionate Voting Shares in respect thereof in accordance with this Plan of Arrangement; |

| (ii) | the JW Entities shall be removed from the register of the Common Shares maintained by or on behalf of the Company and added to the register of the Proportionate Voting Shares maintained by or on behalf of the Company; and |

| (iii) | the Common Shares transferred to the Company shall be cancelled; |

- 6 -

| (c) | each Canopy Warrant held by either Canopy Growth or Canopy Rivers shall, without any further action by or on behalf of Canopy Growth or Canopy Rivers, be deemed to be acquired by the Company (resulting, for the avoidance of doubt, in the cancellation of such Canopy Warrant) in exchange for the issuance by the Company to Canopy Growth or Canopy Rivers, as applicable, of a fraction of a Common Share per Canopy Warrant equal to (i) the Common Share VWAP minus the exercise price of the Canopy Warrant; divided by (ii) the Common Share VWAP; |

| (d) | each Common Share held by either Canopy Growth or Canopy Rivers (including each Common Share issued in accordance with Section 2.3(c)) shall, without any further action by or on behalf of Canopy Growth or Canopy Rivers, be deemed to be assigned and transferred by the holder thereof to the Company (free and clear of all Liens) in exchange for one Exchangeable Share, and: |

| (i) | Canopy Growth and Canopy Rivers shall cease to be the holders thereof and to have any rights as holders of such Common Shares other than the right to receive Exchangeable Shares in respect thereof in accordance with this Plan of Arrangement; |

| (ii) | Canopy Growth and Canopy Rivers shall be removed from the register of the Common Shares maintained by or on behalf of the Company and added to the register of the Exchangeable Shares maintained by or on behalf of the Company; and |

| (iii) | the Common Shares transferred to the Company shall be cancelled; |

| (e) | the JW Warrants will be amended to reflect that each JW Warrant is exercisable for 0.001 of a Proportionate Voting Share instead of one Common Share; and |

| (f) | each of the Subscription Agreements will be amended to delete Section 6(vv) [Canadian Operations] thereof, |

provided that none of the foregoing will occur or will be deemed to occur unless all of the foregoing occur and, if they occur, all of the foregoing will be deemed to occur without further act or formality.

- 7 -

ARTICLE

3

CERTIFICATES AND PAYMENTS

| 3.1 | Issuance of Shares |

| (a) | Forthwith following the Effective Time, the Company shall, subject to Section 3.1(b), issue and deliver to the Transfer Agent one or more irrevocable treasury directions authorizing the Transfer Agent, as the registrar and transfer agent of the Common Shares, Proportionate Voting Shares and Exchangeable Shares, to register and issue the aggregate number of Proportionate Voting Shares and Exchangeable Shares, as applicable, to which each of the JW Entities, Canopy Growth and Canopy Rivers are entitled in accordance with Sections 2.3(b) and (d). |

| (b) | Upon surrender to the Transfer Agent for cancellation of a certificate or certificates (as applicable) which, immediately prior to the Effective Time, represented outstanding Common Shares that were transferred or deemed to be transferred, as applicable, pursuant to Section 2.3, together with such additional documents and instruments as the Transfer Agent may reasonably require, the holder of the Common Shares represented by such surrendered certificate(s) shall be entitled to receive in exchange therefore, and the Transfer Agent shall deliver to such holder, the applicable consideration that such holder has the right to receive under this Plan of Arrangement for such Common Shares, less any amounts withheld pursuant to Section 3.4, and any certificate(s) so surrendered shall forthwith be cancelled. |

| (c) | Until surrendered as contemplated by this Section 3.1, each certificate that immediately prior to the Effective Time represented Common Shares that were transferred or deemed to be transferred, as applicable, pursuant to Section 2.3 shall be deemed after the Effective Time to represent only the right to receive upon such surrender the consideration which such holder has the right to receive under this Plan of Arrangement for such Common Shares, less any amounts withheld pursuant to Section 3.4. |

| (d) | No holder of Common Shares, Options or Warrants as of the Effective Time shall be entitled to receive any consideration with respect to such Common Shares, Options or Warrants under this Plan of Arrangement other than any consideration to which such holder is entitled to receive in accordance with Section 2.3 and this Section 3.1 and, for greater certainty, no such holder will be entitled to receive any interest, dividends, premium or other payment in connection therewith. |

| 3.2 | Fractional Shares |

No fractional Common Shares or Exchangeable Shares shall be issued to Canopy Growth or Canopy Rivers pursuant to this Plan of Arrangement. A holder of Canopy Warrants or a Common Shareholder otherwise entitled to a fractional interest in a Common Share or Exchangeable Share shall receive the nearest whole number of Common Shares or Exchangeable Shares, as applicable, with fractions equal to 0.5 or more being rounded up. Fractional Proportionate Voting Shares equal to 0.001 of a Proportionate Voting Share or greater may be issued to the JW Entities pursuant to this Plan of Arrangement. A Common Shareholder otherwise entitled to a fractional interest in an Exchangeable Share that is less than 0.001 shall receive the nearest thousandth of an Exchangeable Share, with fractions equal to 0.0005 or more being rounded up.

| 3.3 | Lost Certificates |

In the event any certificate which immediately prior to the Effective Time represented one or more outstanding Common Shares that were transferred pursuant to Section 2.3 shall have been lost, stolen or destroyed, upon the making of an affidavit of that fact by the Person claiming such certificate to be lost, stolen or destroyed, the Transfer Agent will issue in exchange for such lost, stolen or destroyed certificate the applicable number of Proportionate Voting Shares or Exchangeable Shares, subject to any withholdings in accordance with Section 3.4. When authorizing such issuance in exchange for any lost, stolen or destroyed certificate, the Person to whom such Proportionate Voting Shares or Exchangeable Shares are to be delivered shall as a condition precedent to the delivery of such Proportionate Voting Shares or Exchangeable Shares, give a bond satisfactory to the Company and the Transfer Agent (acting reasonably) in such sum as the Company may direct, or otherwise indemnify the Company in a manner satisfactory to the Company, acting reasonably, against any claim that may be made against the Company with respect to the certificate alleged to have been lost, stolen or destroyed.

- 8 -

| 3.4 | Withholding Rights |

The Company and the Transfer Agent, as applicable, shall be entitled to deduct and withhold from any Proportionate Voting Shares or Exchangeable Shares deliverable or consideration otherwise deliverable to any former Common Shareholder such amounts as they may be required to deduct and withhold therefrom under any provision of applicable Laws in respect of Taxes. To the extent that any amounts are so deducted and withheld, such amounts shall be treated for all purposes hereof as having been paid to the Person to whom such amounts would otherwise have been paid, provided that such withheld amounts are actually remitted to the appropriate taxing authority. To satisfy the amount required to be deducted or withheld from any payment to any such Common Shareholder, the Company or the Transfer Agent, as applicable, may sell or otherwise dispose of (or exercise any exchange or conversion rights applicable and then sell or otherwise dispose of the underlying Common Shares) any portion of the Proportionate Voting Shares or Exchangeable Voting Shares deliverable to such holder as is necessary to provide sufficient funds to enable the Company or the Transfer Agent, as applicable, to comply with such deduction and/or withholding requirements.

| 3.5 | No Liens |

Any exchange or transfer of securities pursuant to this Plan of Arrangement shall be free and clear of any Liens or other claims of third parties of any kind.

| 3.6 | Existing Options and Warrants |

For clarity, from and after the Effective Time all Options and Warrants issued and outstanding following the Effective Time, other than the JW Warrants, will remain exercisable for Common Shares.

| 3.7 | Paramountcy |

From and after the Effective Time, this Plan of Arrangement shall take precedence and priority over any and all Common Shares, Options and Warrants issued or outstanding prior to the Effective Time.

