EXHIBIT 3.3

Published on December 22, 2021

Exhibit 3.3

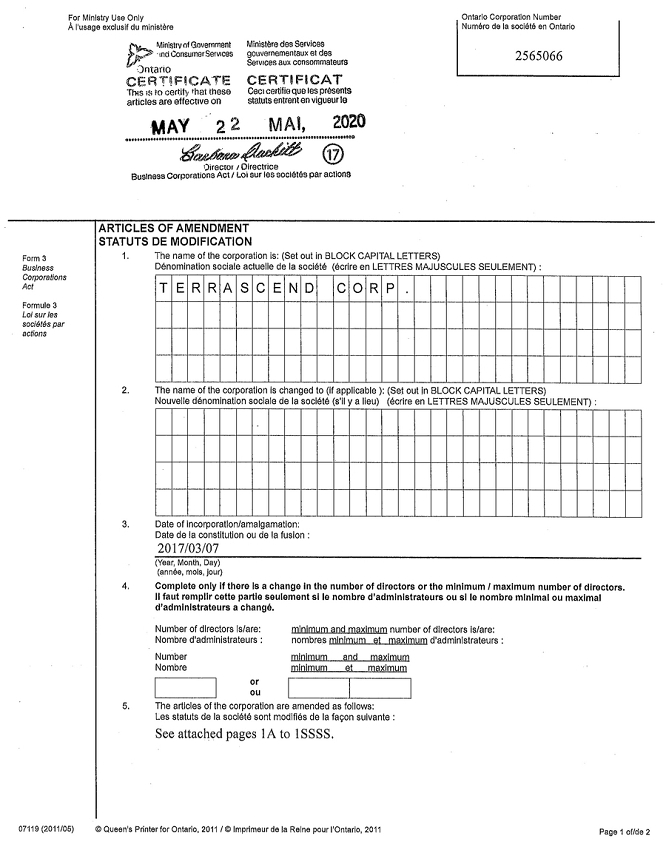

Form 3 Business Corporations Act Formula 3 Loi sur /es socletes par actions For Ministry Use Only A l'usage exclusif du ministere Ministrv of Government Consumer Services ntano CERTIFICATE This 1s to certifv that these articles are effective on Ministere des Services gouvernementaux et des Services aux consommateurs CERTIFICAT Caci certifie➔ que tes presents statuts entrant en vigueur la MAV 2 2 MAI, 2020 1)irecro1 1 Directrice Business Corporations Act/ Loi sur tes socletes par actions ARTICLES OF AMENDMENT STATUTS DE MODIFICATION 1. The name of the corporation is: (Set out in BLOCK CAPITAL LETTERS) Ontario Corporation Number Numero de la societe en Ontario 2565066 Denomination sociale actuelle de la societe (ecrlre en LETTRES MAJUSCULES SEULEMENT) : 2, 3, 4. T E R R A s C E N D C 0 R p The name of the corporation Is changed to (if applicable ): (Set out in BLOCK CAPITAL LETTERS) Nouvelle denomination soclale de la societe (s'il ya lieu) (ecrlre en LETTRES MAJUSCULES SEU LEM ENT) : Date of Incorporation/amalgamation: Date de la constitution ou de la fusion : 2017/03/07 (Year, Month, Day) (annee, mols, Jour) Complete only If there Is a change in the number of directors or the minimum / maximum number of directors. II faut rempllr cette partle seulement si le nombre d'admlnlstrateurs ou sl le nombre minimal ou maximal d'admlnlstrateurs a change. Number of directors ls/are: Nombre d'administrateurs : Number Nombre or OU minimum and maximum number of directors ls/are: nombres minimum et maximum d'adminlstrateurs : minimum minimum and maximum et maximum 5. The articles of the corporation are amended as follows: Les statuts de la soclete son! modifies de la fa9on sulvante : See attached pages lA to lSSSS. 07119 (2011/06) © Queen's Printer for Ontario, 2011 / © lmprlmeur de la Reine pour !'Ontario, 2011 Page 1 of/de 2

1A

SCHEDULE

TO

ARTICLES OF AMENDMENT

TERRASCEND CORP.

(the “Company”)

The Articles of the Company are amended as follows:

| (a) | to increase the authorized capital of the Company by creating four series of Preferred Shares (as defined in the existing Articles of the Company) in the capital of the Company to be designated the “Series A Convertible Preferred Shares”, the “Series B Convertible Preferred Shares”, the “Series C Convertible Preferred Shares” and the “Series D Convertible Preferred Shares”, of which an unlimited number of each series shall be authorized for issuance; and |

| (b) | to attach the rights, privileges, restrictions and conditions to each of the Series A Convertible Preferred Shares as set forth in Exhibit A, the Series B Convertible Preferred Shares as set forth in Exhibit B, the Series C Convertible Preferred Shares as set forth in Exhibit C and the Series D Convertible Preferred Shares as set forth in Exhibit D. |

[Rest of page intentionally left blank.]

1B

Exhibit A

PROVISIONS ATTACHING TO THE

SERIES A CONVERTIBLE PREFERRED SHARES

In addition to the rights, privileges, restrictions and conditions attaching to the preferred shares as a class, the Series A Convertible Preferred Shares shall have the following rights, privileges, restrictions and conditions. Capitalized terms not defined where used shall have the meanings ascribed to such terms in Section 8.

1. Liquidation Preference

| (a) | In the event of liquidation, dissolution or winding up of the Company, whether voluntary or involuntary, or upon any other return of capital or distribution of the assets of the Company among its shareholders, in each case for the purposes of winding up its affairs, each Series A Convertible Preferred Share entitles the holder thereof to receive and to be paid out of the assets of the Company available for distribution, before any distribution or payment may be made to a holder of any Common Shares, Proportionate Voting Shares, Exchangeable Shares or any other shares ranking junior in such liquidation, dissolution or winding up to the Series A Convertible Preferred Shares, an amount per Series A Convertible Preferred Share equal to the Liquidation Preference. |

| (b) | The “Liquidation Preference” per Series A Convertible Preferred Share shall initially be equal to US$2,000; provided that if the Company makes a distribution to holders of all or substantially all of the Series A Convertible Preferred Shares, payable in Series A Convertible Preferred Shares, or if the Company effects a share split or share consolidation on the Series A Convertible Preferred Shares, then the Liquidation Preference shall be adjusted on the effective date of such event by multiplying the then-effective Liquidation Preference by: |

| CS0 | ||

| CS1 |

where,

CS0 = the number of Series A Convertible Preferred Shares outstanding immediately before giving effect to such share dividend, distribution, split or share consolidation, as the case may be; and

CS1 = the number of Series A Convertible Preferred Shares outstanding immediately after giving effect to such dividend, distribution, share split or share consolidation.

| (c) | After payment to the holders of the Series A Convertible Preferred Shares of the full Liquidation Preference to which they are entitled in respect of outstanding Series A Convertible Preferred Shares (which, for greater certainty, have not been converted prior to such payment), such Series A Convertible Preferred Shares will have no further right or claim to any of the assets of the Company. |

| (d) | The Liquidation Preference shall be payable to holders of Series A Convertible Preferred Shares in cash; provided, however, that to the extent the Company has, having exercised commercially reasonable efforts to make such payment, insufficient cash available to pay the Liquidation Preference in full in cash, the portion of the Liquidation Preference with respect to which the Company has insufficient cash may be paid in property or other assets of the Company. The value of any property or assets not consisting of cash that is distributed by the Company in satisfaction of any portion of the Liquidation Preference will equal the Fair Market Value thereof on the date of distribution. |

2. Voting Rights

Except as otherwise provided in the Business Corporations Act (Ontario) (the “Act”), the holders of Series A Convertible Preferred Shares shall not be entitled to receive notice of, or to attend or to vote at any meeting of the shareholders of, the Company.

3. Dividends

The holders of Series A Convertible Preferred Shares shall not be entitled to receive any dividends, except that the Company shall issue such dividends as are necessary to comply with the provisions of Section 7(f)(iii) in respect of an adjustment to the Conversion Ratio in connection with any dividend paid on the Common Shares. The Company will provide holders of Series A Convertible Preferred Shares with 21 days’ notice of the record date for any dividend payable on the Common Shares.

4. Purchase for Cancellation

Subject to such provisions of the Act as may be applicable, the Company may at any time or times purchase (if obtainable) for cancellation all or any part of the Series A Convertible Preferred Shares outstanding from time to time in one or more negotiated transactions at such price or prices as are determined by the Board of Directors and as may be agreed to with the relevant holders of the Series A Convertible Preferred Shares. From and after the date of purchase of any Series A Convertible Preferred Shares under the provisions of this Section 4, any shares so purchased shall be cancelled.

5. [RESERVED]

6. [RESERVED]

| -3- |

| 7. | Conversion. |

Each Series A Convertible Preferred Share is convertible into Proportionate Voting Shares as provided in this Section 7.

| (a) | Conversion at the Option of Holders of Series A Convertible Preferred Shares. Each holder of Series A Convertible Preferred Shares is entitled to convert, at any time and from time to time, at the option and election of such holder, any or all outstanding Series A Convertible Preferred Shares held by such holder into a number of duly authorized, validly issued, fully paid and non-assessable Proportionate Voting Shares equal to the product obtained by multiplying (i) the then-effective Conversion Ratio by (ii) the number of Series A Convertible Preferred Shares so converted; provided that the Company shall not effect any conversion pursuant to this Section 7(a), and no holder shall have the right to convert its Series A Convertible Preferred Shares pursuant to this Section 7(a), to the extent that after giving effect to such conversion such holder, alone or together with its affiliates and persons acting jointly or in concert with such holder and its affiliates (including any person not dealing at arm’s length with the holder for the purpose of the Income Tax Act (Canada)), would beneficially own securities representing in excess of 49.9% of the voting power of the outstanding capital stock of the Company immediately after giving effect to such conversion and any concurrent conversion or exercise of Convertible Securities. |

The “Conversion Ratio” is initially 1.00, as adjusted from time to time as provided in Section 7(f). In order to convert the Series A Convertible Preferred Shares into Proportionate Voting Shares pursuant to this Section 7(a), the holder must surrender the certificates representing such Series A Convertible Preferred Shares, accompanied by transfer instruments reasonably satisfactory to the Company, free of any adverse interest or liens at the office of the Company or its transfer agent for the Series A Convertible Preferred Shares (as directed by the Company), together with the prescribed form of written notice, set forth on the Series A Convertible Preferred Share certificates, that such holder elects to convert all or such number of shares represented by such certificates as specified therein.

| (b) | Automatic Conversion upon a Change of Control. |

| (i) | The Company shall provide written notice (the “Conversion Notice”) pursuant to this Section 7(b) at least 30 days prior to the effective date of a Change of Control to the holders of record of the Series A Convertible Preferred Shares as they appear in the records of the Company. The Conversion Notice must state: (A) the consideration per Series A Convertible Preferred Share deliverable upon conversion; and (B) the date (the “Automatic Conversion Date”), which shall be not less than 30 days after the date of delivery of the Conversion Notice, on which the Series A Convertible Preferred Shares will automatically convert pursuant to Section 7(b)(ii). |

| (ii) | On the Automatic Conversion Date, each Series A Convertible Preferred Share that remains outstanding shall automatically convert into a number of duly authorized, validly issued, fully paid and non-assessable Proportionate Voting Shares (or equivalent Reference Property, as applicable) equal to the then-applicable Conversion Ratio. |

| -4- |

| (c) | Fractional Shares. Any fractional Proportionate Voting Shares issuable upon conversion of the Series A Convertible Preferred Shares will be rounded down to the nearest 1/1000th of a Proportionate Voting Share. If more than one Series A Convertible Preferred Share is being converted at one time by or for the benefit of the same holder, then the number of Proportionate Voting Shares issuable upon conversion will be calculated on the basis of the aggregate number of Series A Convertible Preferred Shares converted by or for the benefit of such holder at such time. |

| (d) | Mechanics of Conversion. |

| (i) | Promptly after the Conversion Date, the Company shall issue and deliver to each holder of Series A Convertible Preferred Shares the number of Proportionate Voting Shares to which such holder is entitled in exchange for the certificates formerly representing Series A Convertible Preferred Shares. Such conversion will be deemed to have been made on the Conversion Date, and the person entitled to receive the Proportionate Voting Shares issuable upon such conversion shall be treated for all purposes as the record holder of such Proportionate Voting Shares on such Conversion Date. In case fewer than all the Series A Convertible Preferred Shares represented by any certificate are to be converted, a new certificate shall be issued representing the unconverted Series A Convertible Preferred Shares without cost to the holder thereof, except for any documentary, stamp or similar issue or transfer tax due because any certificates for Proportionate Voting Shares or Series A Convertible Preferred Shares are issued in a name other than the name of the converting holder. The Company shall pay any documentary, stamp or similar issue or transfer tax due on the issue of Proportionate Voting Shares upon conversion or due upon the issuance of a new certificate for any Series A Convertible Preferred Shares not converted other than any such tax due because Proportionate Voting Shares or a certificate for Series A Convertible Preferred Shares are issued in a name other than the name of the converting holder, which shall be paid by the converting holder. |

| (ii) | From and after the Conversion Date, the Series A Convertible Preferred Shares to be converted on such Conversion Date will no longer be outstanding, and all rights and privileges of the holder thereof as a holder of Series A Convertible Preferred Shares (except the right to receive from the Company the Proportionate Voting Shares upon conversion) shall cease and terminate with respect to such shares. |

| -5- |

| (iii) | All Proportionate Voting Shares issued upon conversion of the Series A Convertible Preferred Shares will, upon issuance by the Company, be duly and validly issued, as fully paid and non-assessable Proportionate Voting Shares in the capital of the Company. |

| (e) | [RESERVED] |

| (f) | Adjustments to Conversion Ratio. |

| (i) | Adjustments for Change in Share Capital. |

| (A) | Adjustments for Common Shares and/or Exchangeable Shares. If the Company shall, at any time and from time to time while any Series A Convertible Preferred Shares are outstanding, issue a dividend or make a distribution (other than, if applicable, dividends issued in the ordinary course) on its Common Shares and Exchangeable Shares payable in Common Shares or Exchangeable Shares to all or substantially all holders of its Common Shares and Exchangeable Shares, then the then-applicable Conversion Ratio at the opening of business on the Ex-Dividend Date for such dividend or distribution will be adjusted in accordance with the following formula: |

| CR1 = CR0 x | OS1 | |

| OS0 |

where

CR0 = the Conversion Ratio in effect immediately prior to the opening of business on the Ex-Dividend Date for such dividend or distribution;

CR1 = the Conversion Ratio in effect immediately after the open of business on the Ex-Dividend Date for such dividend or distribution;

OS0 = number of Common Shares and Exchangeable Shares outstanding at the close of business on the Business Day immediately preceding such Ex-Dividend Date; and

OS1 = the sum of the number of Common Shares and Exchangeable Shares outstanding at the close of business on the Business Day immediately preceding the Ex-Dividend Date for such dividend or distribution, plus the total number of Common Shares and Exchangeable Shares constituting such dividend or other distribution.

Any adjustment to the Conversion Ratio made pursuant to this Section 7(f)(i)(A) shall become effective immediately after the opening of business on the Ex-Dividend Date for such dividend or distribution. If any dividend or distribution of the type described in this Section 7(f)(i)(A) is declared but not so paid or made, the Conversion Ratio shall again be adjusted to the Conversion Ratio which would then be in effect if such dividend or distribution had not been declared.

| -6- |

| (B) | Adjustments for share splits and combinations. If the Company shall, at any time or from time to time while any of the Series A Convertible Preferred Shares are outstanding, subdivide or reclassify its outstanding Common Shares and/or Exchangeable Shares into a greater number of Common Shares and/or Exchangeable Shares, then the then-applicable Conversion Ratio in effect at the opening of business on the day upon which such subdivision or reclassification becomes effective shall be proportionately increased, and conversely, if the Company shall, at any time or from time to time while any of the Series A Convertible Preferred Shares are outstanding, combine or reclassify its outstanding Common Shares and/or Exchangeable Shares into a smaller number of Common Shares and/or Exchangeable Shares, then the then-applicable Conversion Ratio in effect at the opening of business on the day upon which such combination or reclassification becomes effective shall be proportionately decreased. In each such case, the Conversion Ratio shall be adjusted in accordance with the following formula: |

| CR1 = CR0 x | OS1 | |

| OS0 |

where,

CR0 = the Conversion Ratio in effect immediately prior to the open of business on the effective date of such subdivision, combination or reclassification, as the case may be;

CR1 = the Conversion Ratio in effect immediately after the open of business on the effective date of such subdivision, combination or reclassification, as the case may be;

OS0 = the number of Common Shares and Exchangeable Shares outstanding immediately before giving effect to such subdivision, combination or reclassification; and

OS1 = the number of Common Shares and Exchangeable Shares outstanding immediately after giving effect to such subdivision, combination or reclassification.