- 9 -

| 3.8 | Tax Election |

The Company will, at the request of Canopy Rivers or Canopy Growth, jointly elect with Canopy River or Canopy Growth, as applicable, under subsection 85(1) of the Tax Act with respect to the transfer of the Canopy Warrants. Such elections will be duly and timely prepared (in the form and manner prescribed by the Tax Act and the regulations thereunder) by Canopy Rivers or Canopy Growth, as applicable, timely delivered to the Company for execution (providing the Company with reasonable time to review in advance of the filing deadline), whereupon such elections will be .timely signed by an appropriate signing officer of the Company and returned to Canopy Rivers or Canopy Growth, as applicable, for timely filing. The agreed amount for the purposes of paragraph 85(1)(a) of the Tax Act in respect of the Canopy Warrants will be such amount as is determined by Canopy Rivers or Canopy Growth, as applicable, within the limits prescribed in the Tax Act. The Company will, at the request of Canopy Rivers and/or Canopy Growth, as applicable, jointly elect with Canopy Rivers and/or Canopy Growth, as applicable, under corresponding provisions of applicable provincial income tax legislation with respect to the transfer of the Company Warrants in respect of which a request to file a tax election is made by Canopy Rivers or Canopy Growth, as applicable. The foregoing provisions of this Section 3.8 will apply to the making of any such provincial elections, with necessary changes. The Company will not be responsible or liable for any taxes, interest, penalties, damages or expenses resulting from the failure by anyone to properly complete or file an election referred to above in the form and manner and within the time prescribed by the Tax Act or relevant provincial tax legislation, as the case may be, unless such taxes, interest, penalties, damages or expenses result solely from the failure by the Company to fulfil its obligations under this Section 3.8.

| 3.9 | Shares Fully Paid |

All Common Shares, Proportionate Voting Shares and Exchangeable Shares issued pursuant to this Plan of Arrangement shall be fully paid and non-assessable, and the Company shall be deemed to have received the full consideration therefor.

ARTICLE

4

AMENDMENTS

| 4.1 | Amendments to Plan of Arrangement |

| (a) | The JW Entities, Canopy Growth, Canopy Rivers and the Company may amend, modify and/or supplement this Plan of Arrangement at any time and from time to time prior to the Effective Time, provided that each such amendment, modification and/or supplement must (i) be set out in writing, (ii) be approved by the JW Entities, Canopy Growth, Canopy Rivers and the Company, each acting reasonably, (iii) filed with the Court and, if made following the Company Meeting, approved by the Court, and (iv) communicated to the Company Shareholders if and as required by the Court. |

| (b) | Any amendment, modification or supplement to this Plan of Arrangement may be proposed by the Company at any time prior to the Company Meeting (provided that the JW Entities, Canopy Growth and Canopy Rivers shall have consented thereto) with or without any other prior notice or communication, and if so proposed and accepted by the Persons voting at the Company Meeting (other than as may be required under the Interim Order), shall become part of this Plan of Arrangement for all purposes. |

- 10 -

| (c) | Any amendment, modification or supplement to this Plan of Arrangement that is approved or directed by the Court following the Company Meeting shall be effective only if (i) it is consented to in writing by the JW Entities, Canopy Growth, Canopy Rivers and the Company (in each case, acting reasonably), and (ii) if required by the Court, it is consented to by some or all of the Company Shareholders voting in the manner directed by the Court. |

| (d) | Any amendment, modification or supplement to this Plan of Arrangement may be made following the Effective Date unilaterally by the Company, provided that it concerns a matter which, in the reasonable opinion of the Company, is of an administrative nature required to better give effect to the implementation of this Plan of Arrangement and is not expected by the Company, acting reasonably, to be materially prejudicial to any other Party. |

| 4.2 | Termination |

This Plan of Arrangement may be withdrawn prior to the Effective Time in accordance with the terms of the Arrangement Agreement.

ARTICLE

5

FURTHER ASSURANCES

| 5.1 | Further Assurances |

Notwithstanding that the transactions and events set out in this Plan of Arrangement shall occur and shall be deemed to occur in the order set out in this Plan of Arrangement without any further act or formality, each of the Parties shall make, do and execute, or cause to be made, done and executed, all such further acts, deeds, agreements, transfers, assurances, instruments or documents as may reasonably be required by either of them in order to further document or evidence any of the transactions or events set out in this Plan of Arrangement.

EXHIBIT A

RIGHTS, PRIVILEGES. RESTRICTIONS

AND CONDITIONS

ATTACHING TO SHARES

Except as set out below, the Proportionate Voting Shares, Common Shares and Exchangeable Shares (collectively, the “Shares”) have the same rights, are equal in all respects and are treated by the Corporation as if they were shares of one class only.

Notwithstanding any other provision herein, but subject to the Business Corporations Act (Ontario) (the “Act”), the special rights and restrictions attached to any class of Shares may be modified if the amendment is authorized by not less than 66⅔% of the votes cast at a meeting of holders of Shares duly held for that purpose. However, if the holders of Proportionate Voting Shares, as a class, the holders of Common Shares, as a class, or the holders of Exchangeable Shares, as a class, are to be affected in a manner materially different from any other classes of Shares, the amendment must, in addition, be authorized by not less than 66⅔% of the votes cast at a meeting of the holders of the class of Shares which is affected differently.