Any adjustment to the Conversion Ratio made pursuant to this Section 7(f)(i)(B) shall become effective immediately after the open of business on the effective date of such subdivision, combination or reclassification becomes effective.

| -7- |

| (ii) | Adjustments for certain rights, options and warrants. If the Company shall, at any time or from time to time, while any Series A Convertible Preferred Shares are outstanding, distribute rights, options or warrants to all or substantially all holders of its Common Shares and Exchangeable Shares entitling them, for a period expiring not more than forty-five (45) days immediately following the record date of such distribution, to purchase or subscribe for Common Shares, or securities convertible into, or exchangeable or exercisable for, Common Shares, in either case, at less than 95% of the average of the Closing Prices (if the Closing Price on any Trading Day is quoted only in Canadian dollars, the USD Equivalent Amount thereof on such Trading Day) for the ten (10) consecutive Trading Days immediately preceding the date of the first public announcement of the distribution, then the then-applicable Conversion Ratio shall be adjusted in accordance with the following formula: |

| CR1 = CR0 x | OS0+ Y | |

| OS0+X |

where,

CR0 = the Conversion Ratio in effect immediately prior to the opening of business on the Ex-Dividend Date for such distribution;

CR1 = the Conversion Ratio in effect immediately after the opening of business on the Ex-Dividend Date for such distribution;

OS0 = the number of Common Shares deemed to be outstanding immediately prior to the open of business on the Ex-Dividend Date for such distribution on a fully diluted basis, including on the conversion, exercise or exchange of any convertible, exercisable or exchangeable securities;

X = the number of Common Shares equal to the aggregate price payable to exercise such rights, options or warrants, divided by the average of the Closing Prices of the Common Shares over the ten (10) consecutive Trading Day period ending on, and including, the Trading Day immediately preceding the date of the first public announcement of the distribution of such rights, options or warrants;

Y = the total number of additional Common Shares issuable pursuant to such rights, options or warrants.

| -8- |

Any adjustment to the Conversion Ratio made pursuant to this Section 7(f)(ii) shall become effective immediately after the opening of business on the Ex-Dividend Date for such distribution. To the extent that such rights, options or warrants are not exercised prior to their expiration or Common Shares are otherwise not delivered pursuant to such rights, options or warrants upon the exercise of such rights or warrants, the Conversion Ratio shall be readjusted to such Conversion Ratio that would have then been in effect had the adjustment made upon the issuance of such rights, options or warrants been made on the basis of the delivery of only the number of Common Shares actually delivered. If such rights, options or warrants are only exercisable upon the occurrence of certain triggering events, then the Conversion Ratio shall not be adjusted until such triggering events occur. In determining the aggregate offering price payable for such Common Shares, the Company shall take into account the Fair Market Value of any consideration (if other than cash) received for such rights, options or warrants and the Fair Market Value of any consideration (if other than cash) paid or payable upon the exercise of such rights, options or warrants.

| (iii) | Adjustments for Payment of Cash Dividends. If the Company shall, at any time and from time to time while any Series A Convertible Preferred Shares are outstanding, declare a cash dividend on its Common Shares and Exchangeable Shares payable to all or substantially all holders of its Common Shares and Exchangeable Shares, then the then-applicable Conversion Ratio at the opening of business on the Ex-Dividend Date for such dividend will be adjusted in accordance with the following formula: |

| CR1 = CR0 x | SP0 |

| (SP0 – C) |

where,

CR0 = the Conversion Ratio in effect immediately prior to the opening of business on the Ex-Dividend Date for such dividend;

CR1 = the Conversion Ratio in effect immediately after the opening of business on the Ex-Dividend Date for such dividend;

SP0 = the Current Market Price of the Common Shares on the Business Day immediately preceding such Ex-Dividend Date; and

C = the amount in cash per Common Share and Exchangeable Share the Company distributes to all or substantially all holders of the Common Shares and Exchangeable Shares (which cash dividend, if payable in Canadian dollars, shall be converted into the USD Equivalent Amount of such dividend as of the Business Day immediately preceding such Ex-Dividend Date).

| -9- |

Any adjustment to the Conversion Ratio made pursuant to this Section 7(:f)(iii) shall become effective immediately after the opening of business on the Ex-Dividend Date for such dividend.

If any dividend of the type described in this Section 7(:f)(iii) is declared but not so paid or made, the Conversion Ratio shall again be adjusted to the Conversion Ratio which would then be in effect if such dividend had not been declared.

Notwithstanding the foregoing, if “C” (as defined above) is equal to or greater than “SP0” (as defined above), in lieu of the foregoing increase, each holder of Series A Convertible Preferred Shares shall receive at the same time and upon the same terms as holders of Common Shares and Exchangeable Shares, the amount of cash as a dividend on the Series A Convertible Preferred Shares that such holder would have received if such holder owned a number of Proportionate Voting Shares at the Conversion Ratio in effect immediately prior to the opening of business on the Ex-Dividend Date for such cash dividend or distribution.

| (iv) | Adjustments for Proportionate Voting Shares. If the number of Common Shares into which each Proportionate Voting Share is convertible is adjusted, then the Conversion Ratio will be adjusted upon giving effect to such adjustment by multiplying the then-applicable Conversion Ratio by the following fraction: |

| P0 | ||

| P1 |

where,

P0 = the number of Common Shares into which each Proportionate Voting Share is convertible immediately prior to the effective time of such adjustment to the Proportionate Voting Shares; and

P1 = the number of Common Shares into which each Proportionate Voting Share is convertible immediately after the effective time of such adjustment to the Proportionate Voting Shares.

| -10- |

| (v) | Adjustments for certain distributions. If the Company shall, at any time and from time to time while any Series A Convertible Preferred Shares are outstanding, distribute to all or substantially all holders of Common Shares and Exchangeable Shares evidences of indebtedness, shares of capital stock, securities, cash or other assets (excluding any such distribution otherwise contemplated in Section 7(f)(i), (ii), or (iii) or in the case of a spin-off transaction as contemplated below in this Section 7(f)(v)), then the then-applicable Conversion Ratio at the opening of business on the Ex-Dividend Date for such distribution will be adjusted by multiplying such then-applicable Conversion Ratio by the following fraction: |

|

SP0 |

| (SP0 – FMV) |

where,

SP0 = the aggregate Current Market Price of the Common Shares into which the Proportionate Voting Shares issuable upon conversion of one Series A Convertible Preferred Share are convertible; and

FMV = the Fair Market Value of the portion of the distribution applicable to one Series A Convertible Preferred Share on such date.

In a “spin-off,” where the Company makes a distribution to all holders of Common Shares and Exchangeable Shares consisting of capital stock of any class or series, or similar equity interests of, or relating to, a subsidiary of the Company or other business unit, the Conversion Ratio will be adjusted on the fifteenth Business Day after the effective date of the distribution by multiplying the then-applicable Conversion Ratio in effect immediately prior to such fifteenth Business Day by the following fraction:

|

(MP0 + MPS |

| MP0 |

where,

MP0 = the Current Market Price of the Common Shares on the Business Day immediately preceding such Ex-Dividend Date for the “spin-off” aggregated for all Common Shares underlying the Proportionate Voting Shares issuable upon conversion of one Series A Convertible Preferred Share; and

MPS = the Fair Market Value of the portion of the distribution applicable to one Series A Convertible Preferred Share on such date.

In the event that such distribution described in this Section 7(f)(v) is not so paid or made, the Conversion Ratio shall be readjusted, effective as of the date the Board of Directors publicly announces its decision not to pay or make such distribution, to the Conversion Ratio that would then be in effect if such distribution had not been announced.

| -11- |

| (vi) | Adjustments for Issuer Bids. If the Company or any subsidiary of the Company shall, at any time and from time to time while any Series A Convertible Preferred Shares are outstanding, make an issuer bid or a tender or exchange offer (other than an odd lot offer or a normal course issuer bid) to all or substantially all of the holders of Common Shares and Exchangeable Shares for all or any portion of the Common Shares and/or Exchangeable Shares (any such issuer bid or tender or exchange offer being called an “Issuer Bid”) where the cash and the value of any other consideration included in such payment per Common Share and/or Exchangeable Share exceeds the Current Market Price of the Common Shares on the Trading Day that is ten consecutive Trading Days after the Trading Day next succeeding the date such Issuer Bid expires, then the then-applicable Conversion Ratio will be adjusted by multiplying the then-applicable Conversion Ratio by the following fraction: |

|

AC + (SP1x0S1) |

| OS0xSP1 |

where,

AC = the aggregate value of all cash and other consideration (as determined by the Board of Directors) paid or payable for shares purchased in such Issuer Bid;

OS0 = the number of Common Shares and Exchangeable Shares outstanding immediately prior to the open of business on the Trading Day next succeeding the date such Issuer Bid expires;

OS1 = the number of Common Shares and Exchangeable Shares outstanding immediately after the open of business on the Trading Day next succeeding the date such Issuer Bid expires (after giving to the purchase of all shares accepted for purchase in such Issuer Bid); and

SP1 = the aggregate Current Market Price of the Common Shares on the day that is ten consecutive Trading Days after the Trading Day next succeeding the date such Issuer Bid expires.

If the Company or one of its subsidiaries is obligated to purchase Common Shares or Exchangeable Shares pursuant to any such Issuer Bid, but the Company or such subsidiary is permanently prevented by applicable law from effecting any such purchases or all such purchases are rescinded, the Conversion Ratio shall again be adjusted to be the Conversion Ratio that would then be in effect if such Issuer Bid had not been made.

| -12- |

| (vii) | Adjustments for Certain Issuances of Additional Common Shares. |

| (A) | In the event the Company shall within one year after the Original Issuance Date issue Additional Common Shares in a financing transaction or transactions priced in accordance with the rules of the applicable Exchange, if any, pursuant to which the Company receives gross proceeds in excess of US$30,000,000 (a “Qualified Financing”) at an average price that in the good faith determination of the Board of Directors, considering each transaction as a whole, is less than the average price of the offering pursuant to which the Series A Convertible Preferred Shares were initially issued, then the then-applicable Conversion Ratio shall be increased upon completion of such Qualified Financing to an amount that in the good faith determination of the Board of Directors is equitable in the circumstances to ensure that the economic value of the offering pursuant to which the Series A Convertible Preferred Shares were initially issued is at least equivalent to the economic value offered to purchasers in the Qualified Financing. |

| (B) | For purposes of this Section 7(f)(vii), the term “Additional Common Shares” means any Common Shares or Convertible Securities (collectively, “Common Share Equivalents”) issued by the Company after the Original Issuance Date, provided that Additional Common Shares will not include any of the following: |

| (1) | Common Share Equivalents issued or issuable upon conversion of Series A Convertible Preferred Shares or pursuant to the terms of any other Convertible Security issued and outstanding on the Original Issuance Date; |

| (2) | Any Common Shares or Common Share Equivalents issued or issuable pursuant to or under any equity incentive grants, plans, programs or similar arrangements adopted by the Company, including the Company’s stock option plan; |

| (3) | Common Share Equivalents issued or issuable as full or partial consideration for acquisitions of any entities, businesses and/or related assets or other business combinations by the Company or any of its subsidiaries, whether by merger, consolidation, sale of assets, sale or exchange of stock or otherwise (but, for the avoidance of doubt, not including any securities sold to finance or fund all or part of any cash consideration payable in connection with any such transaction); or |

| (4) | Common Share Equivalents issued or issuable in an aggregate amount equal to less than one percent (1%) of the total issued and outstanding Common Shares on the Original Issuance Date for all issuances in the aggregate pursuant to this clause (4), after taking into account any subdivisions, combinations or reclassifications thereof, and assuming the conversion of all outstanding Series A Convertible Preferred Shares into Common Shares after taking into account any adjustments to the Conversion Ratio from time to time pursuant to the terms of this Section 7 and any increases to the Liquidation Preference from time to time. |

| -13- |

In the case of the issuance of Additional Common Shares for cash, the consideration shall be deemed to be the amount of cash paid (with any Canadian dollar consideration being converted into the USD Equivalent Amount, if necessary) therefor before deducting any discounts, commissions or other expenses allowed, paid or incurred by the Company for any underwriting or otherwise in connection with the issuance and sale thereof. In the case of the issuance of Additional Common Shares for consideration in whole or in part other than cash, the consideration other than cash shall be deemed to be the Fair Market Value thereof. In the case of the issuance of Convertible Securities, the aggregate maximum number of Common Shares deliverable upon exercise, conversion or exchange of such Convertible Securities shall be deemed to have been issued at the time such Convertible Securities were issued and for a consideration equal to the consideration (determined in the manner provided in this paragraph) if any, received by the Company upon the issuance of such Convertible Securities plus the minimum additional consideration payable pursuant to the terms of such Convertible Securities for the Common Shares covered thereby, but no further adjustment shall be made for the actual issuance of Common Shares upon the exercise, conversion or exchange of any such Convertible Securities. Upon the expiration or forfeiture of any Additional Common Shares consisting of options, warrants or other rights to acquire Common Shares or Convertible Securities, the termination of any such rights to convert or exchange or the expiration or forfeiture of any options or rights related to such convertible or exchangeable securities, the Conversion Ratio, to the extent in any way affected by or computed using such options, rights or securities or options or rights related to such securities, shall be recomputed to reflect the issuance of only the number of Common Shares (and Convertible Securities that remain in effect) actually issued upon the exercise of such options, warrants or rights, upon the conversion or exchange of such securities or upon the exercise of the options or rights related to such securities.

| (viii) | Adjustment upon a Fundamental Change. On the effective date of a Fundamental Change, if the Liquidation Preference is greater than the product of (i) the Fair Market Value of the kind and amount of shares, other securities or other property or assets (or any combination thereof) that a holder of one Proportionate Voting Share would have owned or been entitled to receive (following conversion into Common Shares, if necessary) upon completion of such Fundamental Change (the “Per Share Conversion Value”) and (ii) the Conversion Ratio, then the then-effective Conversion Ratio shall be increased to the amount obtained by dividing the Liquidation Preference by the Per Share Conversion Value. |

| -14- |

| (ix) | Capital Reorganization Events. In the case of: (A) any recapitalization, reclassification or change of the Common Shares or the Proportionate Voting Shares (other than changes resulting from a subdivision or combination), (B) any consolidation, merger, amalgamation or combination involving the Company, (C) any sale, lease or other transfer to a third party of all or substantially all of the consolidated assets of the Company and its subsidiaries, or (D) any statutory share exchange, as a result of which the Common Shares or Proportionate Voting Shares are converted into, or exchanged for, shares, other securities, other property or assets (including cash or any combination thereof) (any such transaction or event, a “Capital Reorganization”), then, at and after the effective time of such Capital Reorganization, the right to exchange each Series A Convertible Preferred Share shall be changed into a right to exchange such share into the kind and amount of shares, other securities or other property or assets (or any combination thereof) that a holder of a number of Proportionate Voting Shares equal to the Conversion Ratio (with respect to such Series A Convertible Preferred Share) immediately prior to such Capital Reorganization would have owned or been entitled to receive (following conversion into Common Shares, if necessary) upon such Capital Reorganization (such shares, securities or other property or assets, the “Reference Property”). In each case, if a Capital Reorganization causes the Proportionate Voting Shares to be converted into, or exchanged for, the right to receive more than a single type of consideration (determined based in part upon any form of shareholder election), then the Reference Property into which the Series A Convertible Preferred Shares will be exchangeable shall be deemed to be the weighted average of the types and amounts of consideration received by the holders of Proportionate Voting Shares. The Company shall notify the holders of the Series A Convertible Preferred Shares of such weighted average as soon as practicable after such determination is made. None of the foregoing provisions shall affect (x) the right of a holder of Series A Convertible Preferred Shares to convert its Series A Convertible Preferred Shares (1) into Proportionate Voting Shares prior to the effective time of such Capital Reorganization or (2) into Proportionate Voting Shares or Reference Property, as applicable, following the effective time of such Capital Reorganization, in any case pursuant to Section 7(a), or, (y) if the event constituting a Capital Reorganization is also a Change of Control, the automatic conversion of the Series A Convertible Preferred Shares in connection with such transaction pursuant to Section 7(b). The provisions of this Section 7(f)(ix) shall similarly apply to successive Capital Reorganization events. This Section 7(f)(ix) shall not apply to any share split or combination to which Section 7(f)(i) is applicable or to a liquidation, dissolution or winding up to which Section 1 applies. |