PROPORTIONATE VOTING SHARES

| 1. | Voting Rights. The holders of the Proportionate Voting Shares shall be entitled to receive notice of, and to attend, all meetings of the shareholders of the Corporation and shall have 1000 votes for each Proportionate Voting Share held at all meetings of the shareholders of the Corporation, except for meetings at which only holders of another specified class or series of shares of the Corporation are entitled to vote separately as a class or series. |

| 2. | Dividends. The holders of the Proportionate Voting Shares shall be entitled to receive, subject to the rights of the holders of any other class of shares, any dividend declared by the Corporation. If, as and when dividends are declared by the directors, each Proportionate Voting Share shall be entitled to 1,000 times the amount paid or distributed per Common Share (or, if a stock dividend is declared, each Proportionate Voting Share shall be entitled to receive the same number of Proportionate Voting Shares per Proportionate Voting Share as the number of Common Shares entitled to be received per Common Share). |

| 3. | Dissolution. In the event of the dissolution, liquidation or winding-up of the Corporation, whether voluntary or involuntary, or any other distribution of assets of the Corporation among its shareholders for the purpose of winding-up its affairs, the holders of the Proportionate Voting Shares shall, subject to the rights of any other class of shares, be entitled to receive the remaining property of the Corporation on the basis that each Proportionate Voting Share shall be entitled to 1,000 times the amount distributed per Common Share, but otherwise there is no preference or distinction among or between the Proportionate Voting Shares and the Common Shares. |

| 4. | Subdivision or Consolidation. No subdivision or consolidation of the Proportionate Voting Shares may be carried out unless, at the same time, the Common Shares and Exchangeable Shares are subdivided or consolidated in a manner so as to preserve the relative rights of the holders of each class of securities. |

- 12 -

| 5. | Conversion at Option of Holder. Each issued and outstanding Proportionate Voting Share may at any time, at the option of the holder, be converted into 1,000 Common Shares, The conversion right may be exercised at any time and from time to time by notice in writing delivered to the Corporation’s transfer agent (the “Transfer Agent”) accompanied by the certificate or certificates representing the Proportionate Voting Shares or, if uncertificated, such other evidence of ownership as the Transfer Agent may require, in respect of which the holder wishes to exercise the right of conversion. The notice must be signed by the registered holder of the Proportionate Voting Shares in respect of which the right of conversion is being exercised or by his, her or its duly authorized attorney and must specify the number of Proportionate Voting Shares which the holder wishes to have converted. Upon receipt of the conversion notice and share certificate(s) or other evidence of ownership satisfactory to the Transfer Agent, the Corporation will issue a share certificate or other evidence of ownership representing Common Shares on the basis set out above to the registered holder of the Proportionate Voting Shares. If fewer than all of the Proportionate Voting Shares represented by a certificate accompanying the notice are to be converted, the holder is entitled to receive a new certificate representing the shares comprised in the original certificate which are not to be converted. No fractional Common Shares will be issued on any conversion of Proportionate Voting Shares. Proportionate Voting Shares converted into Common Shares hereunder will automatically be cancelled. |

| 6. | Conversion at Option of Corporation. If the directors of the Corporation, in good faith, determine that it is no longer advisable to maintain the Proportionate Voting Shares as a separate class of shares (a “Conversion Event”), then, effective on the date approved by the directors, all of the Proportionate Voting Shares shall, without any further action on the part of any holder of Proportionate Voting Shares, immediately and automatically be converted into Common Shares at the conversion ratio of 1000 Common Shares for each Proportionate Voting Share. Promptly following conversion, the Corporation will issue a share certificate or other evidence of ownership representing Common Shares on the basis set out above to the registered holders of Proportionate Voting Shares. No fractional Common Shares will be issued on any conversion of Proportionate Voting Shares. Proportionate Voting Shares converted into Common Shares hereunder will automatically be cancelled. If a Conversion Event occurs, the directors shall not be entitled to issue any further Proportionate Voting Shares. |

| 7. | Fractional Shares. Any fractional Proportionate Voting Shares issued and outstanding shall have the rights set forth above, provided that each 0.001 of a Proportionate Voting Share shall: (i) entitle the holder to one vote at all meetings of the shareholders of the Corporation, except for meetings at which only holders of another specified class or series of shares of the Corporation are entitled to vote separately as a class or series; (ii) if, as and when dividends are declared by the directors, be entitled to the amount paid or distributed per Common Share (or, if a stock dividend is declared, each 0.001 of a Proportionate Voting Share shall be entitled to receive 0.001 of a Proportionate Voting Share for each Common Share that a holder of a Common Shares is entitled to receive); (iii) shall be entitled to receive the remaining property of the Corporation on the basis that each 0.001 of a Proportionate Voting Share shall be entitled to the amount distributed per Common Share; and (iv) may be converted into one Common Share. |

- 13 -

COMMON SHARES

| 1. | Voting Rights. The holders of the Common Shares shall be entitled to receive notice of, and to attend, all meetings of the shareholders of the Corporation and shall have one vote for each Common Share held at all meetings of the shareholders of the Corporation, except for meetings at which only holders of another specified class or series of shares of the Corporation are entitled to vote separately as a class or series. |

| 2. | Dividends. The holders of the Common Shares shall be entitled to receive, subject to the rights of the holders of any other class of shares, any dividend declared by the Corporation. If, as and when dividends are declared by the directors, each Common Share shall be entitled to 0.001 times the amount paid or distributed per Proportionate Voting Share (or, if a stock dividend is declared, each Common Share shall be entitled to receive the same number of Common Shares per Common Share as the number of Proportionate Voting Shares entitled to be received per Proportionate Voting Share). |

| 3. | Dissolution. In the event of the dissolution, liquidation or winding-up of the Corporation, whether voluntary or involuntary, or any other distribution of assets of the Corporation among its shareholders for the purpose of winding-up its affairs, the holders of the Common Shares shall, subject to the rights of any other class of shares, be entitled to receive the remaining property of the Corporation on the basis that each Common Share shall be entitled to 0.001 times the amount distributed per Proportionate Voting Share, but otherwise there is no preference or distinction among or between the Proportionate Voting Shares and the Common Shares. |

| 4. | Subdivision or Consolidation. No subdivision or consolidation of the Common Shares may be carried out unless, at the same time, the Proportionate Voting Shares and Exchangeable Shares are subdivided or consolidated in a manner so as to preserve the relative rights of the holders of each class of securities. |

| 5. | Conversion. Each issued and outstanding Common Share may at any time, at the option of the holder, be converted into 0.001 of a Proportionate Voting Share. The conversion right may be exercised at any time and from time to time by notice in writing delivered to the Transfer Agent accompanied by the certificate or certificates representing the Common Shares or, if uncertificated, such other evidence of ownership as the Transfer Agent may require, in respect of which the holder wishes to exercise the right of conversion. The notice must be signed by the registered holder of the Common Shares in respect of which the right of conversion is being exercised or by his, her or its duly authorized attorney and must specify the number of Common Shares which the holder wishes to have converted. Upon receipt of the conversion notice and share certificate(s) or other evidence of ownership satisfactory to the Transfer Agent, the Corporation will issue a share certificate or other evidence of ownership representing Proportionate Voting Shares on the basis set out above to the registered holder of the Common Shares. If fewer than all of the Common Shares represented by a certificate accompanying the notice are to be converted, the holder is entitled to receive a new certificate representing the shares comprised in the original certificate which are not to be converted. Common Shares converted into Proportionate Voting Shares hereunder will automatically be cancelled. The right to convert Common Shares into Proportionate Voting Shares hereunder shall terminate if a Conversion Event occurs. |

- 14 -

EXCHANGEABLE SHARES

| 1. | Voting Rights. The holders of Exchangeable Shares shall not be entitled to receive notice of, attend, or vote at meetings of the shareholders of the Corporation; provided that the holders of Exchangeable Shares shall, however, be entitled to receive notice of meetings of shareholders called for the purpose of authorizing the dissolution of the Corporation or the sale of its undertaking or assets, or a substantial part thereof, but holders of Exchangeable Shares shall not be entitled to vote at such meetings of the shareholders of the Corporation. |

| 2. | Dividends. The holders of the Exchangeable Shares shall not be entitled to receive any dividends. |

| 3. | Dissolution. In the event of the dissolution, liquidation or winding-up of the Corporation, whether voluntary or involuntary, or any other distribution of assets of the Corporation among its shareholders for the purpose of winding-up its affairs, the holders of the Exchangeable Shares shall not be entitled to receive any amount, property or assets of the Corporation. |

| 4. | Exchange Right. Each issued and outstanding Exchangeable Share may at any time following the Exchange Start Date applicable to the holder of such Exchangeable Share, at the option of the holder, be exchanged for one Common Share. The conversion right may be exercised at any time and from time to time by notice in writing delivered to the Transfer Agent accompanied by the certificate or certificates representing the Exchangeable Shares or, if uncertificated, such other evidence of ownership as the Transfer Agent may require, in respect of which the holder wishes to exercise the right of conversion. The notice must be signed by the registered holder of the Exchangeable Shares in respect of which the right of conversion is being exercised or by his, her or its duly authorized attorney and must specify the number of Exchangeable Shares which the holder wishes to have converted. Upon receipt of the conversion notice and share certificate(s) or other evidence of ownership satisfactory to the Transfer Agent, the Corporation will issue a share certificate or other evidence of ownership representing Common Shares on the basis set out above to the registered holder of the Exchangeable Shares. If fewer than all of the Exchangeable Shares represented by a certificate accompanying the notice are to be exchanged, the holder is entitled to receive a new certificate representing the shares comprised in the original certificate which are not to be converted. Exchangeable Shares converted into Common Shares hereunder will automatically be cancelled. |

“Exchange Start Date” means the date following satisfaction of the following terms and conditions: (i) the Triggering Event has occurred; and (ii) all stock exchanges upon which the securities of the holder of the Exchangeable Share (or any entity of which the holder is a subsidiary) are listed for trading have approved the exchange of the Exchangeable Share into a Common Share, to extent that any such approval is required.

“Triggering Event” means the earlier of: (i) the date that federal laws regarding the cultivation, distribution or possession of marijuana in the United States are changed, such that the Corporation is fully compliant with federal regulation in the United States; and (ii) the date that all stock exchanges upon which the securities of the holder of the Exchangeable Share (or any entity of which the holder is a subsidiary) are listed for trading have amended their policies to permit listed issuers to invest in entities that are engaged in the cultivation, distribution or possession of marijuana in states in the United States where it is legal to do so, such that the holder of the Exchangeable Share (and any entity of which the holder is a subsidiary) is fully compliant with all rules and regulations of all stock exchanges upon which the securities of the holder of the Exchangeable Shares (or any entity of which the holder is a subsidiary) are listed for trading.

- 15 -

| 5. | Change of Control Adjustment. Upon any consolidation, amalgamation, arrangement, merger, redemption, compulsory acquisition or similar transaction of or involving the Common Shares, or a sale or conveyance of all or substantially all the assets of the Corporation to any other body corporate, trust, partnership or other entity (each a “Change of Control”), each Exchangeable Share that is outstanding on the effective date of a Change of Control shall remain outstanding and, upon the exchange of such Exchangeable Share thereafter, shall be entitled to receive and shall accept, in lieu of the number of Common Shares that the holder thereof would have been entitled to receive prior to such effective date (assuming the Exchange Start Date had occurred), the number of shares or other securities or property (including cash) that such holder would have been entitled to receive on such Change of Control, if, on the effective date of such Change of Control, the holder had been the registered holder of the number of Common Shares which it was entitled to acquire upon the exchange of the Exchangeable Share as of such date (assuming the Exchange Start Date had occurred) (the “Adjusted Exchange Consideration”). |

If the Adjusted Exchange Consideration includes cash, then the Corporation shall, or shall cause the other body corporate, trust, partnership or other entity resulting from or party to such Change of Control to, deposit with an escrow agent appointed by the Corporation on the closing date of the Change of Control the aggregate cash that would be payable to holders of Exchangeable Shares if all of the outstanding Exchangeable Shares were exchanged immediately following the Change of Control. All such funds shall be held by the escrow agent in a segregated interest-bearing account for the benefit of the holders of Exchangeable Shares, and shall solely be used to satisfy the cash portion of the Adjusted Exchange Consideration upon exchanges of Exchangeable Shares from time to time after the Exchange Start Date (with holders of Exchangeable Shares being entitled to any accumulated interest on the funds from the date of initial deposit to and including the business day immediately preceding the date of exchange, on a pro rata basis).

If, in connection with a Change of Control, a holder of a Common Share may elect a form of consideration (including, without limitation, shares, other securities, cash or other property) from options made available, then all holders of Exchangeable Shares shall be deemed to have elected to receive an equal percentage of each of the different types of consideration offered, unless otherwise agreed in writing by all holders of Exchangeable Shares in accordance with the terms of the transaction and prior to any applicable election deadline. In such case, the Adjusted Exchange Consideration shall equal the consideration that a holder of Common Shares making an election on the terms set forth in the preceding sentence would have received in the transaction.

After any adjustment pursuant to these terms, the term “Common Shares”, where used above, shall be interpreted to mean securities of any class or classes which, as a result of such adjustment and all prior adjustments pursuant to this section, the holder is entitled to receive upon the exchange of Exchangeable Shares, and the number of Common Shares indicated by any exchange of an Exchangeable Share shall be interpreted to mean the number of Common Shares or other property or securities the holder of the Exchangeable Share is entitled to receive upon the exchange of an Exchangeable Share as a result of such adjustment and all prior adjustments pursuant to these terms.