| -15- |

The Company shall not enter into any agreement for a transaction constituting a Capital Reorganization unless (i) such agreement provides for or does not interfere with or prevent (as applicable) conversion of the Series A Convertible Preferred Shares into the Reference Property in a manner that is consistent with and gives effect to this Section 7, and (ii) to the extent that the Company is not the surviving entity in such Capital Reorganization or will be dissolved in connection with such Capital Reorganization, proper provision shall be made in the agreements governing such Capital Reorganization for the conversion of the Series A Convertible Preferred Shares into Reference Property and, in the case of a Capital Reorganization constituting any sale, lease or other transfer to a third party of the consolidated assets of the Company and its subsidiaries substantially as an entirety, an exchange of Series A Convertible Preferred Shares for the shares of the person to whom the Company’s assets are conveyed or transferred, having voting powers, preferences, and relative, participating, optional or other special rights as nearly equal as possible to those provided in these Articles of Amendment.

| (x) | Other Adjustments. In case the Company takes any action affecting the Series A Convertible Preferred Shares, the Proportionate Voting Shares or the Common Shares other than actions described in this Section 7, which in the opinion of the Board of Directors, would materially adversely affect the rights of the holders of the Series A Convertible Preferred Shares (including their conversion rights), the Conversion Ratio will be adjusted in such manner and at such time, by action of the Board of Directors, subject to the prior written consent of the Exchange on which the Common Shares are then listed if required, as the Board of Directors in its sole discretion may determine to be equitable in the circumstances. |

| (xi) | Minimum Adjustment. Notwithstanding the foregoing, the Conversion Ratio will not be increased if the amount of such increase would be an amount less than 111000th of a Proportionate Voting Share, but any such amount will be carried forward and reduction with respect thereto will be made at the time that such amount, together with any subsequent amounts so carried forward, aggregates to 1/1000th of a Proportionate Voting Share or more. |

| (xii) | When No Adjustment Required. Notwithstanding anything herein to the contrary, no adjustment to the Conversion Ratio need be made: |

| (A) | for a transaction referred to in Section 7(f)(i), Section 7(f)(iii) or Section 7(f)(v) if the Series A Convertible Preferred Shares participate, without conversion, in the transaction or event that would otherwise give rise to an adjustment pursuant to such Section at the same time as holders of the Proportionate Voting Shares participate with respect to such transaction or event and on the same terms as holders of the Proportionate Voting Shares participate with respect to such transaction or event as if the holders of Series A Convertible Preferred Shares, at such time, held a number of Proportionate Voting Shares issuable to them upon conversion of the Series A Convertible Preferred Shares at such time; |

| -16- |

| (B) | for rights to purchase Common Shares pursuant to any present or future plan by the Company for reinvestment of dividends or interest payable on the Company’s securities and the investment of additional optional amounts in Common Shares under any plan; |

| (C) | for any event otherwise requiring an adjustment under this Section 7 if such event is not consummated (in which case, any adjustment previously made as a result of such event shall be reversed); or |

| (D) | to the extent such adjustment would not comply with the requirements of the Exchange. |

| (xiii) | Provisions Governing Adjustment to Conversion Ratio. Rights, options or warrants distributed by the Company to all or substantially all holders of Common Shares and Exchangeable Shares entitling the holders thereof to subscribe for or purchase shares of the Company’s capital (either initially or under certain circumstances), which rights, options or warrants, until the occurrence of a specified event or events (“Rights Trigger”): (A) are deemed to be transferred with such Common Shares and Exchangeable Shares; (B) are not exercisable; and (C) are also issued in respect of future issuances of Common Shares and Exchangeable Shares, shall be deemed not to have been distributed for purposes of Section 7(f) (and no adjustment to the Conversion Ratio under Section 7(:f) will be required) until the Rights Trigger occurs, whereupon such rights, options and warrants shall be deemed to have been distributed and, if and to the extent such rights, options and warrants are exercisable for Common Shares, Exchangeable Shares or the equivalents thereof, an appropriate adjustment (if any is required) to the Conversion Ratio shall be made under Section 7(:f)(ii). If any such right, option or warrant, including any such existing rights, options or warrants distributed prior to the Original Issuance Date, are subject to events upon the occurrence of which such rights, options or warrants become exercisable to purchase different securities, evidences of indebtedness or other assets, then the date of the occurrence of any and each such event shall be deemed to be the date of distribution and Ex-Dividend Date with respect to new rights, options or warrants with such rights (and a termination or expiration of the existing rights, options or warrants without exercise by any of the holders thereof). In addition, in the event of any distribution (or deemed distribution) of rights, options or warrants, or any Rights Trigger or other event (of the type described in the preceding sentence) with respect thereto that was counted for purposes of calculating a distribution amount for which an adjustment to the Conversion Ratio was made, (1) in the case of any such rights, options or warrants that shall all have been redeemed or repurchased without exercise by any holders thereof, such Conversion Ratio shall be readjusted upon such final redemption or repurchase to give effect to such distribution or Rights Trigger, as the case may be, as though it were a cash distribution in an amount equal to the per share redemption or repurchase price received by a holder or holders of Common Shares and Exchangeable Shares, as the case may be, with respect to such rights, options or warrants (assuming such holder had retained such rights, options or warrants), made to all or substantially all holders of Common Shares and Exchangeable Shares as of the date of such redemption or repurchase, and (2) in the case of such rights, options or warrants that shall have expired or been terminated without exercise by any holders thereof, the Conversion Ratio shall be readjusted as if such rights, options and warrants had not been issued. Notwithstanding the foregoing, to the extent any such rights, options or warrants are redeemed by the Company prior to a Rights Trigger or are exchanged by the Company, in either case for Common Shares, the Conversion Ratio shall be appropriately readjusted (if and to the extent previously adjusted pursuant to this Section 7(f)(xi)) as if such rights, options or warrants had not been issued, and instead the Conversion Ratio will be adjusted as if the Company had issued the Common Shares issued upon such redemption or exchange (if any) as a dividend or distribution of Common Shares subject to Section 7(f)(i)(A) and 7(f)(i)(B). |

| -17- |

| (xiv) | Rules of Calculation. All calculations will be made to the nearest one hundredth of a cent or to the nearest one-ten thousandth of a share. Except as explicitly provided herein, the number of Common Shares and Exchangeable Shares outstanding will be calculated on the basis of the number of issued and outstanding Common Shares and Exchangeable Shares, as applicable, including Common Shares issuable upon the conversion of outstanding Proportionate Voting Shares. |

| (xv) | Waiver. Notwithstanding anything in this Section 7(f) to the contrary, no adjustment need be made to the Conversion Ratio for any event with respect to which an adjustment would otherwise be required pursuant to this Section 7(f) if the Company receives, prior to the effective time of the adjustment to the Conversion Ratio, written notice from the holders representing at least a majority of the then outstanding Series A Convertible Preferred Shares that no adjustment is to be made as the result of a particular issuance of Common Shares or Exchangeable Shares or other dividend or other distribution on Common Shares or Exchangeable Shares. This waiver will be limited in scope and will not be valid for any issuance of Common Shares or Exchangeable Shares or other dividend or other distribution on Common Shares or Exchangeable Shares or any other event not specifically provided for in such notice. |

| -18- |

| (xvi) | No Duplication. If any action would require adjustment of the Conversion Ratio pursuant to more than one of the provisions described in this Section 7 in a manner such that such adjustments are duplicative, only one adjustment shall be made (with the adjustment most favorable to the holders of Series A Convertible Preferred Shares being the adjustment that shall be made in such case). |