- 16 -

| 6. | Subdivision or Consolidation. No subdivision or consolidation of the Exchangeable Shares may be carried out unless, at the same time, the Proportionate Voting Shares and Common Shares are subdivided or consolidated in a manner so as to preserve the relative rights of the holders of each class of securities. |

PREFERRED SHARES

The rights privileges, restrictions and conditions attaching to the Preferred Shares are as follows:

| 1. | One or More Series. The Preferred Shares may at any time and from time to time be issued in one or more series. |

| 2. | Terms of Each Series. Subject to the Act, the directors may fix, before the issue thereof, the number of Preferred Shares of each series, the designation, rights, privileges, restrictions and conditions attaching to the Preferred Shares of each series, including, without limitation, any voting rights, any right to receive dividends (which may be cumulative or non-cumulative and variable or fixed) or the means of determining such dividends, the dates of payment thereof, any terms and conditions of redemption or purchase, any conversion rights, and any rights on the liquidation, dissolution or winding up of the Corporation, any sinking fund or other provisions, the whole to be subject to the issue of a certificate of amendment setting forth the designation, rights, privileges, restrictions and conditions attaching to the Preferred Shares of the series. |

| 3. | Ranking of Preferred Shares. The Preferred Shares of each series shall, with respect to the payment of dividends and the distribution of assets in the event of the liquidation, dissolution or winding-up of the Corporation, whether voluntary or involuntary, rank on a parity with the Preferred Shares of every other series and be entitled to preference over the Proportionate Voting Shares, Common Shares and Exchangeable Shares. If any amount of cumulative dividends (whether or not declared) or declared non-cumulative dividends or any amount payable on any such distribution of assets constituting a return of capital in respect of the Preferred Shares of any series is not paid in full, the Preferred Shares of such series shall participate rateably with the Preferred Shares of every other series in respect of all such dividends and amounts. |

Exhibit “B”

Court File No. CV-18-607367-00CL

ONTARIO

SUPERIOR COURT OF JUSTICE

(coMMERCIAL LIST)

| THE HONOURABLE | ) | THURSDAY, THE 29th |

| ) | ||

| ) | DAY OF NOVEMBER, 2018 |

THE MATTER OF AN APPLICATION UNDER SECTION 182 OF THE BUSINESS CORPORATIONS ACT (ONTARIO), R.S.O. 1990, CHAP. B.16, AS AMENDED

AND IN THE MATTER OF RULE 14.05(2) OF THE RULES OF CIVIL PROCEDURE

AND IN THE MATTER OF AN APPLICATION BY TERRASCEND CORP. RELATING TO A PROPOSED ARRANGEMENT

FINAL ORDER

THIS APPLICATION made by the Applicant, TerrAscend Corp. (“TerrAscend”) pursuant to section 182 of the Business Corporations Act, R.S.O. 1990, c. B.16, as amended (the “OBCA”) was heard this day at 330 University Avenue, Toronto, Ontario.

ON READING the Notice of Application issued on October 22, 2018, the affidavit of Adam Kozak sworn October 22, 2018, (the “Affidavit”), the supplementary affidavit of Adam Kozak sworn November 27, 2018, together with the exhibits thereto, and the Interim Order of the Honourable Justice Penny dated October 24, 2018, and .

- 19 -

ON HEARING the submissions of the lawyers for TerrAscend, on being advised that TerrAscend intends to rely upon the exemption available under Section 3(a)(10) of the U.S. Securities Act of 1933, no-one appearing for any other person, including any shareholder of TerrAscend, and having determined that the Arrangement, as described in the Plan of Arrangement attached as Schedule “A” to this order is an arrangement for the purposes of section 182 of the OBCA and is fair and reasonable as that term is understood for the purposes of that section.

| 1. | THIS COURT ORDERS that the Arrangement, as described in the Plan of Arrangement attached as Schedule “A” to this order, shall be and is hereby approved. |

| 2. | THIS COURT ORDERS that TerrAscend shall be entitled to seek leave to vary this order upon such terms and upon giving such notice as this court may direct, to seek the advice and directions of this court as to the implementation of this order, and to apply for such further order or orders as may be appropriate. |

____________________________

PLAN OF ARRANGEMENT

PLAN OF ARRANGEMENT UNDER SECTION 182

OF THE BUSINESS CORPORATIONS ACT (ONTARIO)

ARTICLE

1

INTERPRETATION

| 1.1 | Definitions |

Unless indicated otherwise, where used in this Plan of Arrangement, capitalized terms used but not defined shall have the meanings specified in the Arrangement Agreement and the following terms shall have the following meanings (and grammatical variations of such terms shall have corresponding meanings):

“Arrangement” means the arrangement under Section 182 of the OBCA on the terms and subject to the conditions set out in this Plan of Arrangement.

“Arrangement Agreement” means the arrangement agreement made as of October 8, 2018 among the JW Entities, Canopy Growth, Canopy Rivers and the Company (including the Schedules thereto) as it may be amended, modified or supplemented from time to time in accordance with its terms.

“Arrangement Resolution” means the special resolution approving this Plan of Arrangement to be considered at the Company Meeting by the Company Shareholders entitled to vote thereon pursuant to the Interim Order.

“Articles of Arrangement” means the articles of arrangement of the Company in respect of the Arrangement, required by the OBCA to be sent to the Director after the Final Order is made, which shall include this Plan of Arrangement and otherwise be in a form satisfactory to the JW Entities, Canopy Growth, Canopy Rivers and the Company, each acting reasonably.

“Business Day” means any day of the year, other than a Saturday, Sunday or any day on which major banks are closed for business in Toronto, Ontario.

“Certificate of Arrangement” means the certificate of arrangement issued by the Director pursuant to subsection 183(2) of the OBCA in respect of the Articles of Arrangement.

“Canopy Growth” means Canopy Growth Corporation, a corporation incorporated under the federal laws of Canada.

“Canopy Rivers” means Canopy Rivers Corporation, a corporation incorporated under the federal laws of Canada.

“Canopy Warrants” means (i) the outstanding Warrants issued by the Company to Canopy Growth on December 8, 2017, being 9,545,456 Warrants as of the date of the Arrangement Agreement represented by Warrant certificate 2017-05; and (ii) the outstanding Warrants issued by the Company to Canopy Rivers on December 8, 2017, being 9,545,456 Warrants as of the date of the Arrangement Agreement represented by Warrant certificate 2017-04.

- 2 -

“Common Share VWAP” means $7.5778, being the volume weighted average trading price of the Common Shares on the. CSE for the five trading days immediately prior to the date of the Arrangement Agreement.

“Common Shares” means the common shares in the capital of the Company.

“Company” means TerrAscend Corp., a corporation incorporated under the laws of the Province of Ontario.

“Company Meeting” means the special meeting of Company Shareholders, including any adjournment or postponement of such special meeting in accordance with the terms of the Arrangement Agreement, to be called and held in accordance with the Interim Order to consider the Arrangement Resolution and for any other purpose as may be set out in the Company Circular and agreed to in writing by the Parties.

“Company Shareholders” means the registered or beneficial holders of Common Shares, as the context requires.

“Court” means the Ontario Superior Court of Justice (Commercial List), or other court as applicable.

“Director” means the Director appointed pursuant to Section 278 of the OBCA.

“Effective Date” means the date shown on the Certificate of Arrangement giving effect to the Arrangement.

“Effective Time” means 12:01 a.m. (Toronto time) on the Effective Date, or such other time as the Parties agree to in writing before the Effective Date.

“Exchangeable Shares” has the meaning specified in Section 2.3(a).

“Final Order” means the final order of the Court made pursuant to Section 182(5)(f) of the OBCA in a form acceptable to the JW Entities, Canopy Growth, Canopy Rivers and the Company, each acting reasonably, approving the Arrangement, as such order may be amended by the Court (with the consent of the JW Entities, Canopy Growth, Canopy Rivers and the Company, each acting reasonably) at any time prior to the Effective Date or, if appealed, then, unless such appeal is withdrawn or denied, as affirmed or as amended (provided that any such amendment is acceptable to the JW Entities, Canopy Growth, Canopy Rivers and the Company, each acting reasonably) on appeal.

“Governmental Entity” means (i) any international, multinational, national, federal, provincial, territorial, state, regional, municipal, local or other government, governmental or public department, central bank, court, tribunal, arbitral body, commission, board, bureau, ministry, agency or instrumentality, domestic or foreign, (ii) any subdivision or authority of any of the above, (iii) any quasi-governmental or private body exercising any regulatory, anti-trust, foreign investment, expropriation or taxing authority under or for the account of any of the foregoing or (iv) any stock exchange.

- 3 -

“Interim Order” means the interim order of the Court made pursuant to section 182(5) of the OBCA, in a form acceptable to the JW Entities, Canopy Growth, Canopy Rivers and the Company, each acting reasonably, providing for, among other things, the calling and holding of the Company Meeting, as such order may be amended by the Court with the consent of the JW Entities, Canopy Growth, Canopy Rivers and the Company, each acting reasonably.

“JW Entities” means, collectively, (i) JW Opportunities Master Fund, Ltd., a corporation incorporated under the laws of the Cayman Islands (ii) JW Partners, LP, a limited partnership formed under the laws of Delaware, USA and (iii) Pharmaceutical Opportunities Fund, LP, a limited partnership formed under the laws of Delaware, USA.

“JW Warrants” means the outstanding Warrants issued by the Company to the JW Entities on December 8, 2017, being an aggregate of 28,636,361 Warrants as of the date of the Arrangement Agreement represented by Warrant certificates 2017-01, 2017-02 and 2017-03.

“Law” means, with respect to any Person, any and all applicable law (statutory, common or otherwise), constitution, treaty, convention, ordinance, code, rule, regulation, order, injunction, notice, judgment, decree, ruling or other similar requirement, whether domestic or foreign, enacted, adopted, promulgated or applied by a Governmental Entity that is binding upon or applicable to such Person or its business, undertaking, property or securities, and to the extent that they have the force of law, policies, guidelines, notices and protocols of any Governmental Entity, as amended unless expressly specified otherwise.

“Lien” means any mortgage, charge, pledge, hypothec, security interest, lien (statutory or otherwise), or adverse right or claim, or other third party interest or encumbrance of any kind.

“OBCA” means the Business Corporations Act (Ontario).

“Options” means the options to purchase Common Shares issued pursuant to the Company’s Stock Option Plan dated March 8, 2017, as amended on August 6, 2018.

“Parties” means the JW Entities, Canopy Growth, Canopy Rivers and the Company, and “Party” means any one of them.

“Person” includes any individual, partnership, association, body corporate, trust, organization, estate, trustee, executor, administrator, legal representative, government (including Governmental Entity), syndicate or other entity whether or not having legal status.

“Plan of Arrangement” means this plan of arrangement proposed under Section 182 of the OBCA, and any amendments or variations made in accordance with the Arrangement Agreement or Section 4.1 hereof or made at the direction of the Court in the Interim Order or Final Order with the prior written consent of the JW Entities, Canopy Growth, Canopy Rivers and the Company, each acting reasonably.

“Proportionate Voting Shares” has the meaning specified in Section 2.3(a).

“Subscription Agreements” means the subscription agreements entered into between the Company and each of the JW Entities, Canopy Growth and Canopy Rivers dated November 15, 2017.

- 4 -

“Tax Act” means the Income Tax Act (Canada).

“Transfer Agent” means, prior to the Effective Time, the Person appointed as the transfer agent and registrar of the Common Shares, and following the Effective Time, the Person appointed as the transfer agent and registrar of the Common Shares, Proportionate Voting Shares and the Exchangeable Shares.

“Warrants” means all outstanding warrants to purchase Common Shares, including the Canopy Warrants and the JW Warrants.

| 1.2 | Certain Rules of Interpretation |

In this Plan of Arrangement, unless otherwise specified:

| (a) | Headings, etc. The division of this Plan of Arrangement into Articles and Sections and the insertion of headings are for convenient reference only and do not affect the construction or interpretation of this Plan of Arrangement. |

| (b) | Currency. All references to dollars or to $ are references to Canadian dollars, unless specified otherwise. |

| (c) | Gender and Number. Any reference to gender includes all genders. Words importing the singular number only include the plural and vice versa. |

| (d) | Certain Phrases, etc. The words (i) ‘‘including”, “includes” and “include” mean “including (or includes or include) without limitation,” (ii) ‘‘the aggregate of’, “the total of”, “the sum of”, or a phrase of similar meaning means “the aggregate (or total or sum), without duplication, of,” and (iii) unless stated otherwise, “Article”, “Section”, and “Schedule” followed by a number or letter mean and refer to the specified Article or Section of or Schedule to this Plan of Arrangement. |

| (e) | Statutes. Any reference to a statute refers to such statute and all rules, resolutions and regulations made under it, as it or they may have been or may from time to time be amended or re-enacted, unless stated otherwise. |

| (f) | Computation of Time. A period of time is to be computed as beginning on the day following the event that began the period and ending at 5:00 p.m. on the last day of the period, if the last day of the period is a Business Day, or at 5:00 p.m. on the next Business Day if the last day of the period is not a Business Day. If the date on which any action is required or permitted to be taken under this Plan of Arrangement by a Person is not a Business Day, such action shall be required or permitted to be taken on the next succeeding day which is a Business Day. |

| (g) | Time References. References to time herein are to local time, Toronto, Ontario. |

- 5 -

ARTICLE 2

THE ARRANGEMENT

| 2.1 | Arrangement Agreement |

This Plan of Arrangement is made pursuant to the Arrangement Agreement.

| 2.2 | Binding Effect |

This Plan of Arrangement and the Arrangement, upon the filing of the Articles of Arrangement and the issuance of the Certificate of Arrangement, will become effective and be binding on the JW Entities, Canopy Growth, Canopy Rivers, the Company, all holders and beneficial owners of Common Shares, Options and Warrants, the Transfer Agent and all other Persons, at and after the Effective Time without any further act or formality required on the part of any Person.