| (xvii) | For the purpose of effecting the conversion of Series A Convertible Preferred Shares, the Company shall at all times reserve and keep available, free from any preemptive rights, out of its treasury or authorized but unissued Proportionate Voting Shares (or Reference Property, to the extent applicable), the full number of Proportionate Voting Shares (or Reference Property, to the extent applicable) deliverable upon the conversion of all outstanding Series A Convertible Preferred Shares and, out of its treasury or authorized but unissued Common Shares, the full number of Common Shares deliverable upon conversion of the Proportionate Voting Shares into which the Series A Convertible Preferred Shares are convertible, in each case after taking into account any adjustments to the Conversion Ratio from time to time pursuant to the terms of this Section 7 assuming for the purposes of this calculation that all outstanding Series A Convertible Preferred Shares are held by one holder. |

| (xviii) | Successive Adjustments. For the avoidance of doubt, after an adjustment to the Conversion Ratio under this Section 7, any subsequent event requiring an adjustment under this Section 7 shall cause an adjustment to such Conversion Ratio as so adjusted. |

| (g) | Notice of Record Date. In the event of: |

| (i) | any share split or combination of the outstanding Common Shares or Exchangeable Shares; |

| (ii) | any declaration or making of a dividend or other distribution to holders of Common Shares and Exchangeable Shares in additional Common Shares or Exchangeable Shares, any other share capital, other securities or other property (including, but not limited to, cash and evidences of indebtedness, other than ordinary cash dividends paid on a quarterly basis); |

| (iii) | any reclassification or change to which Section 7(f)(i)(B) applies; |

| (iv) | the dissolution, liquidation or winding up of the Company or other return of capital or distribution of the assets of the Company among its shareholders, in each case for the purposes of winding up its affairs; or |

| (v) | any other event constituting a Capital Reorganization; |

| -19- |

then the Company shall file with its corporate records and mail to the holders of the Series A Convertible Preferred Shares at their last addresses as shown on the records of the Company, at least ten (10) days prior to the record date specified in (A) below or ten (10) days prior to the date specified in (B) below, a notice stating:

| (A) | the record date of such share split, combination, dividend or other distribution, or, if a record is not to be taken, the date as of which the holders of Common Shares or Exchangeable Shares of record to be entitled to such share split, combination, dividend or other distribution are to be determined, or |

| (B) | the date on which such reclassification, change, dissolution, liquidation, winding up of the Company or upon any other return of capital or distribution of the assets of the Company among its shareholders, in each case for the purposes of winding up its affairs, or any other event constituting a Capital Reorganization, is estimated to become effective, and the date as of which it is expected that holders of Common Shares or Proportionate Voting Shares of record will be entitled to exchange their Common Shares or Proportionate Voting Shares, as the case may be, for the share capital, other securities or other property (including, but not limited to, cash and evidences of indebtedness) deliverable upon such reclassification, change, liquidation, dissolution, winding up of the Company or other return of capital or distribution of the assets of the Company among its shareholders, in each case for the purposes of winding up its affairs or other Capital Reorganization. |

| (h) | Certificate of Adjustments. Promptly upon the occurrence of any event requiring an adjustment or readjustment of the Conversion Ratio pursuant to this Section 7, the Company shall compute such adjustment or readjustment in accordance with the terms hereof and, within ten (10) Business Days of such event, furnish to each holder of Series A Convertible Preferred Shares a certificate, duly signed and executed by an officer of the Company, setting forth such adjustment or readjustment and showing in detail the facts upon which such adjustment or readjustment is based. The Company shall, upon the reasonable written request of any holder of Series A Convertible Preferred Shares, furnish to such holder a similar certificate setting forth (i) the calculation of such adjustments and readjustments in reasonable detail, (ii) the Conversion Ratio then in effect, and (iii) the number of Proportionate Voting Shares and the amount, if any, of share capital, other securities or other property (including, but not limited to, cash and evidences of indebtedness) which then would be received upon the conversion of Series A Convertible Preferred Shares. |

| -20- |

| 8. | Additional Definitions |

For purposes of these Articles of Amendment, the following terms shall have the following meanings:

| (a) | “Board of Directors” means the board of directors of the Company, as constituted from time to time, or, with respect to any action to be taken by the Board of Directors, any committee of the Board of Directors duly authorized to take such action. |

| (b) | “Business Day” means any day which is not a Saturday, a Sunday or a day on which the principal commercial banks located in the City of Toronto, Ontario or New York, New York are not open for business during normal banking hours. |

| (c) | “Change of Control” means: |

| (i) | a transaction or series of related transactions as a result of which a person or group of persons acting jointly or in concert (within the meaning of the Securities Act (Ontario)), excluding JW Asset Management LLC, Jason Wild (collectively, “JW”) or any funds controlled by JW, acquires, directly or indirectly, securities representing at least a majority of the voting power of the Company’s outstanding capital stock; and |

| (ii) | a Fundamental Change. |

| (d) | “Closing Price” means, with respect to any security on any date, the closing sale price per share (or if no closing sale price is reported, the average of the bid and ask prices or, if more than one in either case, the average of the average bid and the average ask prices) on that date as reported in composite transactions for the Canadian national stock exchange or automated inter-dealer quotation system upon which such security is listed or quoted (or, if such security are not listed and posted for trading on a Canadian national stock exchange or automated inter-dealer quotation system, such other over-the-counter market on which such security may be listed or quoted). If such securities are not so listed or quoted, the last reported sale price will be the average of the mid-point of the last bid and ask prices for such security on the relevant date from each of at least two recognized investment banking firms selected by the Company for this purpose. For purposes of these Articles of Amendment, all references herein to the “Closing Price” and “last reported sale price” of the Common Shares on the Exchange shall be such closing sale price and last reported sale price as reflected on the website of the Exchange. If the date of determination is not a Trading Day, then such determination shall be made as of the last Trading Day prior to such date. |

| (e) | “Common Shares” means the common shares in the capital of the Company. |

| (f) | “Company” means TerrAscend Corporation, a corporation governed by the Act. |

| -21- |

| (g) | “Conversion Date” means the effective date of a conversion of Series A Convertible Preferred Shares to Proportionate Voting Shares, being (i) in the case of a conversion pursuant to Section 7(a), the date on which the Company shall have received such certificates, together with such notice and such other information or documents as may be required by the Company or its transfer agent, (ii) in the case of a conversion pursuant to Section 7(b), the Automatic Conversion Date. |

| (h) | “Convertible Security” means any debt or other evidences of indebtedness, shares of capital, options, warrants, subscription rights or other securities of the Company directly or indirectly convertible into or exercisable or exchangeable for Common Shares. |

| (i) | “Current Market Price” of Common Shares on any date means the average of the Closing Prices (or if the Closing Price on any Trading Day is quoted only in Canadian dollars, the USD Equivalent Amount thereof on such Trading Day) per Common Share for each of the 10 (ten) consecutive Trading Days ending on the earlier of the day in question and the day before the Ex-Dividend Date with respect to the issuance or distribution requiring such computation. |

| (j) | “Exchangeable Shares” means the exchangeable shares in the capital of the Company. |

| (k) | “Ex-Dividend Date” means, with respect to any issuance, dividend or distribution on the Common Shares, the first date on which the Common Shares trade on the applicable Exchange or in the applicable market, regular way, without the right to receive such issuance or distribution. |

| (l) | “Exchange” means any United States or Canadian national stock exchange or automated inter-dealer quotation system upon which the Common Shares are listed or quoted, provided that if the Common Shares are dual listed on both a United States national stock exchange and a Canadian national stock exchange the United States national stock exchange shall be the Exchange; as of the date hereof, the Exchange for the Common Shares is the Canadian Securities Exchange. |

| (m) | “Fair Market Value” of the Common Shares or any other security, property or assets means the fair market value thereof as reasonably determined in good faith by the Board of Directors, which determination must be set forth in a written resolution of the Board of Directors, in accordance with the following rules: |

| (i) | for Common Shares, the Fair Market Value will be the average of the Closing Prices of such security on the Exchange over a ten (10) consecutive Trading Day period, ending on the Trading Day immediately prior to the date of determination; |