| 2.3 | Arrangement |

At the Effective Time each of the following events shall occur and shall be deemed to occur sequentially as set out below without any further authorization, act or formality, in each case, unless stated otherwise, effective as at five minute intervals starting at the Effective Time:

| (a) | the articles of the Company will be amended to: (i) authorize the issuance of an unlimited number of a new class of proportionate voting shares (the “Proportionate Voting Shares”); (ii) authorize the issuance of an unlimited number of a new class of exchangeable shares (the “Exchangeable Shares”); (iii) authorize the issuance of an unlimited number of a new class of preferred shares, issuable in series (the “Preferred Shares”); and (iv) add the rights, privileges, restrictions and conditions attaching to the Proportionate Voting Shares, Common Shares, Exchangeable Shares and Preferred Shares set out in Exhibit A; |

| (b) | each Common Share held by any of the JW Entities shall, without any further action by or on behalf of the JW Entities, be deemed to be assigned and transferred by the holder thereof to the Company (free and clear of all Liens) in exchange for 0.001 of a Proportionate Voting Share, and: |

| (i) | the JW Entities shall cease to be the holders thereof and to have any rights as holders of such Common Shares other than the right to receive Proportionate Voting Shares in respect thereof in accordance with this Plan of Arrangement; |

| (ii) | the JW Entities shall be removed from the register of the Common Shares maintained by or on behalf of the Company and added to the register of the Proportionate Voting Shares maintained by or on behalf of the Company; and |

| (iii) | the Common Shares transferred to the Company shall be cancelled; |

- 6 -

| (c) | each Canopy Warrant held by either Canopy Growth or Canopy Rivers shall, without any further action by or on behalf of Canopy Growth or Canopy Rivers, be deemed to be acquired by the Company (resulting, for the avoidance of doubt, in the cancellation of such Canopy Warrant) in exchange for the issuance by the Company to Canopy Growth or Canopy Rivers, as applicable, of a fraction of a Common Share per Canopy Warrant equal to (i) the Common Share VWAP minus the exercise price of the Canopy Warrant; divided by (ii) the Common Share VWAP; |

| (d) | each Common Share held by either Canopy Growth or Canopy Rivers (including each Common Share issued in accordance with Section 2.3(c)) shall, without any further action by or on behalf of Canopy Growth or Canopy Rivers, be deemed to be assigned and transferred by the holder thereof to the Company (free and clear of all Liens) in exchange for one Exchangeable Share, and: |

| (i) | Canopy Growth and Canopy Rivers shall cease to be the holders thereof and to have any rights as holders of such Common Shares other than the right to receive Exchangeable Shares in respect thereof in accordance with this Plan of Arrangement; |

| (ii) | Canopy Growth and Canopy Rivers shall be removed from the register of the Common Shares maintained by or on behalf of the Company and added to the register of the Exchangeable Shares maintained by or on behalf of the Company; and |

| (iii) | the Common Shares transferred to the Company shall be cancelled; |

| (e) | the JW Warrants will be amended to reflect that each JW Warrant is exercisable for 0.001 of a Proportionate Voting Share instead of one Common Share; and |

| (f) | each of the Subscription Agreements will be amended to delete Section 6(vv) [Canadian Operations] thereof, |

provided that none of the foregoing will occur or will be deemed to occur unless all of the foregoing occur and, if they occur, all of the foregoing will be deemed to occur without further act or formality.

ARTICLE

3

CERTIFICATES AND PAYMENTS

| 3.1 | Issuance of Shares |

| (a) | Forthwith following the Effective Time, the Company shall, subject to Section 3.1(b), issue and deliver to the Transfer Agent one or more irrevocable treasury directions authorizing the Transfer Agent, as the registrar and transfer agent of the Common Shares, Proportionate Voting Shares and Exchangeable Shares, to register and issue the aggregate number of Proportionate Voting Shares and Exchangeable Shares, as applicable, to which each of the JW Entities, Canopy Growth and Canopy Rivers are entitled in accordance with Sections 2.3(b) and (d). |

- 7 -

| (b) | Upon surrender to the Transfer Agent for cancellation of a certificate or certificates (as applicable) which, immediately prior to the Effective Time, represented outstanding Common Shares that were transferred or deemed to be transferred, as applicable, pursuant to Section 2.3, together with such additional documents and instruments as the Transfer Agent may reasonably require, the holder of the Common Shares represented by such surrendered certificate(s) shall be entitled to receive in exchange therefore, and the Transfer Agent shall deliver to such holder, the applicable consideration that such holder has the right to receive under this Plan of Arrangement for such Common Shares, less any amounts withheld pursuant to Section 3.4, and any certificate(s) so surrendered shall forthwith be cancelled. |

| (c) | Until surrendered as contemplated by this Section 3.1, each certificate that immediately prior to the Effective Time represented Common Shares that were transferred or deemed to be transferred, as applicable, pursuant to Section 2.3 shall be deemed after the Effective Time to represent only the right to receive upon such surrender the consideration which such holder has the right to receive under this Plan of Arrangement for such Common Shares, less any amounts withheld pursuant to Section 3.4. |

| (d) | No holder of Common Shares, Options or Warrants as of the Effective Time shall be entitled to receive any consideration with respect to such Common Shares, Options or Warrants under this Plan of Arrangement other than any consideration to which such holder is entitled to receive in accordance with Section 2.3 and this Section 3.1 and, for greater certainty, no such holder will be entitled to receive any interest, dividends, premium or other payment in connection therewith. |

| 3.2 | Fractional Shares |

No fractional Common Shares or Exchangeable Shares shall be issued to Canopy Growth or Canopy Rivers pursuant ‘to this Plan of Arrangement. A holder of Canopy Warrants or a Common Shareholder otherwise entitled to a fractional interest in a Common Share or Exchangeable Share shall receive the nearest whole number of Common Shares or Exchangeable Shares, as applicable, with fractions equal to 0.5 or more being rounded up. Fractional Proportionate Voting Shares equal to 0.001 of a Proportionate Voting Share or greater may be issued to the JW Entities pursuant to this Plan of Arrangement. A Common Shareholder otherwise entitled to a fractional interest in an Exchangeable Share that is less than 0.001 shall receive the nearest thousandth of an Exchangeable Share, with fractions equal to 0.0005 or more being rounded up.

- 8 -

| 3.3 | Lost Certificates |

In the event any certificate which immediately prior to the Effective Time represented one or more outstanding Common Shares that were transferred pursuant to Section 2.3 shall have been lost, stolen or destroyed, upon the making of an affidavit of that fact by the Person claiming such certificate to be lost, stolen or destroyed, the Transfer Agent will issue in exchange for such lost, stolen or destroyed certificate the applicable number of Proportionate Voting Shares or Exchangeable Shares, subject to any withholdings in accordance with Section 3.4. When authorizing such issuance in exchange for any lost, stolen or destroyed certificate, the Person to whom such Proportionate Voting Shares or Exchangeable Shares are to be delivered shall as a condition precedent to the delivery of such Proportionate Voting Shares or Exchangeable Shares, give a bond satisfactory to the Company and the Transfer Agent (acting reasonably) in such sum as the Company may direct, or otherwise indemnify the Company in a manner satisfactory to the Company, acting reasonably, against any claim that may be made against the Company with respect to the certificate alleged to have been lost, stolen or destroyed.

| 3.4 | Withholding Rights |

The Company and the Transfer Agent, as applicable, shall be entitled to deduct and withhold from any Proportionate Voting Shares or Exchangeable Shares deliverable or consideration otherwise deliverable to any former Common Shareholder such amounts as they may be required to deduct and withhold therefrom under any provision of applicable Laws in respect of Taxes. To the extent that any amounts are so deducted and withheld, such amounts shall be treated for all purposes hereof as having been paid to the Person to whom such amounts would otherwise have been paid, provided that such withheld amounts are actually remitted to the appropriate taxing authority. To satisfy the amount required to be deducted or withheld from any payment to any such Common Shareholder, the Company or the Transfer Agent, as applicable, may sell or otherwise dispose of (or exercise any exchange or conversion rights applicable and then sell or otherwise dispose of the underlying Common Shares) any portion of the Proportionate Voting Shares or Exchangeable Voting Shares deliverable to such holder as is necessary to provide sufficient funds to enable the Company or the Transfer Agent, as applicable, to comply with such deduction and/or withholding requirements.

| 3.5 | No Liens |

Any exchange or transfer of securities pursuant to this Plan of Arrangement shall be free and clear of any Liens or other claims of third parties of any kind.

| 3.6 | Existing Options and Warrants |

For clarity, from and after the Effective Time all Options and Warrants issued and outstanding following the Effective Time, other than the JW Warrants, will remain exercisable for Common Shares.

| 3.7 | Paramountcy |

From and after the Effective Time, this Plan of Arrangement shall take precedence and priority over any and all Common Shares, Options and Warrants issued or outstanding prior to the Effective Time.

- 9 -

| 3.8 | Tax Election |

The Company will, at the request of Canopy Rivers or Canopy Growth, jointly elect with Canopy River or Canopy Growth, as applicable, under subsection 85(1) of the Tax Act with respect to the transfer of the Canopy Warrants. Such elections will be duly and timely prepared (in the form and manner prescribed by the Tax Act and the regulations thereunder) by Canopy Rivers or Canopy Growth, as applicable, timely delivered to the Company for execution (providing the Company with reasonable time to review in advance of the filing deadline), whereupon such elections will be timely signed by an appropriate signing officer of the Company and returned to Canopy Rivers or Canopy Growth, as applicable, for timely filing. The agreed amount for the purposes of paragraph 85(1)(a) of the Tax Act in respect of the Canopy Warrants will be such amount as is determined by Canopy Rivers or Canopy Growth, as applicable, within the limits prescribed in the Tax Act. The Company will, at the request of Canopy Rivers and/or Canopy Growth, as applicable, jointly elect with Canopy Rivers and/or Canopy Growth, as applicable, under corresponding provisions of applicable provincial income tax legislation with respect to the transfer of the Company Warrants in respect of which a request to file a tax election is made by Canopy Rivers or Canopy Growth, as applicable. The foregoing provisions of this Section 3.8 will apply to the making of any such provincial elections, with necessary changes. The Company will not be responsible or liable for any taxes, interest, penalties, damages or expenses resulting from the failure by anyone to properly complete or file an election referred to above in the form and manner and within the time prescribed by the Tax Act or relevant provincial tax legislation, as the case may be, unless such taxes, interest, penalties, damages or expenses result solely from the failure by the Company to fulfil its obligations under this Section 3.8.

| 3.9 | Shares Fully Paid |

All Common Shares, Proportionate Voting Shares and Exchangeable Shares issued pursuant to this Plan of Arrangement shall be fully paid and non-assessable, and the Company shall be deemed to have received the full consideration therefor.

ARTICLE

4

AMENDMENTS

| 4.1 | Amendments to Plan of Arrangement |

| (a) | The JW Entities, Canopy Growth, Canopy Rivers and the Company may amend, modify and/or supplement this Plan of Arrangement at any time and from time to time prior to the Effective Time, provided that each such amendment, modification and/or supplement must (i) be set out in writing, (ii) be approved by the JW Entities, Canopy Growth, Canopy Rivers and the Company, each acting reasonably, (iii) filed with the Court and, if made following the Company Meeting, approved by the Court, and (iv) communicated to the Company Shareholders if and as required by the Court. |

| (b) | Any amendment, modification or supplement to this Plan of Arrangement may be proposed by the Company at any time prior to the Company Meeting (provided that the JW Entities, Canopy Growth and Canopy Rivers shall have consented thereto) with or without any other prior notice or communication, and if so proposed and accepted by the Persons voting at the Company Meeting (other than as may be required under the Interim Order), shall become part of this Plan of Arrangement for all purposes. |

- 10 -

| (c) | Any amendment, modification or supplement to this Plan of Arrangement that is approved or directed by the Court following the Company Meeting shall be effective only if (i) it is consented to in writing by the JW Entities, Canopy Growth, Canopy Rivers and the Company (in each case, acting reasonably), and (ii) if required by the Court, it is consented to by some or all of the Company Shareholders voting in the manner directed by the Court. |

| (d) | Any amendment, modification or supplement to this Plan of Arrangement may be made following the Effective Date unilaterally by the Company, provided that it concerns a matter which, in the reasonable opinion of the Company, is of an administrative nature required to better give effect to the implementation of this Plan of Arrangement and is not expected by the Company, acting reasonably, to be materially prejudicial to any other Party. |

| 4.2 | Termination |

This Plan of Arrangement may be withdrawn prior to the Effective Time in accordance with the terms of the Arrangement Agreement.

ARTICLE

5

FURTHER ASSURANCES

| 5.1 | Further Assurances |

Notwithstanding that the transactions and events set out in this Plan of Arrangement shall occur and shall be deemed to occur in the order set out in this Plan of Arrangement without any further act or formality, each of the Parties shall make, do and execute, or cause to be made, done and executed, all such further acts, deeds, agreements, transfers, assurances, instruments or documents as may reasonably be required by either of them in order to further document or evidence any of the transactions or events set out in this Plan of Arrangement.

- 11 -

EXHIBIT A

RIGHTS.

PRIVILEGES. RESTRICTIONS AND CONDITIONS

ATTACHING TO SHARES

Except as set out below, the Proportionate Voting Shares, Common Shares and Exchangeable Shares (collectively, the “Shares”) have the same rights, are equal in all respects and are treated by the Corporation as if they were shares of one class only.

Notwithstanding any other provision herein, but subject to the Business Corporations Act (Ontario) (the “Act”), the special rights and restrictions attached to any class of Shares may be modified if the amendment is authorized by not less than 66⅔% of the votes cast at a meeting of holders of Shares duly held for that purpose. However, if the holders of Proportionate Voting Shares, as a class, the holders of Common Shares, as a class, or the holders of Exchangeable Shares, as a class, are to be affected in a manner materially different from any other classes of Shares, the amendment must, in addition, be authorized by not less than 66⅔% of the votes cast at a meeting of the holders of the class of Shares which is affected differently.

PROPORTIONATE VOTING SHARES

| 1. | Voting Rights. The holders of the Proportionate Voting Shares shall be entitled to receive notice of, and to attend, all meetings of the shareholders of the Corporation and shall have 1000 votes for each Proportionate Voting Share held at all meetings of the shareholders of the Corporation, except for meetings at which only holders of another specified class or series of shares of the Corporation are entitled to vote separately as a class or series. |