| (ii) | for any security other than Common Shares that are traded or quoted on any United States or Canadian national stock exchange or automated inter-dealer quotation system, the Fair Market Value will be the average of the Closing Prices of such security on such national stock exchange or automated inter-dealer quotation system over a ten (10) consecutive Trading Day period, ending on the Trading Day immediately prior to the date of determination; and |

| -22- |

| (iii) | for any other property or assets, the Fair Market Value shall be determined by the Board of Directors as the monetary consideration that a prudent and informed buyer would pay to a prudent and informed seller, each acting at arm’s length with the other and under no compulsion to act. |

| (n) | “Fundamental Change” means: |

| (i) | a merger or consolidation in which: |

| (A) | the Company is a constituent party or |

| (B) | a subsidiary of the Company is a constituent party and the Company issues shares of its capital stock pursuant to such merger or consolidation, |

except any such merger or consolidation involving the Company or a subsidiary in which the shares of capital stock of the Company outstanding immediately prior to such merger or consolidation continue to represent, or are converted into or exchanged for shares of capital stock that represent, immediately following such merger or consolidation, at least a majority, by voting power, of the capital stock of (1) the surviving or resulting corporation; or (2) if the surviving or resulting corporation is a wholly owned subsidiary of another corporation immediately following such merger or consolidation, the parent corporation of such surviving or resulting corporation; or

| (ii) | the sale, lease, transfer or other disposition, in a single transaction or series of related transactions, by the Company or any subsidiary of the Company of all or substantially all the assets of the Company and its subsidiaries taken as a whole, except where such sale, lease, transfer or other disposition is to one or more subsidiaries of the Company. |

| (o) | “hereof,” “herein” and “hereunder” and words of similar import refer to these Articles of Amendment as a whole and not merely to any particular clause, provision, section or subsection. |

| (p) | “Market Disruption Event” means, with respect to the Common Shares, (i) a failure by the Exchange to open for trading during its regular trading session or (ii) the occurrence or existence for more than one half hour period in the aggregate on any scheduled Trading Day for the Common Shares of any suspension or limitation imposed on trading (by reason of movements in price exceeding limits permitted by the Exchange, or otherwise) in the Common Shares or in any options, contracts or future contracts relating to the Common Shares, and such suspension or limitation occurs or exists at any time before 1:00 p.m. (Toronto time) on such day. |

| -23- |

| (q) | “Original Issuance Date” means May 22, 2020. |

| (r) | “person” means any individual, corporation, limited liability company, limited or general partnership, joint venture, association, joint-stock company, trust, unincorporated organization, government, any agency or political subdivisions thereof. |

| (s) | “Proportionate Voting Shares” means the proportionate voting shares in the capital of the Company. |

| (t) | “share capital” means any and all shares, interests, participations or other equivalents (however designated, whether voting or non-voting) of capital, partnership interests (whether general or limited) or equivalent ownership interests in or issued by such person, and with respect to the Company includes, without limitation, any and all Common Shares, Proportionate Voting Shares, Exchangeable Shares and the Series A Convertible Preferred Shares. |

| (u) | “Trading Day” means any date on which (i) there is no Market Disruption Event and (ii) the Exchange is open for trading or, if the Common Shares are not so listed, admitted for trading or quoted, any Business Day. A Trading Day only includes those days that have a scheduled closing time of 4:00 p.m. (Toronto time) or the then standard closing time for regular trading on the relevant Exchange. |

| (v) | “USD Equivalent Amount” means on any date with respect to the specified amount of Canadian dollars the U.S. dollar equivalent amount after giving effect to the conversion of Canadian dollars to U.S. dollars at the Bank of Canada daily average exchange rate (as quoted or published from time to time by the Bank of Canada) on that date. |

| (w) | Each of the following terms is defined in the Section set forth opposite such term: |

| Term | Section |

| Additional Common Shares | Section 7(f)(vii)(B) |

| Automatic Conversion Date | Section 7(b)(i) |

| Common Share Equivalents | Section 7(f)(vii)(B) |

| Conversion Ratio | Section 7(a) |

| Series A Convertible Preferred Shares | Recital |

| Liquidation Preference | Section 1(b) |

| Per Share Conversion Value | Section 7(f)(viii) |

| Reference Property | Section 7(f)(ix) |

| Rights Trigger | Section 7(f)(xiii) |

| -24- |

| (x) | The expressions “ranking senior to”, “ranking junior to” and similar expressions refer to the order of priority in the distribution of assets in the event of any voluntary or involuntary liquidation, dissolution or winding up of the Company or any other return of capital or distribution of the assets of the Company among its shareholders, in each case for the purposes of winding up its affairs, in the payment of dividends or upon redemption. |

| (y) | If any day on which any action is required to be taken by the Company is not a Business Day, then such action may be taken on or by the next succeeding day that is a Business Day. |

| 9. | Miscellaneous |

For purposes of these Articles of Amendment, the following provisions shall apply:

| (a) | Withholding Tax. Notwithstanding any other provision of these Articles of Amendment, the Company may deduct or withhold from any payment, distribution, issuance or delivery (whether in cash or in shares) to be made pursuant to these Articles of Amendment any amounts required (or permitted, in the event that the Series A Convertible Preferred Shares are or become “taxable Canadian property” at any relevant time for purposes of the Income Tax Act (Canada) as determined by the Company acting reasonably) by applicable law to be deducted or withheld from any such payment, distribution, issuance or delivery and the Company will timely remit any such amounts to the relevant tax authority as required, and will provide evidence thereof reasonably acceptable to the affected holder(s) of Series A Convertible Preferred Shares. All such remitted amounts shall be treated as having been paid to the relevant holder(s). If the cash component of any payment, distribution, issuance or delivery to be made pursuant to these Articles of Amendment is less than the amount that the Company is so required (or permitted, in the event that the Series A Convertible Preferred Shares are or become “taxable Canadian property” at any relevant time for purposes of the Income Tax Act (Canada) as determined by the Company acting reasonably) to deduct or withhold, the Company shall be permitted to deduct and withhold from any noncash payment, distribution, issuance or delivery to be made pursuant to these Articles of Amendment any amounts required (or permitted, in the event that the Series A Convertible Preferred Shares are or become “taxable Canadian property” at any relevant time for purposes of the Income Tax Act (Canada) as determined by the Company acting reasonably) by law to be deducted or withheld from any such payment, distribution, issuance or delivery and to dispose of such property in order to remit any amount required to be remitted to any relevant tax authority. |

| -25- |

| (b) | Wire or Electronic Transfer of Funds. Notwithstanding any other right, privilege, restriction or condition attaching to the Series A Convertible Preferred Shares, the Company may, at its option, make any payment due to registered holders of Series A Convertible Preferred Shares by way of a wire or electronic transfer of funds to such holders. If a payment is made by way of a wire or electronic transfer of funds, the Company shall be responsible for any applicable charges or fees relating to the making of such transfer. As soon as practicable following the determination by the Company that a payment is to be made by way of a wire or electronic transfer of funds, the Company shall provide a notice to the applicable registered holders of Series A Convertible Preferred Shares at their respective addresses appearing on the books of the Company. Such notice shall request that each applicable registered holder of Series A Convertible Preferred Shares provide the particulars of an account of such holder with a chartered bank in Canada or the United States to which the wire or electronic transfer of funds shall be directed. If the Company does not receive account particulars from a registered holder of Series A Convertible Preferred Shares prior to the date such payment is to be made, the Company shall deposit the funds otherwise payable to such holder in a special account or accounts in trust for such holder. |

| (c) | Approval. Each issuance by the Company of shares of a class or series of preferred equity while any Series A Convertible Preferred Shares are outstanding shall be subject to the prior unanimous approval of the disinterested members of the Board of Directors. |

| (d) | Amendments. The provisions attaching to the Series A Convertible Preferred Shares may be deleted, varied, modified, amended or amplified by articles of amendment with such approval as may then be required by the Act. |

| (e) | U.S. Currency. Unless otherwise stated, all references herein to sums of money are expressed in lawful money of the United States. |

[Rest of page intentionally left blank.]

| -26- |

1Z

Exhibit B

PROVISIONS ATTACHING TO THE

SERIES B CONVERTIBLE PREFERRED SHARES

In addition to the rights, privileges, restrictions and conditions attaching to the preferred shares as a class, the Series B Convertible Preferred Shares shall have the following rights, privileges, restrictions and conditions. Capitalized terms not defined where used shall have the meanings ascribed to such terms in Section 8.

1. Liquidation Preference

| (a) | In the event of liquidation, dissolution or winding up of the Company, whether voluntary or involuntary, or upon any other return of capital or distribution of the assets of the Company among its shareholders, in each case for the purposes of winding up its affairs, each Series B Convertible Preferred Share entitles the holder thereof to receive and to be paid out of the assets of the Company available for distribution, before any distribution or payment may be made to a holder of any Common Shares, Proportionate Voting Shares, Exchangeable Shares or any other shares ranking junior in such liquidation, dissolution or winding up to the Series B Convertible Preferred Shares, an amount per Series B Convertible Preferred Share equal to the Liquidation Preference. |

| (b) | The “Liquidation Preference” per Series B Convertible Preferred Share shall initially be equal to US$2,000; provided that if the Company makes a distribution to holders of all or substantially all of the Series B Convertible Preferred Shares, payable in Series B Convertible Preferred Shares, or if the Company effects a share split or share consolidation on the Series B Convertible Preferred Shares, then the Liquidation Preference shall be adjusted on the effective date of such event by multiplying the then-effective Liquidation Preference by: |

| CS0 | ||

| CS1 |

where,

CS0 = the number of Series B Convertible Preferred Shares outstanding immediately before giving effect to such share dividend, distribution, split or share consolidation, as the case may be; and

CS1 = the number of Series B Convertible Preferred Shares outstanding immediately after giving effect to such dividend, distribution, share split or share consolidation.

| (c) | After payment to the holders of the Series B Convertible Preferred Shares of the full Liquidation Preference to which they are entitled in respect of outstanding Series B Convertible Preferred Shares (which, for greater certainty, have not been converted prior to such payment), such Series B Convertible Preferred Shares will have no further right or claim to any of the assets of the Company. |

| -27- |

| (d) | The Liquidation Preference shall be payable to holders of Series B Convertible Preferred Shares in cash; provided, however, that to the extent the Company has, having exercised commercially reasonable efforts to make such payment, insufficient cash available to pay the Liquidation Preference in full in cash, the portion of the Liquidation Preference with respect to which the Company has insufficient cash may be paid in property or other assets of the Company. The value of any property or assets not consisting of cash that is distributed by the Company in satisfaction of any portion of the Liquidation Preference will equal the Fair Market Value thereof on the date of distribution. |

| 2. | Voting Rights |

Except as otherwise provided in the Business Corporations Act (Ontario) (the “Act”), the holders of Series B Convertible Preferred Shares shall not be entitled to receive notice of, or to attend or to vote at any meeting of the shareholders of, the Company.

| 3. | Dividends |

The holders of Series B Convertible Preferred Shares shall not be entitled to receive any dividends, except that the Company shall issue such dividends as are necessary to comply with the provisions of Section 7(f)(iii) in respect of an adjustment to the Conversion Ratio in connection with any dividend paid on the Common Shares. The Company will provide holders of Series B Convertible Preferred Shares with 21 days’ notice of the record date for any dividend payable on the Common Shares.

| 4. | Purchase for Cancellation |

Subject to such provisions of the Act as may be applicable, the Company may at any time or times purchase (if obtainable) for cancellation all or any part of the Series B Convertible Preferred Shares outstanding from time to time in one or more negotiated transactions at such price or prices as are determined by the Board of Directors and as may be agreed to with the relevant holders of the Series B Convertible Preferred Shares. From and after the date of purchase of any Series B Convertible Preferred Shares under the provisions of this Section 4, any shares so purchased shall be cancelled.

| 5. | [RESERVED] |

| 6. | [RESERVED] |

| -28- |

| 7. | Conversion. |

Each Series B Convertible Preferred Share is convertible into Common Shares as provided in this Section 7.

| (a) | Conversion at the Option of Holders of Series B Convertible Preferred Shares. Each holder of Series B Convertible Preferred Shares is entitled to convert, at any time and from time to time, at the option and election of such holder, any or all outstanding Series B Convertible Preferred Shares held by such holder into a number of duly authorized, validly issued, fully paid and non-assessable Common Shares equal to the product obtained by multiplying (i) the then-effective Conversion Ratio by (ii) the number of Series B Convertible Preferred Shares so converted; provided that the Company shall not effect any conversion pursuant to this Section 7(a), and no holder shall have the right to convert its Series B Convertible Preferred Shares pursuant to this Section 7(a); to the extent that after giving effect to such conversion such holder, alone or together with its affiliates and persons acting jointly or in concert with such holder and its affiliates (including any person not dealing at arm’s length with the holder for the purpose of the Income Tax Act (Canada)), would beneficially own securities representing in excess of 49.9% of the voting power of the outstanding capital stock of the Company immediately after giving effect to such conversion and any concurrent conversion or exercise of Convertible Securities. |

The “Conversion Ratio” is initially 1,000, as adjusted from time to time as provided in Section 7(f). In order to convert the Series B Convertible Preferred Shares into Common Shares pursuant to this Section 7(a), the holder must surrender the certificates representing such Series B Convertible Preferred Shares, accompanied by transfer instruments reasonably satisfactory to the Company, free of any adverse interest or liens at the office of the Company or its transfer agent for the Series B Convertible Preferred Shares (as directed by the Company), together with the prescribed form of written notice, set forth on the Series B Convertible Preferred Share certificates, that such holder elects to convert all or such number of shares represented by such certificates as specified therein.

| (b) | Automatic Conversion upon a Change of Control. |

| (i) | The Company shall provide written notice (the “Conversion Notice”) pursuant to this Section 7(b) at least 30 days prior to the effective date of a Change of Control to the holders of record of the Series B Convertible Preferred Shares as they appear in the records of the Company. The Conversion Notice must state: (A) the consideration per Series B Convertible Preferred Share deliverable upon conversion; and (B) the date (the “Automatic Conversion Date”), which shall be not less than 30 days after the date of delivery of the Conversion Notice, on which the Series B Convertible Preferred Shares will automatically convert pursuant to Section 7(b)(ii). |

| (ii) | On the Automatic Conversion Date, each Series B Convertible Preferred Share that remains outstanding shall automatically convert into a number of duly authorized, validly issued, fully paid and non-assessable Common Shares (or equivalent Reference Property, as applicable) equal to the then-applicable Conversion Ratio. |

| -29- |

| (c) | Fractional Shares. Any fractional Common Shares issuable upon conversion of the Series B Convertible Preferred Shares will be rounded down to the nearest Common Share. If more than one Series B Convertible Preferred Share is being converted at one time by or for the benefit of the same holder, then the number of Common Shares issuable upon conversion will be calculated on the basis of the aggregate number of Series B Convertible Preferred Shares converted by or for the benefit of such holder at such time. |

| (d) | Mechanics of Conversion. |

| (i) | Promptly after the Conversion Date, the Company shall issue and deliver to each holder of Series B Convertible Preferred Shares the number of Common Shares to which such holder is entitled in exchange for the certificates formerly representing Series B Convertible Preferred Shares. Such conversion will be deemed to have been made on the Conversion Date, and the person entitled to receive the Common Shares issuable upon such conversion shall be treated for all purposes as the record holder of such Common Shares on such Conversion Date. In case fewer than all the Series B Convertible Preferred Shares represented by any certificate are to be converted, a new certificate shall be issued representing the unconverted Series B Convertible Preferred Shares without cost to the holder thereof, except for any documentary, stamp or similar issue or transfer tax due because any certificates for Common Shares or Series B Convertible Preferred Shares are issued in a name other than the name of the converting holder. The Company shall pay any documentary, stamp or similar issue or transfer tax due on the issue of Common Shares upon conversion or due upon the issuance of a new certificate for any Series B Convertible Preferred Shares not converted other than any such tax due because Common Shares or a certificate for Series B Convertible Preferred Shares are issued in a name other than the name of the converting holder, which shall be paid by the converting holder. |

| (ii) | From and after the Conversion Date, the Series B Convertible Preferred Shares to be converted on such Conversion Date will no longer be outstanding, and all rights and privileges of the holder thereof as a holder of Series B Convertible Preferred Shares (except the right to receive from the Company the Common Shares upon conversion) shall cease and terminate with respect to such shares. |